Freedom and COcheese, how did you decide which bond to buy? I own some CA Munis but have never invested in other type of bonds or preferred before.

This should be discussed in a thread for bond investing but I will try to answer your question on how I select my bonds. My investment strategy is preservation of capital. I do take some risk, but I invest with with my "eyes wide open". I avoid sectors such as mining, energy, commercial real estate, and retail. I have attached screenshots from Fidelity for the examples. Nearly identical screens are available from TD Ameritrade and Charles Schwab. THIS IS JUST AN EXAMPLE.

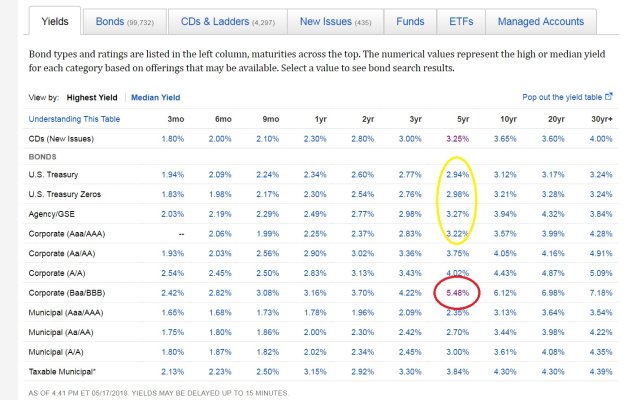

Step 1 (ref: Yield Table):

Start with the fixed income yield table. Note brokers don't show high yield corporate bonds/notes (BA1/BB+ and lower) in their yield table. Always compare corporate bonds with CDs and Treasuries of the same term. The yield curve today shows us that there is no point going beyond 3-5 year terms and CDs are offering better yields considering risk/reward than high investment grade corporate notes and treasuries. Therefore you are better off buying a 3 or 5 year CD than a AAA rated corporate bond/note of the same term. This means that the high investment grade corporate notes/bonds are overpriced relative to their risk. In this example, I selected lower investment grade 5 year corporate notes (circled in red) to see what Fidelity has in inventory.

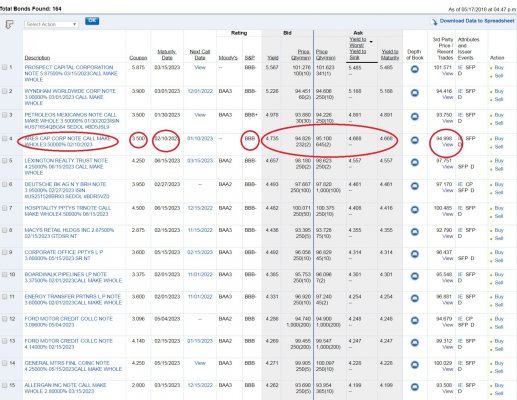

Step 2 (ref: 5 year corporate search results):

The results show the company, coupon rate (what it pays), maturity date, rating, bid/ask price, bid/ask yield, YTW, YTM, and link to recent trades to ensure that your are not overpaying for the bond/note. Note that the yield is higher than the coupon because the note is trading at a discount in the example circled. At maturity it will be redeemed at full par.

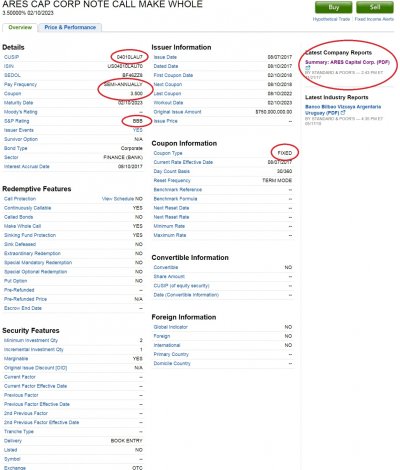

Step 3 (ref: ARES Capital summary):

If we select the 4th entry (ARES CAP CORP NOTE), a summary of the note is presented with the terms of payment and any research on the security. Review the ratings reports from S&P or Moody's for additional information on risk.

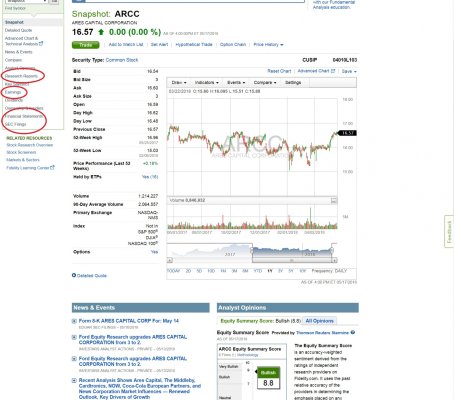

Step 4 (ref Ares stock snapshot)

I usually look at the underlying company information provided by the stock research to determine if the company is profitable, what are the earnings trends, what is the interest coverage ratio. Keep in mind, companies are contractually obligated to pay interest on debt but not contractually obligated to pay dividends. You should avoid companies that burn through their cash. I also look at recent news and SEC filings to ensure that I'm not considering a company with accounting problems or worse.

If everything checks out and I'm happy with the yield and term, then I'll buy otherwise I'll move on. Hope this helps.