REWahoo

Give me a museum and I'll fill it. (Picasso) Give

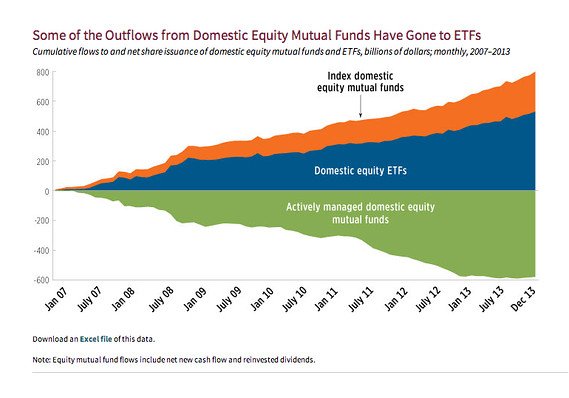

One of the charts in the article Why trading volume is tumbling, explained in 5 charts shows tremendous growth since 2007 in index funds and exchange traded funds that track indexes.

Equally revealing is the corresponding decline in growth of actively managed equity funds.These two types of funds have grabbed about 24% of the U.S. mutual fund and ETF market, down [should be "up"] from less than 5% in 1998...