lazygood4nothinbum

Thinks s/he gets paid by the post

- Joined

- Feb 27, 2006

- Messages

- 3,895

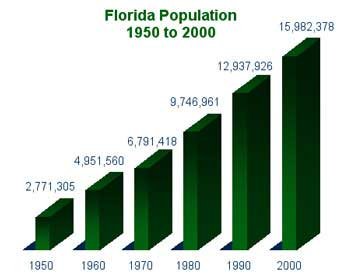

save our home (soh) was instituted about 10 years before the bubble started because we were already watching our property values rise faster than we'd before seen due not to the hot air of investors but to the reality of strong population growth into an area of limited resource. it almost didn't pass and then we only needed 51%, not the 60plus% we needed & got this time.

at that time, how quickly prices could rise here likely wasn't even apparent in places outside of south florida which is a highly desirable area for growth but limited in land by both the atlantic ocean and the everglades. but florida in general will likely always attract speculation of both domestic and international investors and its desirability for residence likely won't subside at least until global warming sinks us.

i don't hear anyone complain how this type of taxing structure has hurt california real estate, we are still a huge bargain compared to them as well florida shields income from taxation so i would imagine it will still attract newcomers who can stomach our apparent inequities even though they still come out ahead.

and you returned the enjoyment of your property that you received during those 58 years before you checked out?

the alternative was getting out of your overtaxed house and voting against an amendment you thought would amount to taxation without representation thereby putting pressure on the legislature to fined better remedy.

even presidential elections are hard pressed to find 51% in their favor. i don't buy for a second that 60plus% for this was a given. but i do find it interesting that amend 1 received so much support.

i had done my due diligence on mom's house at the time of inheritance so i knew i was going to get screwed on taxes. i have no idea why your friend did not act similarly. at least in his case, he would have had the chance to make a more informed decision whereas my situation was rather made for me without even having bought or sold anything.

at that time, how quickly prices could rise here likely wasn't even apparent in places outside of south florida which is a highly desirable area for growth but limited in land by both the atlantic ocean and the everglades. but florida in general will likely always attract speculation of both domestic and international investors and its desirability for residence likely won't subside at least until global warming sinks us.

i don't hear anyone complain how this type of taxing structure has hurt california real estate, we are still a huge bargain compared to them as well florida shields income from taxation so i would imagine it will still attract newcomers who can stomach our apparent inequities even though they still come out ahead.

Well, before I left NY should they have given me a rebate on the taxes I paid for 58years

and you returned the enjoyment of your property that you received during those 58 years before you checked out?

As far as the vote, there was no alternative. You either said OK I'll take the homestead exemption and the portability or I'll take nothing. So, the only people who would have voted no, were either necomers and young people who amounted to no where near the 40% needed to veto this fraud.

the alternative was getting out of your overtaxed house and voting against an amendment you thought would amount to taxation without representation thereby putting pressure on the legislature to fined better remedy.

even presidential elections are hard pressed to find 51% in their favor. i don't buy for a second that 60plus% for this was a given. but i do find it interesting that amend 1 received so much support.

I had a young guy at my house the other day fixing my cable box. He was born in Florida and boought his first house last August. His mortgage payment was $1400 a month, in Nov he got his new payment of over $1800. Now he put the house on the market because he can't make the payment.

i had done my due diligence on mom's house at the time of inheritance so i knew i was going to get screwed on taxes. i have no idea why your friend did not act similarly. at least in his case, he would have had the chance to make a more informed decision whereas my situation was rather made for me without even having bought or sold anything.