- Joined

- Oct 13, 2010

- Messages

- 10,735

In your tax advantaged accounts that hold mutual funds, ETF's, stocks, etc that get dividends, do you have your account configured to reinvest, or just let the money flow to the "core account"?

It's understandable that in non-tax advantage accounts, you can just use dividends for spending money, but in tIRA, Roth, 401k, HSA, etc, the clearing of the money market account is probably not something you'd be doing. I mean, if you're going to pull money for spending, since it's a taxable event, it's probably going to be bigger than removing a few bucks that accumulated from dividends (IOW, you'll be selling something, then pulling a larger chunk of cash out and will be getting a 1099).

The default, in my experience, is that the dividends flow to the core account and it sits there, earning almost nothing nowadays. Although it doesn't earn anything, it's available for purchasing either more of what spawned the dividend, or something else. So you have flexibility of purchasing something else. But you'd probably pay a commission to buy that something else, whereas, as far as I could tell on the Fidelity site, the reinvestment didn't have a fee associated with it.

There's the "book keeping" aspect too. For instance, if you had 1000 shares of something, you have that kind of easy math. The dividend is just some money that appears, versus fractional shares to keep adding each time a dividend comes around. But if you don't care about the fractional shares, you get to have a basically empty core account.

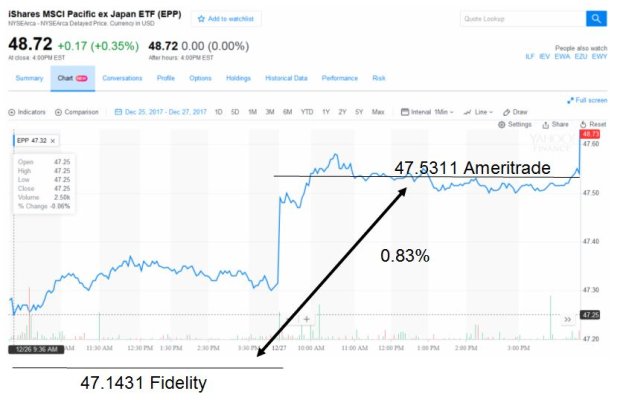

Then there's the price at dividend re-investment time versus the rest of the time. I don't know enough about that to make any kind of statement. Logically, the "higher demand" at dividend reinvestment time would push the price up, but I can't imagine this is a big factor, or nobody would opt-in to DRIPs. Maybe some kind of arbitrage keeps that at bay. Don't know anything about this aspect of the question.

What else is there to the decision about opting for reinvesting dividends? I did search and saw something about a fee of $2.50 at Vanguard, but that was a decade-old thread.

It's understandable that in non-tax advantage accounts, you can just use dividends for spending money, but in tIRA, Roth, 401k, HSA, etc, the clearing of the money market account is probably not something you'd be doing. I mean, if you're going to pull money for spending, since it's a taxable event, it's probably going to be bigger than removing a few bucks that accumulated from dividends (IOW, you'll be selling something, then pulling a larger chunk of cash out and will be getting a 1099).

The default, in my experience, is that the dividends flow to the core account and it sits there, earning almost nothing nowadays. Although it doesn't earn anything, it's available for purchasing either more of what spawned the dividend, or something else. So you have flexibility of purchasing something else. But you'd probably pay a commission to buy that something else, whereas, as far as I could tell on the Fidelity site, the reinvestment didn't have a fee associated with it.

There's the "book keeping" aspect too. For instance, if you had 1000 shares of something, you have that kind of easy math. The dividend is just some money that appears, versus fractional shares to keep adding each time a dividend comes around. But if you don't care about the fractional shares, you get to have a basically empty core account.

Then there's the price at dividend re-investment time versus the rest of the time. I don't know enough about that to make any kind of statement. Logically, the "higher demand" at dividend reinvestment time would push the price up, but I can't imagine this is a big factor, or nobody would opt-in to DRIPs. Maybe some kind of arbitrage keeps that at bay. Don't know anything about this aspect of the question.

What else is there to the decision about opting for reinvesting dividends? I did search and saw something about a fee of $2.50 at Vanguard, but that was a decade-old thread.