I have not posted for a while. Been RVin', ya know, and where we've been staying most of the time, there's no Internet, no cell phone signals.

And when I do get Internet access, I am just too tired at the end of the day to surf much. Too busy with travelin', hikin', sight seein'...

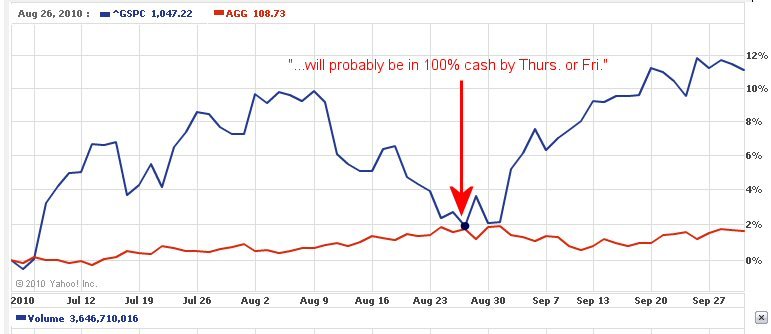

Right now, I just happen to be at a public library in a small Californian town to check my portfolio. Compared to its value on 8/23 when this thread started, I am doing quite OK. Though I am opposite Dex on our recent trades, I respect his opinion and action. "You pay your money, and you take your chances".

And by the way, at a National Park RV campground in Utah, I saw a man with a Casita and I though of Dex. No, I observed but did not ask him

Well, it could be him, and I would also have to reveal myself

Will have to log off soon to resume what we have been doin'... Life is still good... Just a quick post to let everyone knows I am still alive and kickin'...