mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,205

interesting interview with researcher dr wade pfau.

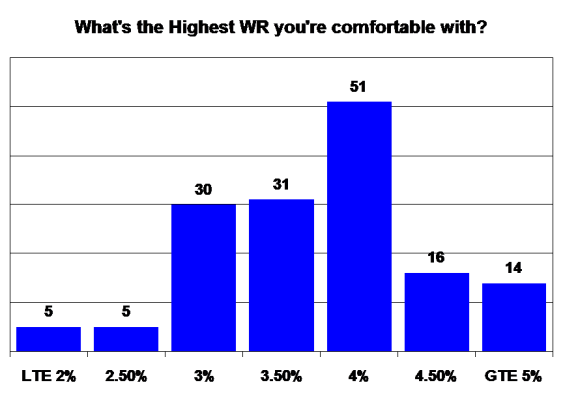

he is concerned the 4% rule may be a little to optomistic going forward.

Interview with Dr. Wade Pfau 01.26.2013 | financialsafari

he is concerned the 4% rule may be a little to optomistic going forward.

Interview with Dr. Wade Pfau 01.26.2013 | financialsafari