You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has your nest egg fully recovered yet?

- Thread starter Maurice

- Start date

We were aggressively DCAing the maximum into retirement accounts during the slump, I picked a great time to throw some extra cash into the kids 529s (almost perfectly timed the bottom), and we bought an apartment at a great, fire-sale price in May 2009 (selling prices have since gone up about 50% from what we paid). We hit our net worth low point in March last year, and it has been steadliy coming back up from there. Net worth was up 52% comparing 01 Jan 09 to 01 Jan 10 figures. We are pretty happy campers! Glad I didn't flinch and sell stuff when things were going down. I did do some rebalancing in August, and feel good about that.

lhamo

lhamo

Within 3%

Our NW peaked at $3.6 MM in June 2007 and bottomed just below $2 MM in Nov 2008. Aggressively rebalanced (OK market timed) and upped my equities from ~60% to 90%. Now at $3.5 MM or about 3% below the peak.

At one point my ESO's were worth $1.3 MM. At the low in Nov 08 they were all under water. (OK I did cash some out in April 08 when Megacorp stock was 5% below its all time high). It was still painful to see an account that once contained $1.3 MM worth a big fat goose egg. Fortunately I have been taking my options off the table in year 8, so not worried about expiring options before 2012 - they are back up to $600K, or $850K if I include the quarter mill in profits I booked April 08.

Our NW peaked at $3.6 MM in June 2007 and bottomed just below $2 MM in Nov 2008. Aggressively rebalanced (OK market timed) and upped my equities from ~60% to 90%. Now at $3.5 MM or about 3% below the peak.

At one point my ESO's were worth $1.3 MM. At the low in Nov 08 they were all under water. (OK I did cash some out in April 08 when Megacorp stock was 5% below its all time high). It was still painful to see an account that once contained $1.3 MM worth a big fat goose egg. Fortunately I have been taking my options off the table in year 8, so not worried about expiring options before 2012 - they are back up to $600K, or $850K if I include the quarter mill in profits I booked April 08.

I don't keep anything but annual data.

Given our aggressive contributions, my wife and I are quite a bit above our Dec 31st 2007 peak again. I'm pretty sure we are still below whatever we had in Sept of 2007, but since I don't keep records of that, I don't really need to worry about it.

Given our aggressive contributions, my wife and I are quite a bit above our Dec 31st 2007 peak again. I'm pretty sure we are still below whatever we had in Sept of 2007, but since I don't keep records of that, I don't really need to worry about it.

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not quite - still down 9.75% from peak of Oct 2007.

In March 2009 I was down 40% from peak.

Audrey

Interestingly, my percentages and dates are almost exactly the same as you and 73SS454. I'm down roughly 10% from my Oct, 2007 net worth peak.

I've been retired 3.5 yrs. I am actually up a little in net worth from what it was on my June, 2006 retirement date despite being in the withdrawal phase.

And, I'm having fun.

theloneranger

Recycles dryer sheets

- Joined

- Dec 27, 2006

- Messages

- 154

Net worth is almost twice the value 15 months ago @ its low.

A few thousand in stock grants.

Mostly recovered stock values and continued contributing to the max in the 401K and partially matched corporate stock purchases.

Also does not hurt that company stock has gone from mid 20's to mid 40's.

A few thousand in stock grants.

Mostly recovered stock values and continued contributing to the max in the 401K and partially matched corporate stock purchases.

Also does not hurt that company stock has gone from mid 20's to mid 40's.

Moemg

Gone but not forgotten

No , my portfolio has not fully recovered but at least it's out of ICU .

hguyw

Recycles dryer sheets

- Joined

- Feb 9, 2008

- Messages

- 106

I'm still down 5% from my known high in May or June of 2008 (includes contributions).

texastech97

Confused about dryer sheets

- Joined

- Dec 24, 2009

- Messages

- 8

My retirement portfolio peaked in June of 2008 and was down 38.5% in March of 2009. Thanks to dollar cost averaging, I recovered in Oct of 2009. I have been ahead since then.

This thread has caused me to reflect on my portfolio. I now realize that even though I held $1 MM in cash before the meltdown (almost 40% of porfolio) that my portfolio ended up down 45%. In other words, at 60% invested my portfolio behaved like a 100% equities portfolio due to the leverage inherent to my employee stock options.

Perhaps that should influence my asset allocation choice for retirement, at least the first few years while I still have in the money ESO's in my portfolio. I anticipated a bad end to the real estate bubble / sub prime mess, and thought I was pretty defensively positioned with $1MM in cash. Now I realize I was effectively still fully invested.

Fortunately the leverage worked on the upside as well and I am now up to 98% of the peak.

PS Mods, I can't seem to edit my post in this thread from yesterday - does the edit button disappear after some time period? I was able to edit it yesterday.

Perhaps that should influence my asset allocation choice for retirement, at least the first few years while I still have in the money ESO's in my portfolio. I anticipated a bad end to the real estate bubble / sub prime mess, and thought I was pretty defensively positioned with $1MM in cash. Now I realize I was effectively still fully invested.

Fortunately the leverage worked on the upside as well and I am now up to 98% of the peak.

PS Mods, I can't seem to edit my post in this thread from yesterday - does the edit button disappear after some time period? I was able to edit it yesterday.

rescueme

Thinks s/he gets paid by the post

XIRR 12/31/2008 - 01/08/2010: -12.24% for me

Retired in early 2007. Values reflect only equity/bond positions. Cash (e.g. retirement cash bucket, held in MM accounts for current retirement income not included in calculation).

Retired in early 2007. Values reflect only equity/bond positions. Cash (e.g. retirement cash bucket, held in MM accounts for current retirement income not included in calculation).

Yep, checked last nite. I am up from my all-time high in Oct 2007. $500 above the top. Who knew?

