You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hard to live on 100K per year ?

- Thread starter Sunset

- Start date

retired1

Recycles dryer sheets

- Joined

- Jun 10, 2011

- Messages

- 297

100K ? That's more than twice that I'm able to live on based on my current budget including mortgage, utility bills, taxes etc. IMHO Unless you are a multi-millionaire, 100K is a big $$s

Pilot2013

Full time employment: Posting here.

My DH just told me from a Kiplinger report, 90% of Americans have a savings of $500K or less. That put us in the top 10% of Americans. Very hard to believe.

From all of the "reports" I have seen lately, $500k is way high for 90%. I have read where 70% have less than $100k....

100k is really easy to spend if you've got kids and want to live in a higher end home. Twelve years ago when I was single I lived in a 2-bedroom apartment with a roommate. My costs were pretty darn low, even though I really didn't make a huge effort to scrimp. I just avoided big recurring payments for the most part.

Now I am married with two children. The small starter home was sold to get the big, nice house in the good school district. Last year with both kids in the Montessori preschool our big expenses were--

~30k for two kids tuition and daycare

~33k for mortgage and utilities

Once you make those expensive choices, your cost of living is going to be expensive.

On the plus side, we love the house and the neighborhood, and my children are way ahead of where I was academically at their age, and I was no slouch in that area as a kid.

We are a dual-income family making just under 200k per year, but month to month money actually feels a little tight, since we have so much going into retirement accounts and my company stock purchase plan (we both max out our 401k/457, and the ESPP allows me to buy at a discount. I sell every 6 months to take the free money). Now that the oldest kid is out of preschool, we've started putting $1000/month extra to the mortgage.

The only time we really feel rich is when we add up the investment account balances, but we are probably spending somewhere around 130k year right now.

On the plus side, all the cheap living before the kids came along has put our net worth in about the $2 million range after this crazy bull market. Once the youngest gets out of preschool we'll be about another 12k/year ahead. Of course, we'll need to start thinking about college soon

Now I am married with two children. The small starter home was sold to get the big, nice house in the good school district. Last year with both kids in the Montessori preschool our big expenses were--

~30k for two kids tuition and daycare

~33k for mortgage and utilities

Once you make those expensive choices, your cost of living is going to be expensive.

On the plus side, we love the house and the neighborhood, and my children are way ahead of where I was academically at their age, and I was no slouch in that area as a kid.

We are a dual-income family making just under 200k per year, but month to month money actually feels a little tight, since we have so much going into retirement accounts and my company stock purchase plan (we both max out our 401k/457, and the ESPP allows me to buy at a discount. I sell every 6 months to take the free money). Now that the oldest kid is out of preschool, we've started putting $1000/month extra to the mortgage.

The only time we really feel rich is when we add up the investment account balances, but we are probably spending somewhere around 130k year right now.

On the plus side, all the cheap living before the kids came along has put our net worth in about the $2 million range after this crazy bull market. Once the youngest gets out of preschool we'll be about another 12k/year ahead. Of course, we'll need to start thinking about college soon

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,221

If I remember correctly, I didn't have 500K until I was in my late 40's, so I am not sure if it is that surprising...?My DH just told me from a Kiplinger report, 90% of Americans have a savings of $500K or less. That put us in the top 10% of Americans. Very hard to believe.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, you don't have state income tax in FL. Not sure what your property tax is. Ours is over $14K this year. That plus state & federal income tax and health insurance/medical costs gets us well on the way. Add in food, transportation, housing, travel, dining out, gifting, etc etc and not hard to see why we're well over $100K. YMMV

Property Taxis $5k with homestead. Assessed value a lot lower than Sale Value.

Lump sum lease averages 5K per year.

HI is No Premium $2450 TOOP

Home Insurance including flood. $1500

Car Insurance $600

Utilities about $3600 - $4000

So far on my Budget Spreadsheet we are averaging $2k pm MANDATORY expenses and I think everything is paid for 2017. Including House Maintenance and Health insurance (ACA).

Last edited:

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Are these lump sum paid leases included in the $50k/year of living costs? I'm skeptical in that we live much more modestly than you describe and I can't imagine doing it on $50k a year.

Also, I've always wondered about those prepaid leases.... what happens if you have an accident and total the car right after you get it? Your insurer just will pay FMV and you need to go and find a replacement acceptable to you and the lessor?

Non US car companies offer pre-paid GAP insurance as part of the one pay lease. You do need to make sure they do the correct lease agreement though. The Title of it is "One Pay Lease Agreement". The other regular one only has GAP insurance for cost of the car, not the payments. Not sure about US companies.

Last edited:

Calico

Thinks s/he gets paid by the post

- Joined

- Apr 16, 2012

- Messages

- 2,936

Thank goodness we have the humidity in North Carolina. Keeps those desert seeking wimps away.

