Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

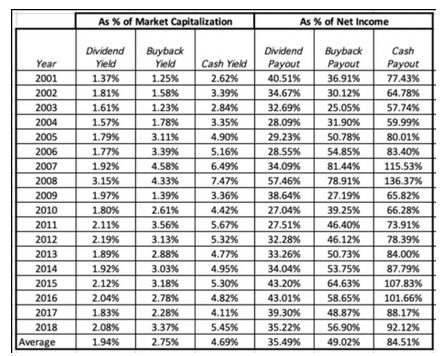

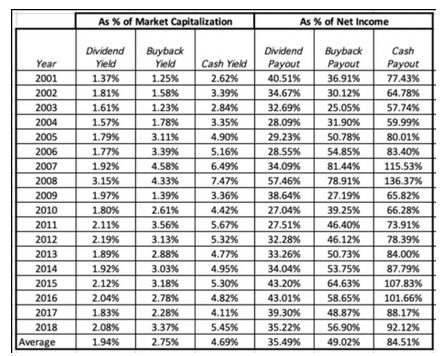

I knew about buy backs but this table below puts it in better perspective. It brings in the idea of buyback yields which I had not heard of.

I guess buy backs have trumped dividends since 2004:

And note the yields of dividends versus buybacks here:

Good overview article by Carlson here: https://awealthofcommonsense.com/2019/04/dividends-dont-matter-as-much-as-they-used-to/

Full article from Damordian: https://aswathdamodaran.blogspot.com/2019/02/january-2019-data-update-8-dividends.html

I guess buy backs have trumped dividends since 2004:

The declining role of dividends, as a form of cash return, has meant that a more relevant measure of cash return has to incorporate stock buybacks, resulting in a broader definition of cash yield and cash payout ratio measures:

Cash Yield = (Dividends + Buybacks) / Market Capitalization

Cash Payout Ratio = (Dividends + Buybacks)/ Net Income

And note the yields of dividends versus buybacks here:

Good overview article by Carlson here: https://awealthofcommonsense.com/2019/04/dividends-dont-matter-as-much-as-they-used-to/

Full article from Damordian: https://aswathdamodaran.blogspot.com/2019/02/january-2019-data-update-8-dividends.html