JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

You may also call up your charity and ask if they have had successful donations from DAFs such as Fidelity or Vanguard before. I did that because it was a bit nerve wracking. I figure that anything "religious" these days is suspect, so I thought it would be harder than "Save The Varmints" for example. Not so. They go by the 501(c)(3) pretty much.As our religious support is a good part of the total I first need to make sure that the entity is set up as a 501(c)(3).

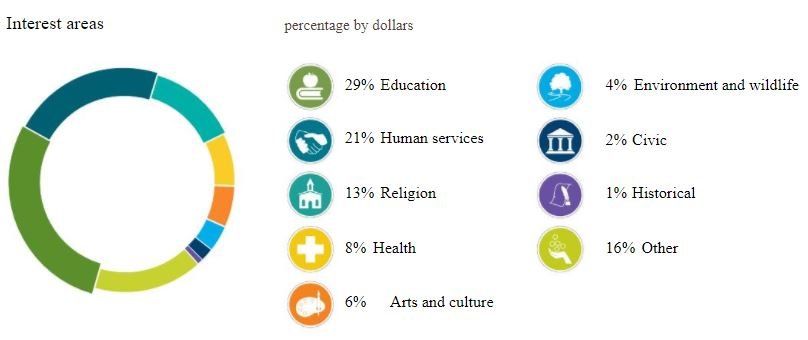

From VG Charitable's report, here's what people are advising, overall: