You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

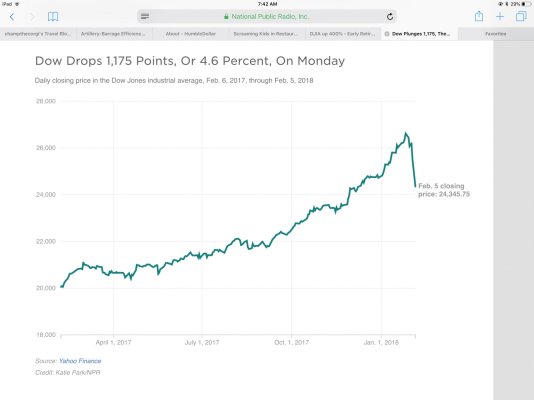

DJIA up 400%

- Thread starter imoldernu

- Start date

Huston55

Thinks s/he gets paid by the post

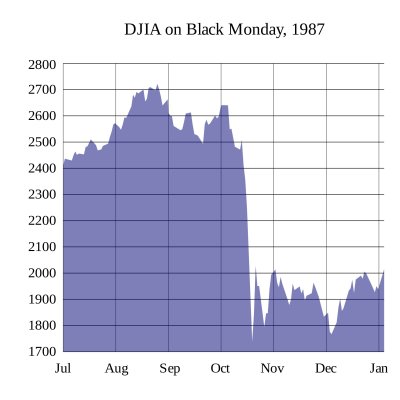

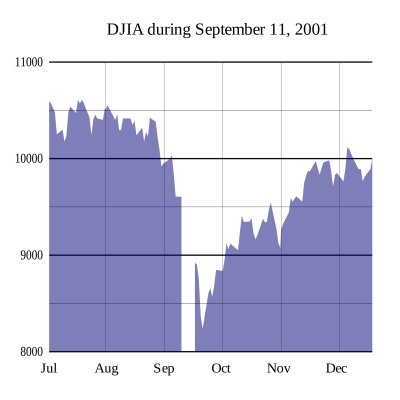

Spinnin’ Wheel got to go round...

What goes up...

What goes up...

Attachments

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Somewhere we have a set of highball glasses that were a gift to my wife after she passed her Series 7 brokerage exam. They commemorate the day that the Dow broke 1000. Yes, the market goes up and down, but the historical trend is very clear. We can only hope that, in this case, past performance is predictive.

Huston55

Thinks s/he gets paid by the post

Yes, the market goes up and down, but the historical trend is very clear. We can only hope that, in this case, past performance is predictive.

Oh, sorry! I thought we were playing the ‘isolated meaningless fact’ game.

HawkeyeNFO

Thinks s/he gets paid by the post

400% is a good start.

Fedup

Thinks s/he gets paid by the post

I feel better, only 200% instead of 400%.

Andre1969

Thinks s/he gets paid by the post

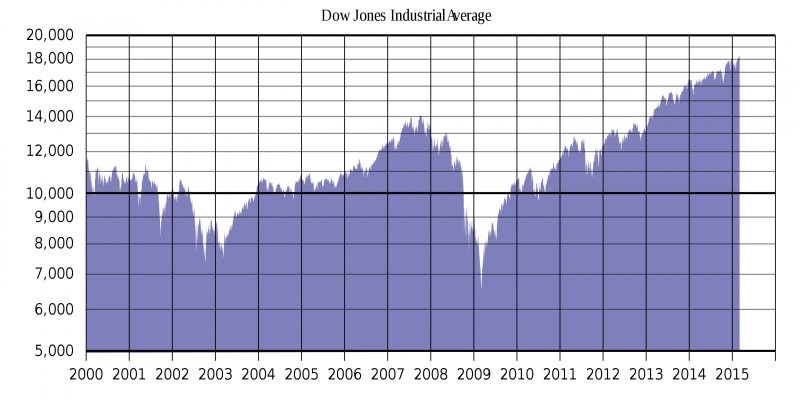

DJIA up 200%

Since December 2007.

And, if you inflation-adjust it, from that peak of around 14100 it hit back in October 2007, it's more like up 55%, in 10 years. Suddenly, it seems kinda "meh", huh?

Red Badger

Thinks s/he gets paid by the post

Up is good.

Down is good.

Just needs to go back up.

Wash, rinse, repeat.

Down is good.

Just needs to go back up.

Wash, rinse, repeat.

Recent article from CBS news

The 2008 recession cost the average person $70,000 in lifetime earnings.

https://www.cbsnews.com/news/how-much-the-2008-financial-crisis-cost-you-in-dollars/

The 2008 recession cost the average person $70,000 in lifetime earnings.

https://www.cbsnews.com/news/how-much-the-2008-financial-crisis-cost-you-in-dollars/

Other signs also show the scars left by the Great Recession, which started in December 2007 as the collapse in housing prices threatened to sink some of the country's largest financial firms. For example, millennials today carry far more debt than Baby Boomers did at their age, data show. The median household income also is the same as it was in the 1970s in inflation-adjusted terms.

Wage growth also remains muted, although that trend long predates the financial crisis. Accounting for inflation, average hourly earnings have fallen in 2018, labor data show.

Last edited:

W2R

Moderator Emeritus

Since March 2009.

Oh rats. I thought you meant it was up 400% today compared with yesterday.

One can dream!

Oz investor

Full time employment: Posting here.

And, if you inflation-adjust it, from that peak of around 14100 it hit back in October 2007, it's more like up 55%, in 10 years. Suddenly, it seems kinda "meh", huh?

5% per annum , after inflation looks good to me add in a little bit of compounding magic and fiscal responsibility and a happy ending is possible .

Huston55

Thinks s/he gets paid by the post

Recent article from CBS news

The 2008 recession cost the average person $70,000 in lifetime earnings.

https://www.cbsnews.com/news/how-much-the-2008-financial-crisis-cost-you-in-dollars/

Sorry but, is it just me who thinks this ‘observation ‘ from the link is meaningless?

“The size of the U.S. economy, as measured by GDP adjusted for inflation, is well below the level implied by the growth rates that prevailed before the financial crisis and Great Recession a decade ago," the researchers wrote

It’s like saying, “I would have got there sooner but, I stopped along the way home & got there later than I would have if I’d kept going.”

Oz investor

Full time employment: Posting here.

in 2007 i was a financial nobody , and now i can happily declare myself eccentric ,

personal circumstance can change ( both ways ) you have to roll with the punches where possible

personal circumstance can change ( both ways ) you have to roll with the punches where possible