Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Everyone here knows projecting spending is essential to retirement planning - you can't plan without spending, nest egg and years at a minimum. And it's easy to project the routine daily-weekly-monthly-annual spending expenses we all have.

But over the course of a 30 year retirement, there will also be significant non-annual big ticket expenses as well, that need to be planned for somehow. Expenses like buying cars periodically, major home renovations, major home repairs (new roof, new siding, HVAC replacement, storm-water-insect damage, etc.), replacing furniture-appliances-electronics for example. Others may have travel, boats, planes, antique cars, family expenses or others. Those expenses don't come up as often in planning threads here. Occasionally there comes a post with someone who didn't plan on replacing their roof wondering how to account for it, after the fact.

Some folks just keep the non-annual big tickets expenses apart from spending tracking, some just take them on the chin as they hit (with/out a budget?), and some may build them into budget spending in some manner - like I do. I am not saying there's a right way - only that it's worthwhile to somehow plan for those expenses as well - unless you plan to use leases and loans for everything.

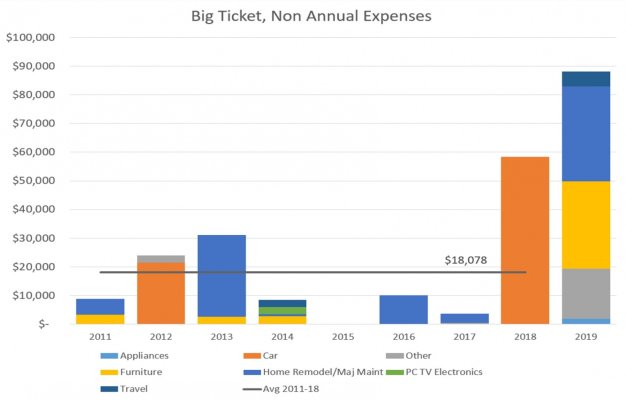

Before I retired, I looked back at what we'd actually spent and at what frequency in the past - and extrapolated what I thought we'd spend over the next 30 years. I came up with average annual expenses of $15,000 per year. Turns out I wasn't too far off, at least so far we've averaged just over $18,000 from 2011 thru 2018. I am excluding 2019 from my average because we moved, bought/sold/renovated homes, and chose to replace almost all our furniture - expenses we don't expect to incur often if ever again. I knew the expenses would vary considerably from year to year, some we can plan for (and defer/accelerate), some we can't.

All I am saying is we all have these expenses, and when planning for retirement spending, it's important to account for not only the routine daily-weekly-monthly-annual spending --- but those infrequent big ticket items too.

Maybe others here have even better ways to build these non-annual big ticket expenses into the spending plan?

FWIW

I track all our spending, though I separate normal expenses from medical expenses, taxes and (somewhat misnamed) "accruals" or non-annual expenses like those shown here. My month to month focus is on all the normal expenses, but I don't want to lose sight of the other expenses.

But over the course of a 30 year retirement, there will also be significant non-annual big ticket expenses as well, that need to be planned for somehow. Expenses like buying cars periodically, major home renovations, major home repairs (new roof, new siding, HVAC replacement, storm-water-insect damage, etc.), replacing furniture-appliances-electronics for example. Others may have travel, boats, planes, antique cars, family expenses or others. Those expenses don't come up as often in planning threads here. Occasionally there comes a post with someone who didn't plan on replacing their roof wondering how to account for it, after the fact.

Some folks just keep the non-annual big tickets expenses apart from spending tracking, some just take them on the chin as they hit (with/out a budget?), and some may build them into budget spending in some manner - like I do. I am not saying there's a right way - only that it's worthwhile to somehow plan for those expenses as well - unless you plan to use leases and loans for everything.

Before I retired, I looked back at what we'd actually spent and at what frequency in the past - and extrapolated what I thought we'd spend over the next 30 years. I came up with average annual expenses of $15,000 per year. Turns out I wasn't too far off, at least so far we've averaged just over $18,000 from 2011 thru 2018. I am excluding 2019 from my average because we moved, bought/sold/renovated homes, and chose to replace almost all our furniture - expenses we don't expect to incur often if ever again. I knew the expenses would vary considerably from year to year, some we can plan for (and defer/accelerate), some we can't.

All I am saying is we all have these expenses, and when planning for retirement spending, it's important to account for not only the routine daily-weekly-monthly-annual spending --- but those infrequent big ticket items too.

Maybe others here have even better ways to build these non-annual big ticket expenses into the spending plan?

FWIW

I track all our spending, though I separate normal expenses from medical expenses, taxes and (somewhat misnamed) "accruals" or non-annual expenses like those shown here. My month to month focus is on all the normal expenses, but I don't want to lose sight of the other expenses.

Attachments

Last edited: