Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

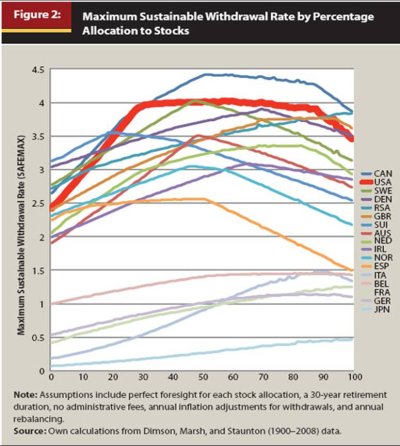

This was on page three of another thread (thanks Chinaco), but I thought it might be interesting to Americans here. I did not realize how low the SWR for many other developed countries was/is compared to the 4%± we all throw around. Note Spain (with equities), Italy, Belgium, France, Germany & Japan esp. You basically can't retire, as we know it, investing in your homeland in Japan (0.5% SWR!!!) and some other countries for all practical purposes. Sheeeeeeesh...

An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?

An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?