Oh, and this is just Vanguard. I have other stuff, like bonds and cash, and they're up too.

I know, nothing to crow about, but at least until Monday, the Eagle is flying again.

Oh, and this is just Vanguard. I have other stuff, like bonds and cash, and they're up too.

I know, nothing to crow about, but at least until Monday, the Eagle is flying again.

golfnut

Full time employment: Posting here.

My nw has just recently exceeded the prior high of 10/31/07. My allocation is 50/30/20. I kept contributing to my 401k and after-tax investments.

Good thing - I did not sell equities when the going got ugly.

Bad thing - I did not actively rebalance i.e. buy more equities

Guess you could say I was brave but not that brave

Good thing - I did not sell equities when the going got ugly.

Bad thing - I did not actively rebalance i.e. buy more equities

Guess you could say I was brave but not that brave

TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Yep, checked last nite. I am up from my all-time high in Oct 2007. $500 above the top. Who knew?

Oh, and this is just Vanguard. I have other stuff, like bonds and cash, and they're up too.

I know, nothing to crow about, but at least until Monday, the Eagle is flying again.

Congrats! However, we did have a conversation about high-flying eagles and jet engines, as I remember.

shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 534

Like many my high water mark of net worth was in 10/07. I entered a deacumulation phase in 4/08. I am down 11.8% from my high but a more important benchmark I look at it is where I am vs. when I started the deacumulation phase, that is down 8% (My spending accounts for 3% of that drop).

I am feeling better, let's hope it lasts. Last winter was not a fun time.

I am feeling better, let's hope it lasts. Last winter was not a fun time.

BUM

Thinks s/he gets paid by the post

My nest egg has almost recovered, but its still got a nasty headache...ssh

Maurice

Full time employment: Posting here.

On one hand I too hope it lasts, on the other hand I definitely benefitted from buying/rebalancing on the dips.

I'll take another 40% drop in the S&P this year as long as it recovers in the next 18 months...

I'll take another 40% drop in the S&P this year as long as it recovers in the next 18 months...

mountaintosea

Full time employment: Posting here.

- Joined

- Aug 6, 2006

- Messages

- 564

I've recovered and then some from my previous high. I'm wondering how long that will last. Some are predicting a double dip.

freebird5825

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Creeping back up there...still down about 10% from a May 2007 high water mark.

Meadbh

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 22, 2006

- Messages

- 11,401

No , my portfolio has not fully recovered but at least it's out of ICU .

You just can't take the nurse out of the girl, can you?

Since I'm still w*rking, I'm saving, and my NW is at an all time high. My three equity accounts are approximately back to their peaks. One in particular has increased by 31% since its nadir, mostly because of Canadian value and dividend stocks, while the US and foreign equities are down. I'm hoping that these sectors will benefit from the next market cycle.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I don't want to sound insensitive, but wonder if many of us whose nest eggs have been scrambled would feel like posting here. The point is that most posters show better results than the market, whether the Dow or S&P500, as measured from trough till now.

And here is another point. It appears that many of us were shuffling money around in the last 2 years. Call it market timing or "rebalance" as you wish, but we as a group did quite a bit of that with various results.

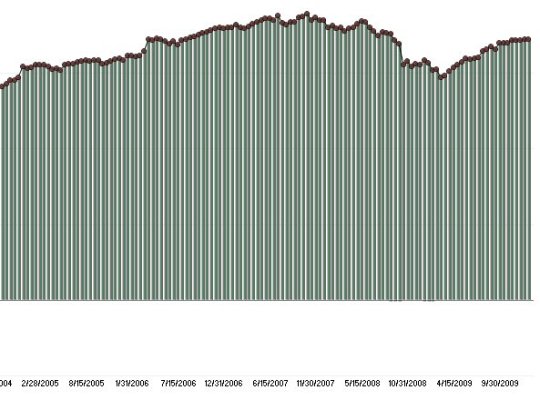

Look at the S&P500, which peaked in Oct 07 at around 1550. The bottom was in March 09, at 735. It is now at 1145.

Now, suppose a person has 50% in SP500, and 50% in low yielding bond or cash at the top of the market. Suppose further that she did nothing and held on without adding money nor withdrawing. At the bottom of 09, she would be down 26% relative to the top in 07. At this point, she would still be down 13%.

Compared to the above, it looks like most people here were down more than 26%, and yet, recover at this point to better than 13%.

I therefore conclude that we as a group hold stocks with a higher beta than the S&P500. Either that, or our "rebalance" hurt us during the downdraft but helped during the upswing somehow. Comments?

And here is another point. It appears that many of us were shuffling money around in the last 2 years. Call it market timing or "rebalance" as you wish, but we as a group did quite a bit of that with various results.

Look at the S&P500, which peaked in Oct 07 at around 1550. The bottom was in March 09, at 735. It is now at 1145.

Now, suppose a person has 50% in SP500, and 50% in low yielding bond or cash at the top of the market. Suppose further that she did nothing and held on without adding money nor withdrawing. At the bottom of 09, she would be down 26% relative to the top in 07. At this point, she would still be down 13%.

Compared to the above, it looks like most people here were down more than 26%, and yet, recover at this point to better than 13%.

I therefore conclude that we as a group hold stocks with a higher beta than the S&P500. Either that, or our "rebalance" hurt us during the downdraft but helped during the upswing somehow. Comments?

kumquat

Thinks s/he gets paid by the post

Or possibly a > 50% allocation to equities? I can't be bothered to do the [-]math[/-] arithmetic.

Similar threads

- Replies

- 117

- Views

- 9K

- Replies

- 119

- Views

- 11K

- Replies

- 53

- Views

- 6K

- Replies

- 14

- Views

- 890