getoutearly

Recycles dryer sheets

- Joined

- Jan 27, 2006

- Messages

- 77

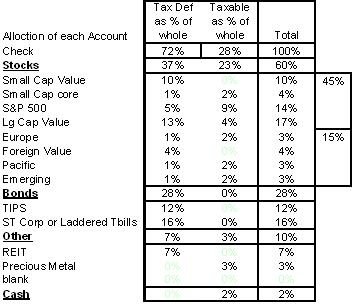

Allright, please throw stones at my proposed allocation below. A little background; 45 yrs old, DW, kids 8, 11. Planning on ER at 50 (if I can make it that long). Should have enough to do it at that time. Have been using a FA. He gives me FA on my whole portfolio, while only managing ~35% of it (so it brings the overall FA fee down as a %-age. ok, so I'm rationalizing here...). Also, just realized a lot of the funds the FA had me in were Front End loaded, which is the icing on the cake for me to go it alone.

After a lot of research and reading the last several months, I have been formulating my own plan to manage the portfolio.

1) what do you think of the allocation

2) Any problems with the Asset class allocation between taxable and tax deferred?

3) Recommendations on brokerage / mutual fund company to use (currently have ~50% of total assets with Fidelity in 401K. That's one option for consolidating the rest of the assets. The other 2 I have been considering are Schwab and Vanguard.

One question I have is, if I am using mostly Vanguard funds, is there any disadvantage / extra cost to Schwab / Fidelity vs Vanguard for holding the Vanguard funds?

Hopefully this table will insert here:

Thanks

After a lot of research and reading the last several months, I have been formulating my own plan to manage the portfolio.

1) what do you think of the allocation

2) Any problems with the Asset class allocation between taxable and tax deferred?

3) Recommendations on brokerage / mutual fund company to use (currently have ~50% of total assets with Fidelity in 401K. That's one option for consolidating the rest of the assets. The other 2 I have been considering are Schwab and Vanguard.

One question I have is, if I am using mostly Vanguard funds, is there any disadvantage / extra cost to Schwab / Fidelity vs Vanguard for holding the Vanguard funds?

Hopefully this table will insert here:

Thanks