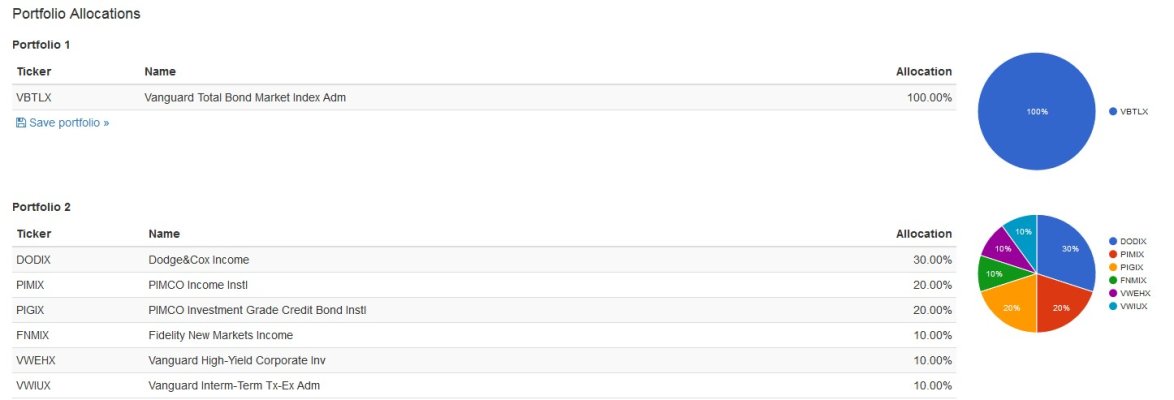

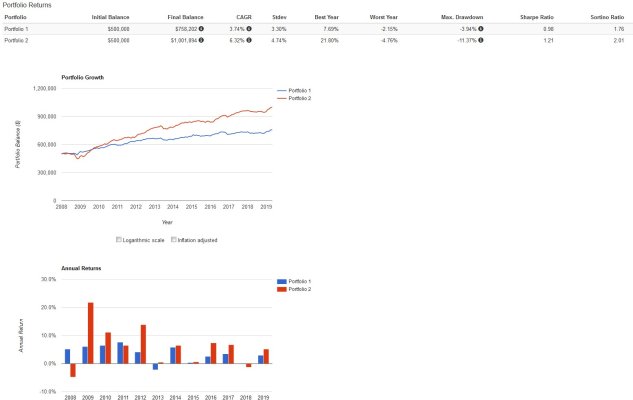

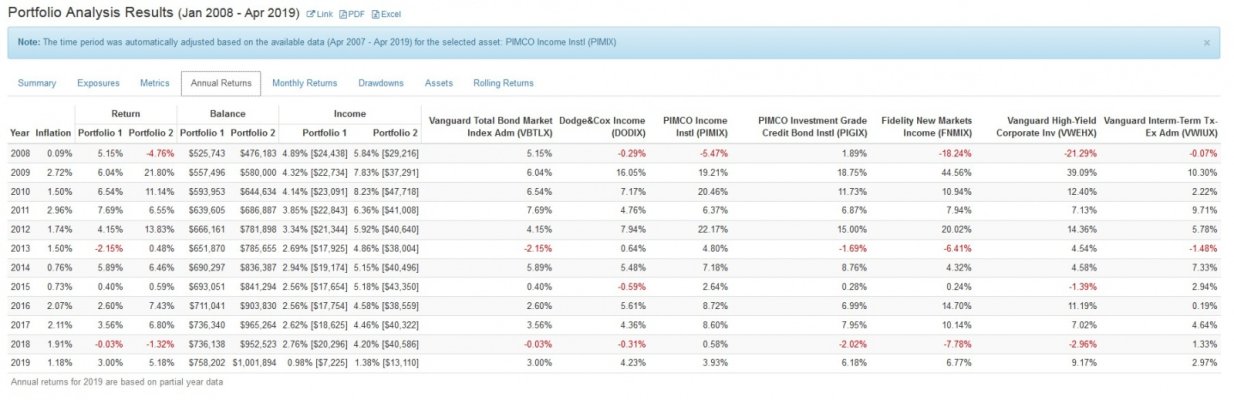

I recommend morningstar.com. Review the 4 or 5 star bond funds. I am a big fan of short term corporate funds such as VFSTX because of the low risk and 4 star rating. See

https://www.kiplinger.com/slideshow...uard-funds-to-own-in-a-bear-market/index.html

Liquidity is important in retirement in order to protect you during a bear market. The longest bear market and recovery time since WW2 is 90 months or 7-1/2 years according to the following link:

https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html

Once you have sufficient liquidity (or a sufficient safety net) to suit your risk tolerance during a potential bear market, you can be more aggressive in your equity investments.

I generally have a 50/50 portfolio but during a 15% or more market decline, I reallocate to 75%stock/25%bond to take advantage of the recovery. Since I already have a sufficient safety net or sufficient liquidity of 7-1/2 years of income in CDs, short term corp bonds, short term treasury bonds, etc, I can afford to reallocate my portfolio to become more aggressive.

A 70% stock and 30% bond portfolio is aggressive but may work only if the 30% bond has about 7-1/2 years of liquidity. Most investors are not concerned about liquidity before retirement because their paychecks acts as their liquidity. However, after retirement, your paychecks stops and you have to make sure you have sufficient liquidity in retirement.

During a bear market, your stock investment loses liquidity because the stock prices have declined and selling stock "locks in your losses" without giving time for your stock investment to recover. Hence you are depending on your other asset classes to hold you over.

During a bull market, everybody is making money and liquidity is not a problem. However, planning for a bull market to last forever is not wise. I therefore recommend thinking about liquidity or constructing a safety net when a bear market do arrive. People can get hurt because they picked the wrong bond fund and they do not have assets in CD or short term treasury bonds.