Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

Then put on some new reality shows that really have little to do with "financial news" but do focus on creating groups of people that need money for something...

Yeah, that's the ticket...

I've gotten started on my elevator pitch for a groundbreaking new show that can be simulcast on CNBC and Animal Planet...

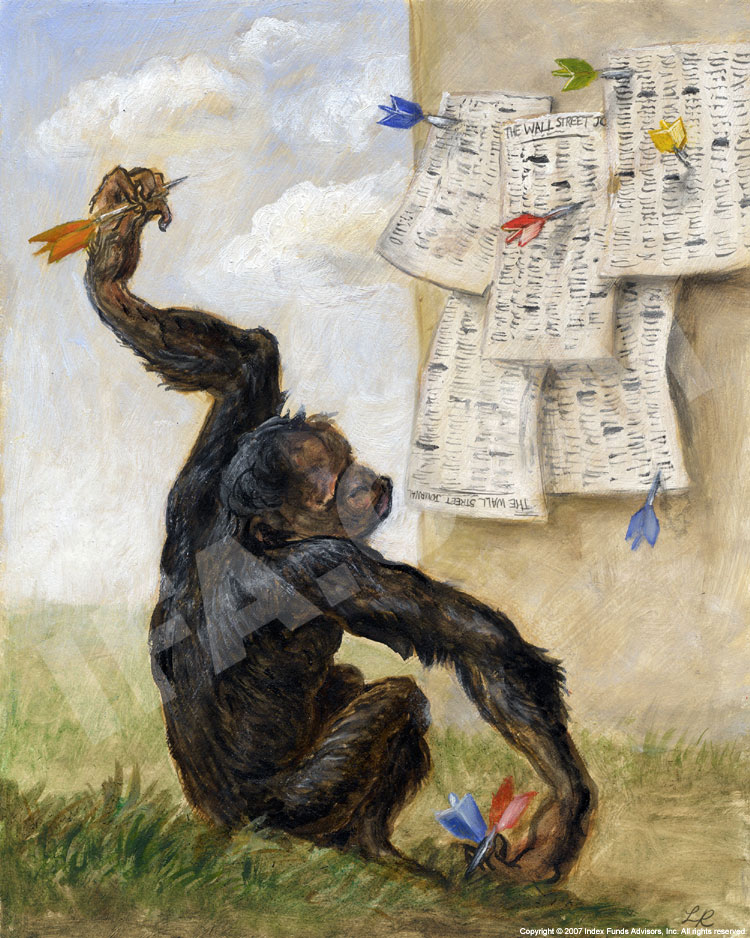

I hear Bubbles the chimp is available. After being kicked out of Neverland, his subsequent gig as an Ameriprise advisor to other down-on-their-luck trust fund babies was very successful, but ultimately ended over a dispute over fees and commissions. He went on to become a senior equity analyst at a major wall street firm, specializing in agricultural commodity firms supplying the primate pet food industry. His track record was stellar. Consistent "strong buy" recommendations on market leaders Chiquita and Dole have paid off handsomely for investors.

Now, he makes his triumphant return to the spotlight in Bubble Busters, the daily show that combines the the excitement of the game show format with hard-hitting stock analysis from industry experts. Watch as a rotating lineup of Wall Street analysts and penny stock newsletter publishers compete for cash and prizes by matching wits with Bubbles. All participants make selections of stocks currently in the news and predict both short-term and long-term (next Friday's closing price) picks. Any stock whose price is listed in the daily edition of the WSJ is fair game for the contestants.

The show's title is meant to be ironic, because Bubbles rarely loses. One month into rehearsals, the results so far show that the "Bubbles Method" has a 50.174% success rate, enough to beat his contestants handily on nearly every pick.

Last edited: