Samz

Dryer sheet aficionado

I thought some of the folks on the forum would be interested in my comparisons using FIRECalc, Fidelity RIP and Financial Mentor BRC retirement calculators. Also, if anyone has any input or can see any holes in my assumptions I’d appreciate the feedback.

I ran all 3 of the above and tried to stay consistent across all three with my input. Below are my input notes.

Here is the Portfolio Balance at End of Plan results for each:

Inputs:

· Current Age 59, planned retirement at 60. Life expectancy to 94. DW also 59

· Beginning Portfolio Bal $1.6M. For both FIRECalc & Fidelity RIP use 50% as % in stocks (fairly conservative). For Financial Mentor BRC I used a straight 5% for Annual Interest / Growth of investments. Right now I’m actually 57/31/12 in stocks / bonds / cash.

· Contribution into Portfolio of $20K more over into next year

· Inflation: For FIRECalc I used the CPI option. For Fidelity RIP & Financial Mentor BRC used 3% for expected inflation.

· DW Social Security starts at age 66 with file & suspend. Her pay into SS has been relatively low. Using $750 /mo from age 66 to 94

· DH (me) Social Security starts at age 70 with file & suspend. $3,500 more per mo from 70 thru age 94. For both DW & DH input for COL increases is 3% for both starting at age 60 with Financial Mentor BRC.

· I realize this is probably on the high side. So I also ran this with 1.5% COL increases and it pushed down the End of Plan balance substantially. I did not see this option for the other two.

· Inheritances: $35K age 61 then another $100K at age 70

· No other income or benefits from previous employers

· Desired Income during retirement $82K before taxes for all years. In reality this should drop once both 65 with Medicare kicking in. $25K of the $82K is for HI and possible maxed out deductibles. No plan to leave any estate. Home sale in today’s $ might get $340K, only owe $20K on mortgage right now). Equity in home and contents / autos are not included in any calculations.

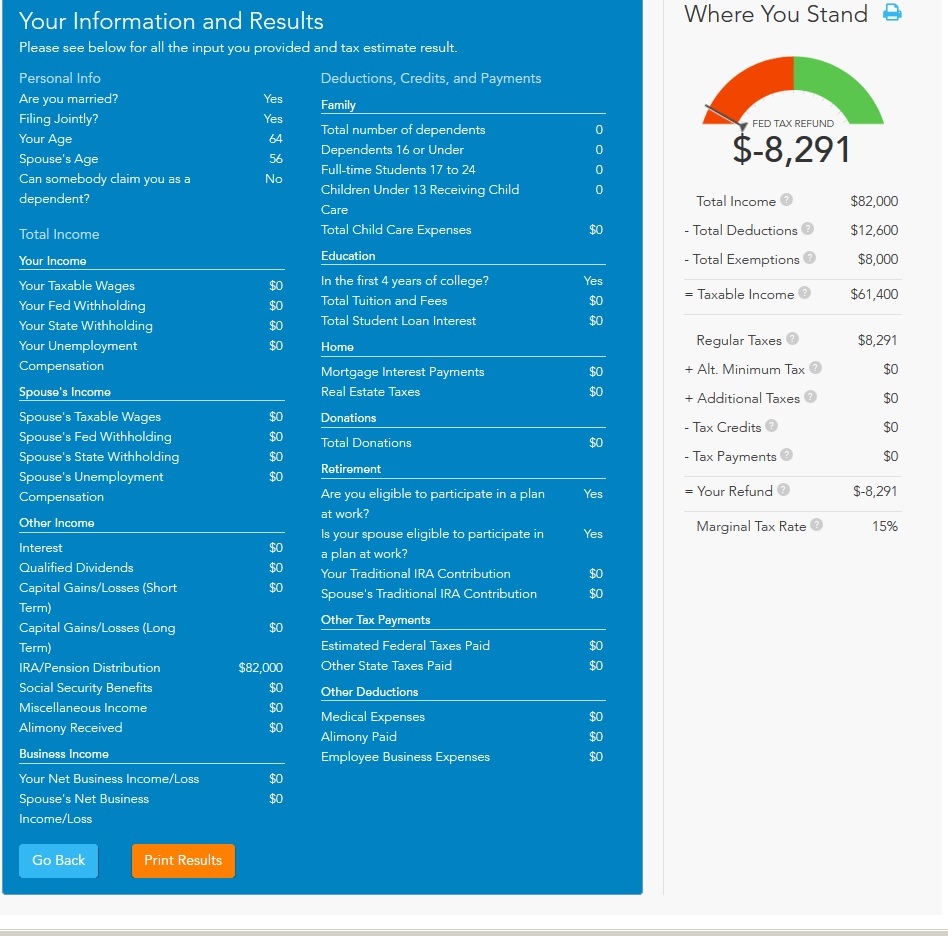

· Taxes: For FIRECalc I added 17% for taxes on top of the $82K (rounded to $96K). For Fidelity RIP, I clicked on my State and taxes were added (Fed & State I presume). For Financial Mentor BRC I plugged in 17% for combined Fed & State tax rate during retirement.

Both FIRECalc & Fidelity RIP use Monte Carlo / Historical returns in their calculations

For Financial Mentor BRC, I have a straight 5% estimated return and 3 % inflation plugged in thinking that on average we will be able to earn 2% on top of any inflation.

In general, I was surprised and wary of the higher End of Plan amount / results. I guess I’m more comfortable with the lower Financial Mentor BRC results since beating inflation by 2% on average seems reasonable. Anyone see any holes in my assumptions? Thanks for looking.

I ran all 3 of the above and tried to stay consistent across all three with my input. Below are my input notes.

Here is the Portfolio Balance at End of Plan results for each:

- FIRECalc $2.36M (ave) low was $134K, high was $8.8M. 100% success rate

- Fidelity RIP $1.96M

- Financial Mentor BRC $1.78M with 3% Social Sec COL increases.

- Financial Mentor BRC $269K with 1.5% Social Sec COL increases.

Inputs:

· Current Age 59, planned retirement at 60. Life expectancy to 94. DW also 59

· Beginning Portfolio Bal $1.6M. For both FIRECalc & Fidelity RIP use 50% as % in stocks (fairly conservative). For Financial Mentor BRC I used a straight 5% for Annual Interest / Growth of investments. Right now I’m actually 57/31/12 in stocks / bonds / cash.

· Contribution into Portfolio of $20K more over into next year

· Inflation: For FIRECalc I used the CPI option. For Fidelity RIP & Financial Mentor BRC used 3% for expected inflation.

· DW Social Security starts at age 66 with file & suspend. Her pay into SS has been relatively low. Using $750 /mo from age 66 to 94

· DH (me) Social Security starts at age 70 with file & suspend. $3,500 more per mo from 70 thru age 94. For both DW & DH input for COL increases is 3% for both starting at age 60 with Financial Mentor BRC.

· I realize this is probably on the high side. So I also ran this with 1.5% COL increases and it pushed down the End of Plan balance substantially. I did not see this option for the other two.

· Inheritances: $35K age 61 then another $100K at age 70

· No other income or benefits from previous employers

· Desired Income during retirement $82K before taxes for all years. In reality this should drop once both 65 with Medicare kicking in. $25K of the $82K is for HI and possible maxed out deductibles. No plan to leave any estate. Home sale in today’s $ might get $340K, only owe $20K on mortgage right now). Equity in home and contents / autos are not included in any calculations.

· Taxes: For FIRECalc I added 17% for taxes on top of the $82K (rounded to $96K). For Fidelity RIP, I clicked on my State and taxes were added (Fed & State I presume). For Financial Mentor BRC I plugged in 17% for combined Fed & State tax rate during retirement.

Both FIRECalc & Fidelity RIP use Monte Carlo / Historical returns in their calculations

For Financial Mentor BRC, I have a straight 5% estimated return and 3 % inflation plugged in thinking that on average we will be able to earn 2% on top of any inflation.

In general, I was surprised and wary of the higher End of Plan amount / results. I guess I’m more comfortable with the lower Financial Mentor BRC results since beating inflation by 2% on average seems reasonable. Anyone see any holes in my assumptions? Thanks for looking.