Shabber2

Recycles dryer sheets

- Joined

- Jul 7, 2007

- Messages

- 55

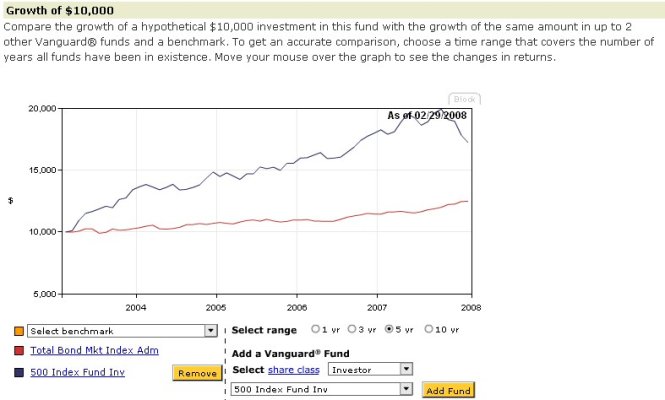

Nothing I find ever seems to tell the real story about mutual fund gains. Example, this is some bond funds I moved into at the beginning of the year. It seems that charts, Google Finance, Yahoo Quotes, my online brokerage site all don't reflect the fact that in a mutual fund where a normal investor is reinvesting dividends, the actual yeilds are much higher than shown. These funds are up 6521/180000 or 3.62%. This is reality. For some reason, the online comunity never computes this stuff right. They just look at the differences in share price and run with it. Shouldn't there be a site that shows real data so we can compare apples to apples. What good is it not factoring in dividends? Help me understand. Am I crazy?

My stupid brokerage account shows the account only going up $5709. Ridiculous and WRONG!

CurrentBONDS Bought Bought Cost03/12/08DaysGainAnnualizedInterm BondVFITX $ 90,000 01/04/08 $ 11.44 $93,386.00 68 $ 3,386.00 20.19%Short BondVFISX $ 54,000 01/07/08 $ 10.69 $55,224.00 65 $ 1,224.00 12.73%TIPSVIPSX $ 36,000 01/07/08 $ 12.62 $37,911.00 65 $ 1,911.00 29.81% $ 180,000 $ 186,521 $ 6,521

My stupid brokerage account shows the account only going up $5709. Ridiculous and WRONG!

CurrentBONDS Bought Bought Cost03/12/08DaysGainAnnualizedInterm BondVFITX $ 90,000 01/04/08 $ 11.44 $93,386.00 68 $ 3,386.00 20.19%Short BondVFISX $ 54,000 01/07/08 $ 10.69 $55,224.00 65 $ 1,224.00 12.73%TIPSVIPSX $ 36,000 01/07/08 $ 12.62 $37,911.00 65 $ 1,911.00 29.81% $ 180,000 $ 186,521 $ 6,521

There aren't many of us, so that's pretty cool.

There aren't many of us, so that's pretty cool.