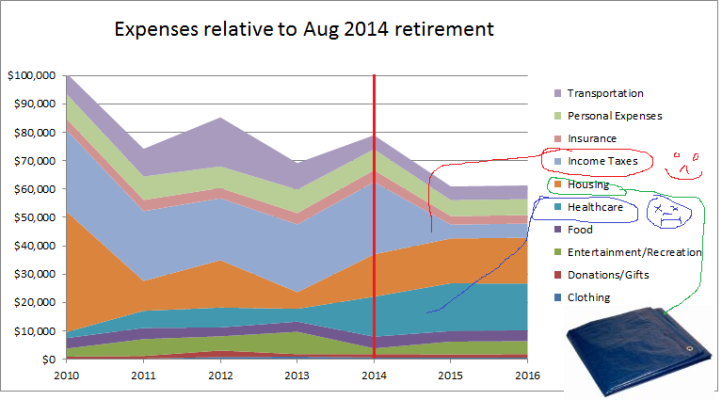

I have a series of potential budgets. I'm going into retirement with the hope of spending 100% of my ending salary. Since we've never spent that much before it ought to be a stretch even with a higher medical insurance cost. This is partly offset by the disappearance of work related expenses. My big goal was international travel and I'm already having problems getting DW to agree to a second trip. I have us scheduled for one 3 week trip but she's balking at doing another one. She's interested in more US travel but has no suggestions on what to see. We've seen the major sites that interest us but I'll start looking at some of the other options.

The basic living expenses keeping our nice house, eating out and generally living the comfortable (upper?) middle-class lifestyle will run about 35% of last years gross including medical and taxes. I'm convinced that we could live on half of this amount without subjecting ourselves to a life of poverty. Of course, I have/had a pretty good income.

I feel sorry for those trying to support children and others but what is the end-game for this? Eventually, your children will have to fend on their own even if you support them until you die. I hope I don't have to support any of my kids but right now they seem to be fully functioning economically.

The basic living expenses keeping our nice house, eating out and generally living the comfortable (upper?) middle-class lifestyle will run about 35% of last years gross including medical and taxes. I'm convinced that we could live on half of this amount without subjecting ourselves to a life of poverty. Of course, I have/had a pretty good income.

I feel sorry for those trying to support children and others but what is the end-game for this? Eventually, your children will have to fend on their own even if you support them until you die. I hope I don't have to support any of my kids but right now they seem to be fully functioning economically.