Sure, we have mountains and unbelievable coast, but you really don't want to come here. Stay away. The humidity is *terrible*.

Yup. The humidity is horrible. And the bugs are huuuuge.

And there are people everywhere. Way too many people. Please don't come here.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yup. The humidity is horrible. And the bugs are huuuuge.

And there are people everywhere. Way too many people. Please don't come here.

Just like FLA, but a little off topic.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,076

WE live in a MCOL and spend about 73k/year. That includes 10k in travel and we go out about 2x's week. WE could cut back if we ever needed too. We love to eat out but it is fattening so limit ourselves usually. We drive our cars until they die. We are lucky that our property taxes are only 700/year.

GTFan

Thinks s/he gets paid by the post

We can live off $40k in Florida, and would live like kings on $100k.

I'm having a hard time spending $24k/year here in the ATL.

It does help to be able to travel for basically nothing other than gas/food/car rentals.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

I'm having a hard time spending $24k/year here in the ATL.

It does help to be able to travel for basically nothing other than gas/food/car rentals.

So tell me more...where do you stay when you travel?

We can go out on the town pretty cheaply. There's Netflix for live events kinds of subscriptions in our area and all sorts of annual passes for activities like wine tasting and museums that bring our per outing cost down pretty low.

Last edited:

I think there is a lot of apples and oranges here. It seems to me that most of the posters here are talkiing about spending, ie net taxes, while choosing to be living a frugal lifestyle off ample investments funding an ER. If you only have an income of $50k, and a paid off home in an average COL area, & most income are low tax divs etc, then taxes are what, $5k or less? Your taxes are much lower, no payment in to SS/Med, no more saving in to savings, etc, etc. You are “there”.

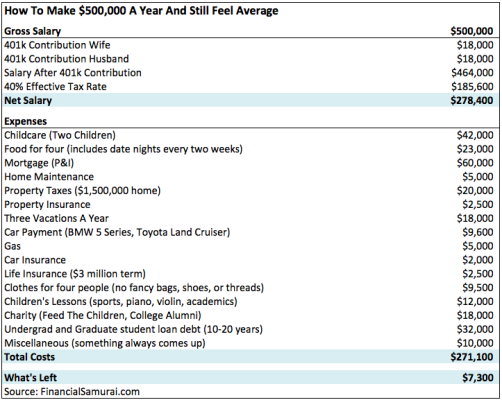

Obviously, even though the article was fluff, the subjects were working stiffs, with mortgages, not smart enough with money, to even comprehend that there is this tiny public segment of early retirees. So expect overall taxes in the $25-30k range, so net is $70-75k minus another $12k mortgage and its easy to see them trying to better their “living” on $58k, with a family and associated costs. Once you are “there”, it’s relatively easy to maintain a low income lifestyle. The hard part is getting “there”.

Obviously, even though the article was fluff, the subjects were working stiffs, with mortgages, not smart enough with money, to even comprehend that there is this tiny public segment of early retirees. So expect overall taxes in the $25-30k range, so net is $70-75k minus another $12k mortgage and its easy to see them trying to better their “living” on $58k, with a family and associated costs. Once you are “there”, it’s relatively easy to maintain a low income lifestyle. The hard part is getting “there”.

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,439

There was an article a couple of years ago about a household with $200 or $250k income living in Brooklyn.

Between private schools and some vacations, they couple said they didn't feel rich.

Well yeah, they passed up on more luxurious things to pay for good schooling for their kids. That is a choice they made.

Between private schools and some vacations, they couple said they didn't feel rich.

Well yeah, they passed up on more luxurious things to pay for good schooling for their kids. That is a choice they made.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Your taxes look a bit heavy... if $100k earned income and MFJ with standard deduction and 2 exemptions and California state tax (high tax state) then total taxes would be $24k... $6.2k SS, $1.45 medicare, $12.3k federal income and $3.7k Ca income per Income Tax Calculator - Tax-Rates.org

That leaves $76k take-home pay or over $6k a month for expenses and saving.

That leaves $76k take-home pay or over $6k a month for expenses and saving.

I was misinformed

Recycles dryer sheets

- Joined

- Jun 14, 2015

- Messages

- 106

Excellent idea!

Hmmm... Robots have no need for stuff that humans do....

I say we confiscate all of their salary. What can they do? They don't even know to complain. If they do, we just pull their plug.

I can’t resist....

[ 2001: A Space Odyssey (1968) - Quotes - IMDb ]

StephieJean

Recycles dryer sheets

Hard to live on $100K

The that thread is hilarious. I wouldn't have the energy either.

The that thread is hilarious. I wouldn't have the energy either.

kcowan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We stayed at The Imperial Palace in Annecy in October. I was thinking of Robbie when we chose that place. Ferraris parked out front like Monaco. Over $1000 for 3 nights. 22 Euros for a Manhattan at their jazz bar. Yea baby! Bring it on.

Parking was free except for the tip (5 euros).

Parking was free except for the tip (5 euros).

Your taxes look a bit heavy... if $100k earned income and MFJ with standard deduction and 2 exemptions and California state tax (high tax state) then total taxes would be $24k... $6.2k SS, $1.45 medicare, $12.3k federal income and $3.7k Ca income per Income Tax Calculator - Tax-Rates.org

That leaves $76k take-home pay or over $6k a month for expenses and saving.

When I said overall taxes, it was just a stab which included property tax. In CA another 6-7k avg? A 1k/mo Mortgage is still low if it was just P&I.

My point was that those that are FIRE are not worried about saving for retirement and have a firm handle on living on their investments and minimizing costs and taxes, which is far above the capabilities of the average working Joe. 10 years ago I wouldn’t have imagined a group like this existed. I wish I had. Knowledge is power.

Last edited:

Danmar

Thinks s/he gets paid by the post

We stayed at The Imperial Palace in Annecy in October. I was thinking of Robbie when we chose that place. Ferraris parked out front like Monaco. Over $1000 for 3 nights. 22 Euros for a Manhattan at their jazz bar. Yea baby! Bring it on.

Parking was free except for the tip (5 euros).

Yes, Europe is insanely expensive. Going to Asia in Feb and May and the 5 star hotels seem to be about 1/3 the price of Europe. I think the most expensive travel we have ever booked was the barge in Burgundy (Belmond, Fleur de Lys). Really blew the dough. Worth it though.

2k6_TX_Dad

Dryer sheet aficionado

- Joined

- Dec 1, 2014

- Messages

- 32

There was an article a couple of years ago about a household with $200 or $250k income living in Brooklyn.

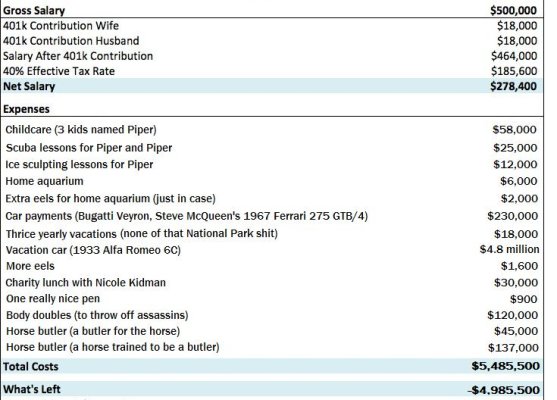

Was it this one?

And the funny reply (More eels)?

Attachments

exnavynuke

Thinks s/he gets paid by the post

I'm having a hard time spending $24k/year here in the ATL.

It does help to be able to travel for basically nothing other than gas/food/car rentals.

Mortgage and utilities put me at almost $20k/year outside Atlanta. Add in food and I'm well over $24k/year and I haven't left the house yet or bought anything but groceries..

explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,439

We stayed at The Imperial Palace in Annecy in October. I was thinking of Robbie when we chose that place. Ferraris parked out front like Monaco. Over $1000 for 3 nights. 22 Euros for a Manhattan at their jazz bar. Yea baby! Bring it on.

Parking was free except for the tip (5 euros).

Yes, Europe is insanely expensive. Going to Asia in Feb and May and the 5 star hotels seem to be about 1/3 the price of Europe. I think the most expensive travel we have ever booked was the barge in Burgundy (Belmond, Fleur de Lys). Really blew the dough. Worth it though.

I haven't been to Annecy but I'm sure there are cheaper accommodations, though it's close to expensive Geneva and I'm sure in peak winter and summer seasons, it gets pricey.

5-star hotels in Hong Kong and Singapore seems to be just as expensive. Bali seems to have resorts that are cheaper but they also have high-end properties for people who have money.

Danmar

Thinks s/he gets paid by the post

I haven't been to Annecy but I'm sure there are cheaper accommodations, though it's close to expensive Geneva and I'm sure in peak winter and summer seasons, it gets pricey.

5-star hotels in Hong Kong and Singapore seems to be just as expensive. Bali seems to have resorts that are cheaper but they also have high-end properties for people who have money.

Agree about Hong Kong. We are going to India and Viet Nam where they still seem a more reasonable price.

In Connecticut, I don't think I could get by on $200k, granted we have three kids, but taxes, sports, and general cost of living is just so high. If I lived in the heartland I am sure $100k would be just fine. Manhatten and lower Westchester is even more ridiculous.

One thing that amazes me is what people spend on groceries. We buy organic but also buy much of our bulk food at Costco and it is easily 15k per year. My real estate taxes are 33k!

One thing that amazes me is what people spend on groceries. We buy organic but also buy much of our bulk food at Costco and it is easily 15k per year. My real estate taxes are 33k!

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 14

- Views

- 2K

- Replies

- 32

- Views

- 3K