madsquopper

Recycles dryer sheets

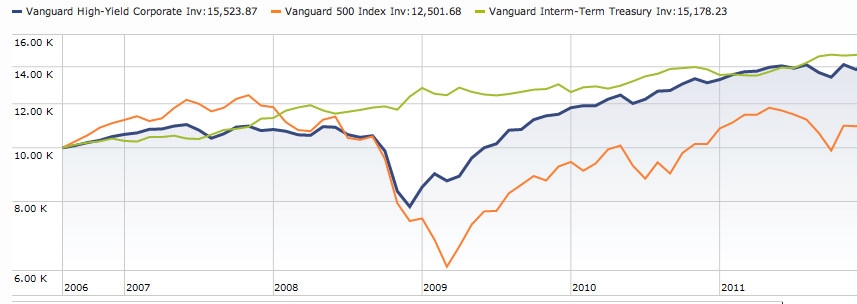

Close to retiring and am thinking about simplifying things a bit and consolidate holdings. General asset allocation is and will stay around 60/40 (equities/bonds) plus or minus a few points. For the 40% bond part I'm considering something like:

50% BND (US bond index)

25% BNDX (International bond index)

25% GHYG (Global high yield, about 60% is US)

Thoughts? Perhaps having 25% of bonds in high yield is a bit much, perhaps go a bit lower. As is, might be more like having an overall 65/35 split.

Larry

50% BND (US bond index)

25% BNDX (International bond index)

25% GHYG (Global high yield, about 60% is US)

Thoughts? Perhaps having 25% of bonds in high yield is a bit much, perhaps go a bit lower. As is, might be more like having an overall 65/35 split.

Larry