Playing around with FireCalc's spending models,

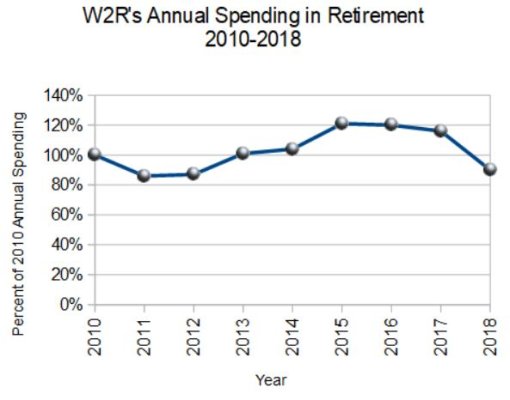

At this point it tells me I good for $60k (constant spending model) or $77,250 if I use Bernickes spending model with a 96% percent rate for both models, 40 year retirement.

So the question to the group, what spending model do you all use?

I tend to agree with Bernickies model based on life experiences, 90 year mother can't spend her SS check it seems, thank god for good health!

50 is around the corner, kids in college, our little shack was paid off 10 years ago and I'm starting to think I may want to cut my hours, slow down a tad etc. Our burn rate is around $50k give or take so think we are good. I feel a little better using Bernickies numbers however!

At this point it tells me I good for $60k (constant spending model) or $77,250 if I use Bernickes spending model with a 96% percent rate for both models, 40 year retirement.

So the question to the group, what spending model do you all use?

I tend to agree with Bernickies model based on life experiences, 90 year mother can't spend her SS check it seems, thank god for good health!

50 is around the corner, kids in college, our little shack was paid off 10 years ago and I'm starting to think I may want to cut my hours, slow down a tad etc. Our burn rate is around $50k give or take so think we are good. I feel a little better using Bernickies numbers however!