|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-03-2013, 10:33 AM

01-03-2013, 10:33 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by azphx1972

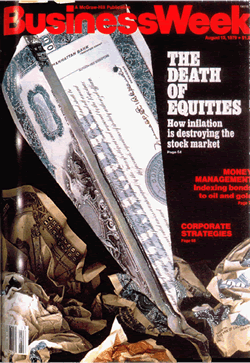

... is it another piece of sensationalist journalism?

|

+1

And perhaps a buy signal...

__________________

Numbers is hard

|

|

|

01-03-2013, 10:33 AM

01-03-2013, 10:33 AM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

Quote: Quote:

Originally Posted by azphx1972

Is there any water to the arguments raised in the commentary, or is it another piece of sensationalist journalism?

|

Yes to both...

If it ever really happens, we'll all be blindsided, even the pros though they'll recognize it before mainstream investors. Someone will undoubtedly "call it" - for the same reason that chimps playing darts can pick stocks (some have to be right if only by chance).

You've noted the most famous earlier example, I'll never forget that issue. They sold a lot of issues, which was the objective...the content is secondary.

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

01-03-2013, 10:42 AM

01-03-2013, 10:42 AM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2006

Posts: 4,872

|

Quote: Quote:

|

LONDON (MarketWatch) — Anyone who invests regularly will inevitably spend a lot of time thinking about which nations and bourses are doing well, where the smart money is going, and which is likely to be the next index to soar or collapse.

|

Well the start of the article isn't too promising, he's got me all wrong!

__________________

“So we beat on, boats against the current, borne back ceaselessly into the past.”

Current AA: 75% Equity Funds / 15% Bonds / 5% Stable Value /2% Cash / 3% TIAA Traditional

Retired Mar 2014 at age 52, target WR: 0.0%,

Income from pension and rent

|

|

|

01-03-2013, 10:46 AM

01-03-2013, 10:46 AM

|

#5

|

|

Moderator Emeritus

Join Date: Sep 2007

Posts: 17,774

|

I'm putting my money in tulip bulbs.

__________________

“Would you like an adventure now, or would you like to have your tea first?” J.M. Barrie, Peter Pan

|

|

|

01-03-2013, 10:51 AM

01-03-2013, 10:51 AM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: May 2005

Location: Texas

Posts: 1,038

|

Quote: Quote:

Originally Posted by Bestwifeever

I'm putting my money in tulip bulbs.

|

No, Emu oil is where its at for smart investors.

__________________

In theory, theory and practice are the same. In practice, they are not.

|

|

|

01-03-2013, 10:55 AM

01-03-2013, 10:55 AM

|

#7

|

|

Full time employment: Posting here.

Join Date: Dec 2010

Posts: 576

|

The two other books this perpetual optimist will be publishing are

Bust: Greece, the Euro and the Sovereign Debt Crisis (2010)

The Long Depression: The Slump of 2008 to 2031

|

|

|

01-03-2013, 10:58 AM

01-03-2013, 10:58 AM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,242

|

Much to do about nothing....

This past decade has not been the best time to do an IPO for most industries....

Wait until the economy is doing well (whenever that will be) and this will be a non-story...

|

|

|

01-03-2013, 11:30 AM

01-03-2013, 11:30 AM

|

#9

|

|

Recycles dryer sheets

Join Date: Jan 2012

Location: Colorado

Posts: 254

|

Quote: Quote:

Originally Posted by Lazarus

No, Emu oil is where its at for smart investors.

|

How about chinchilla fur !!??

__________________

Don't you know that dynamite always blows down ? --- Moe to Curly

|

|

|

01-03-2013, 12:15 PM

01-03-2013, 12:15 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,150

|

Dow was up by only a measly 300 points or so yesterday

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

01-03-2013, 12:45 PM

01-03-2013, 12:45 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Don't worry, Nouriel Roubini a.k.a Dr. Doom has a special message for everyone today:

Dr Doom: The US has not yet woken up to its fiscal nightmare

Dr Doom: The US has not yet woken up to its fiscal nightmare

__________________

Retired since summer 1999.

|

|

|

01-03-2013, 12:53 PM

01-03-2013, 12:53 PM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2006

Posts: 4,872

|

Quote: Quote:

Originally Posted by audreyh1

|

Nou Nou was a drinking buddy of mine back in the late 1980s. He talks more sense now than he did back then and I pretty much agree with everything he says in the article. I'd also include a need to cut military spending. increasing the age for SS and Medicare, maintaining growth and halving the cost of US healthcare.

__________________

“So we beat on, boats against the current, borne back ceaselessly into the past.”

Current AA: 75% Equity Funds / 15% Bonds / 5% Stable Value /2% Cash / 3% TIAA Traditional

Retired Mar 2014 at age 52, target WR: 0.0%,

Income from pension and rent

|

|

|

01-03-2013, 01:01 PM

01-03-2013, 01:01 PM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,420

|

Sooner or later the $4B that is still sitting on the sidelines has to go somewhere in the 'new normal'. IMO equities are still cheap.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

01-03-2013, 01:05 PM

01-03-2013, 01:05 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,242

|

Quote: Quote:

Originally Posted by marko

Sooner or later the $4B that is still sitting on the sidelines has to go somewhere in the 'new normal'. IMO equities are still cheap.

|

Don't you mean "T", as in trillions

|

|

|

01-03-2013, 01:09 PM

01-03-2013, 01:09 PM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,420

|

Billions, trillions...whats the difference!! Just a few zeros.

Thanks, you're right.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

01-03-2013, 03:23 PM

01-03-2013, 03:23 PM

|

#16

|

|

Gone but not forgotten

Join Date: Jul 2012

Location: Peru

Posts: 6,335

|

The coming few months should be interesting for chartists. The confluence of change in a great number of market factors promises more volatility than we've seen in some time.

If Bernancke backs off on interest rates, we may be looking at some major changes in Shadow Banking. This may not be all bad, but the bond market could become scary.

At the same time, the US is not alone in debt-driven assets. A good guess might be that there will not be a safe haven in international currency... particularly China. If this brings a degree of worldwide stability, the long term result could be good.

At the least, moderate to small increases in the Fed rate can stave off inflation, which is more of a threat to the economy and personal wealth than a drop in equities.

Watch the VIX for indications of a correction in the coming 6 to 9 months. Some prognosticators are looking for a new floor with a 20% drop.

Finding the right buy-sell point is going to be a challenge.

My opinion only... just reading between the lines.

|

|

|

01-03-2013, 04:58 PM

01-03-2013, 04:58 PM

|

#17

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,724

|

Quote: Quote:

Originally Posted by azphx1972

Is there any water to the arguments raised in the commentary, or is it another piece of sensationalist journalism financial porn?

|

FIFY. The latter.

|

|

|

01-03-2013, 07:28 PM

01-03-2013, 07:28 PM

|

#18

|

|

Recycles dryer sheets

Join Date: Dec 2012

Posts: 113

|

Thanks. Personally I'm betting the farm (my retirement savings) on equities, so I'm hoping the author is wrong as well.

|

|

|

01-04-2013, 09:47 AM

01-04-2013, 09:47 AM

|

#19

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2010

Location: Chicago

Posts: 1,154

|

Quote: Quote:

Originally Posted by azphx1972

|

When we brake through 20,000 on the Dow these same people will be saying we are going to 40,000.

|

|

|

01-04-2013, 10:03 AM

01-04-2013, 10:03 AM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Quote: Quote:

Originally Posted by ripper1

When we brake through 20,000 on the Dow...

|

I'm hoping we'll coast through or maybe even accelerate through, not brake through, but who knows...

__________________

Numbers is hard

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|