brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Cb said:If you're ER'ing with at a 95% "success rate", you've got a pretty slim chance (~1 in 20) of having picked the worst year or two that leads to a busted ER. A few years later, with a little growth, you've grown away from the 95% rate, perhaps up to 100% and it's smooth sailing.

But if you reset after every up year, you're right back up to that 1 in 20 chance, again and again...do that 10 or 20 times and there's a mighty good chance you'll find that troublesome patch.

Cb

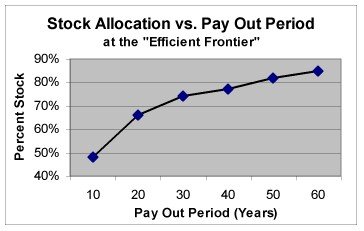

But you are also a year older every time you reset. Do it 10 or 20 times and you will be 10 or 20 years older and the money won't need to last as long (AKA you r withdrawal period will be shorter). So there is a counter-balance.