maddythebeagle

Thinks s/he gets paid by the post

- Joined

- Jun 15, 2005

- Messages

- 2,450

http://biz.yahoo.com/usat/060713/13639559.html

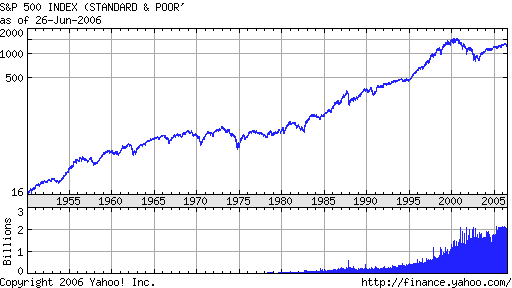

comments on this article? Something that I have been thinking about....I think most people here have learned to slice and dice and not all in sp 500....I am not sure that the sp500 is a good example for this article considering how large cap stocks got out of control a while back.....

comments on this article? Something that I have been thinking about....I think most people here have learned to slice and dice and not all in sp 500....I am not sure that the sp500 is a good example for this article considering how large cap stocks got out of control a while back.....