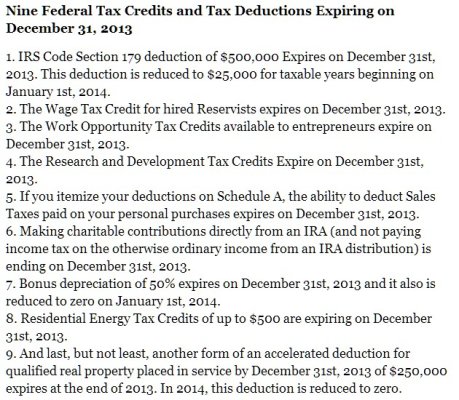

This Forbes Article outlines the tax exmptions scheduled to expire this year.

While the total extent of these deductions may be reversed by congressional action in 2014 (retroactively), they may come back in changes on legislation, but at a lower amount.

Year-End Tax Tips Every Entrepreneur Needs To Know -- Before They Expire - Forbes

The most recent Aljazeera News programs have a good explanation of some of the details... So far, the clip has not appeared on line.

Not mentioned is the expiration of the $7500 credit for "plug in" vehicles.

While the total extent of these deductions may be reversed by congressional action in 2014 (retroactively), they may come back in changes on legislation, but at a lower amount.

Year-End Tax Tips Every Entrepreneur Needs To Know -- Before They Expire - Forbes

The most recent Aljazeera News programs have a good explanation of some of the details... So far, the clip has not appeared on line.

Not mentioned is the expiration of the $7500 credit for "plug in" vehicles.

Attachments

Last edited: