For discussion purposes, I see hedonics as one of the major factors in planning for the longer term retirement.

In particular, decisions on housing, but also to establish a DEW line for major shifts in the economy. A good example of this, the current policy movement among the international Central Banks.

Understanding long term interest rates as a precipitating factor for growth, decline, deflation, inflation or hyperinflation is a step beyond market movement and the stability of the market itself.

Subjects such as housing as a percentage of GDP, and (in another thread) the aging population, the effects of medicine, and climate change are just a some of the factors what will be rebalancing in a "Globalized" world.

We, as a nation, have been through a very long period of relatively stable economy broken by relatively small recessions, and mostly affecting stock market losses. Long forgotten and misunderstood are the periods of real hardship from 1929 to the of recovery in 1941.

There are current arguments that the CPI (before chained CPI) has created a gap between stated and real inflation. (Shadow Statistics). Whether that is true or not, the basis behind the establishment of the value of goods and services is only as good as the basis of the currency underlying the calculations.

I am reminded of the saying: "

A rising tide lifts all boats".

By the same token the corollary that receding tide could earlier strand and damage those boats with greater draft, with a loss of much cargo. Therein lies the thought that early recognition and preparation could avoid running aground.

So... what?

Where to live?

What to pay?

Rent v. own?

Corporations stability and outlook relative to the economy.

Bond v. Stocks v. other Material investments.

Timing?

Widening understanding of alternate investment strategies.

Gold?

Emerging nations?

Commodities?

Population explosion related factors

Environmental concerns.

And the rest of the litany of risk reward factors.

.........................................................................................................

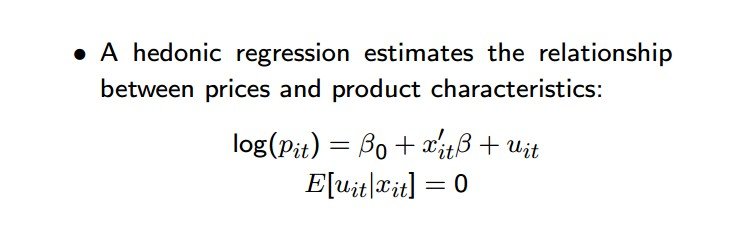

Down to the basics: How is value established?

Will the Michael Jordan Fleers Bubble Gum card be worth $20K in 2024?

Will an extended drought in the West drive up food prices?

Why did property values in Detroit and Las Vegas change? Where else could this happen in ten years?

What could happen with a collapse of the Euro?

Can copyright laws be enforced?

What has value today?

What will have value tomorrow?

Think Pensions, Social Security, Education, Welfare, and especially TAXES.

As food for thought, three minutes spent on this page

World Debt Clocks to look at DEBT, should give a picture of the inequality between nations. For a quick comparison, look at

public debt to GDP and

outside debt to GDP.

Note where the percentage decimal place is!

Check

US

UK

India

China

Russia

So... a wider definition of hedonic... the value we place on what makes up the security part of our lives.... and regression... the actual on-balance measure of what the future may bring.