|

|

06-13-2016, 06:56 PM

06-13-2016, 06:56 PM

|

#21

|

|

Recycles dryer sheets

Join Date: Nov 2012

Location: Navarre

Posts: 141

|

Quote: Quote:

Originally Posted by Ed_The_Gypsy

When I started out, I thought 12% was the norm. Wrong. By the time I wised up it was almost too late. If I get 6% nominal from here out, I will be ecstatic.

I am shooting for 4% w/d rate not corrected for inflation.

Sent from my SM-G900V using Early Retirement Forum mobile app

|

I am using 6% nominal 3% real in my planning currently. I am hoping that is conservative.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

06-13-2016, 07:57 PM

06-13-2016, 07:57 PM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

Yes, it's frustrating when the goalpost moves farther away.

I was lucky--I started investing in the mid-80s, and the expectation of 8% real returns made it easy to stay motivated to put money away every month. It would be harder today, but even more important.

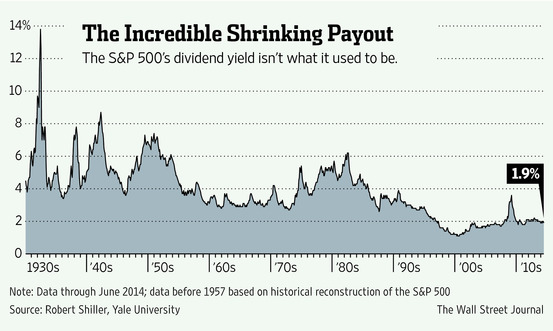

Well, there's this "cheery thought:" When stocks eventually take the plunge from their presently high PE ratios, you'll be able to buy them more cheaply with any money you rebalance and with your continual contribution from your paycheck. And, at that cheap price level, perhaps the dividend yield will go back up to something approaching the historical average.

|

|

|

06-13-2016, 08:17 PM

06-13-2016, 08:17 PM

|

#23

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2010

Location: Kerrville,Tx

Posts: 3,361

|

To get a longer perspective look at this site which calculates returns on the s&P 500 or predecessor index going back to 1871. CAGR of the Stock Market: Annualized Returns of the S&P 500, which if you click the include dividends and adjust for inflation boxes suggests a return of 6.86 percent per annum and $1 grew to 15k covering 2 great depressions (1893 and 1929 and a third bad period the panic of 1873). The average return on the web site is listed as 8.53.

|

|

|

06-13-2016, 11:02 PM

06-13-2016, 11:02 PM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2004

Location: Diablo Valley (SF Bay Area)

Posts: 2,705

|

Since discovering AA, my rate of return has dropped to an average of 5.68%

Figure I'll take out at RMD rate when I hit 70. Hope pension / SSA covers me

|

|

|

06-14-2016, 04:08 PM

06-14-2016, 04:08 PM

|

#25

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2012

Location: Madeira Beach Fl

Posts: 1,403

|

I too got discouraged. Then I went fishing and even though I didn't catch anything I wasn't discouraged about retirement anymore. Capise?

__________________

_______________________________________________

"A man is a success if he gets up in the morning and goes to bed at night and in between does what he wants to do" --Bob Dylan.

|

|

|

06-14-2016, 04:13 PM

06-14-2016, 04:13 PM

|

#26

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2016

Posts: 8,968

|

Two guys were out fishing on the river set up the lawn chairs and one guy noticed that nothing was twitching the other guys rod so he reeled it in and said "you ain't got no bait on your hook"

The other guy said "I know"

|

|

|

06-15-2016, 08:53 AM

06-15-2016, 08:53 AM

|

#27

|

|

Full time employment: Posting here.

Join Date: Apr 2011

Location: Castro Valley

Posts: 788

|

I believe Dave Ramsey uses 12% return to encourage saving and investing vs. spending and borrowing. I think that anyone who quotes a steady 12% return is just trying to sell you something.

I've tried to keep my expectations reasonable so I don't get discouraged. During my accumulation phase (1986 to June 2009), my average annual return was about 2.5%. A non-linear contribution rate and sequence of returns really killed my average rate of return. Not having to withdraw any of my retirement account, it has doubled since 2009.

|

|

|

06-15-2016, 10:08 AM

06-15-2016, 10:08 AM

|

#28

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2004

Location: Diablo Valley (SF Bay Area)

Posts: 2,705

|

Quote: Quote:

Originally Posted by jkern

I believe Dave Ramsey uses 12% return to encourage saving and investing vs. spending and borrowing. I think that anyone who quotes a steady 12% return is just trying to sell you something.

|

Just 1 of my problems with DR. I'd rather have real numbers

Eventually compounding takes over

|

|

|

06-15-2016, 11:01 AM

06-15-2016, 11:01 AM

|

#29

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2013

Posts: 1,660

|

12% might be a bit high but not totally out of whack if you use growth funds. A 100% stock fund has returned 10.1% on average since 1926 according to Vanguard.

https://personal.vanguard.com/us/ins...io-allocations

|

|

|

06-15-2016, 11:04 AM

06-15-2016, 11:04 AM

|

#30

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2015

Location: Michigan

Posts: 5,003

|

While I certainly wish that future returns were higher, I would not go so far as to say I was discouraged. It does help that inflation is low, so part of your return reduction (nominal to real) is better than your statement. I started saving at 21 and my spending is under control, so I will manage with a 2-2.5% WR. Good luck to you.

__________________

"The mountains are calling, and I must go." John Muir

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|