LRDave

Thinks s/he gets paid by the post

$300K in fido IRA. Age 54 - retirement goal is Q3 2020 (Pensions kick in, SS for me (may defer), retirement home paid off.)

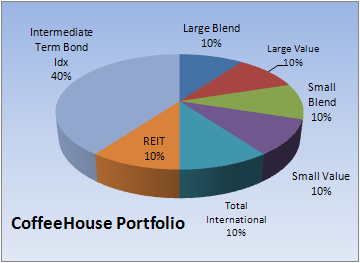

I have 19 funds in my IRA, including 4 I just moved over from MSSB that I have already converted to cash. I'd like to go boglehead-ish/coffee house-ish/couch potato-ish but stay with fido. Moderate to moderate+ on risk.

What about this portfolio?

Fund Level Amt Exp Ratio

Spartan 500 Index (FUSVX) adv. $110K .07

Spartan Inter. Bond Index (FIBAX) adv. $110K .10

Spartan Small Cap Index (FSSPX) inv. $ 25K .31

Spartan Real Estate Index (FRXIX) inv. $ 25K .26

Spartan Global Index (FSGUX) inv. $ 25K .24

Fidelity 4-in-1 Index (FFNOX) $ 5K .23

(Advantage Class needs $100K min. Investor Class needs $10K min. I already own the 4-in-1 and want to keep it for curiousity sake.)

Any and all comments and insights appreciated.

I have 19 funds in my IRA, including 4 I just moved over from MSSB that I have already converted to cash. I'd like to go boglehead-ish/coffee house-ish/couch potato-ish but stay with fido. Moderate to moderate+ on risk.

What about this portfolio?

Fund Level Amt Exp Ratio

Spartan 500 Index (FUSVX) adv. $110K .07

Spartan Inter. Bond Index (FIBAX) adv. $110K .10

Spartan Small Cap Index (FSSPX) inv. $ 25K .31

Spartan Real Estate Index (FRXIX) inv. $ 25K .26

Spartan Global Index (FSGUX) inv. $ 25K .24

Fidelity 4-in-1 Index (FFNOX) $ 5K .23

(Advantage Class needs $100K min. Investor Class needs $10K min. I already own the 4-in-1 and want to keep it for curiousity sake.)

Any and all comments and insights appreciated.