|

|

Housing market spot check

10-08-2007, 08:56 AM

10-08-2007, 08:56 AM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2003

Posts: 18,085

|

Housing market spot check

A couple of our friends are having their rented outer boro of NYC digs sold out from under them. Since they are thinking about having kids, they have decided to look for a house. They looked in Westchester, but were appalled at the prices even after reductions. They were interested in NJ, so DW, some other local friends and I took them on a tour yesterday. I did most of the pseudo-realtor duties, including walking into several open houses as we were cruising around looking at neightborhoods. This was all in central NJ, mostly in Monmouth County. A few observations:

- There is a ton of stuff sitting on the market. 6 months, 9 months not uncommon, and we saw a number of properties that had seen asking prices reduced more than once (with clear intimations that asking prices were just that).

- Some of the 'hoods we looked at were original Levit developments, where the houses were pretty much the same in the same 4 basic models. Prices for the same model varied a bit by age and location, but the price range wasn't that wide and there appears to be a leapfrog effect where vcompeting properties keep chopping prices to get below the other guy.

- Why in Gawd's name would you try to sell a property with the original 60s asbestos shingles, even if they were still in good shape?

- Realtors are looking pretty sad and desparate, and a few even started to size me up as competition as I lead our friends into open houses. I thought this was curious since I was walking around in a faded t shirt, well worn costco shorts, and 3 days beard growth (practicing for ER).

- Even stuff with unique features or location seemed to be open to offers. We saw a ranch that had been turned into a mother-daughter (complete with second kitchen) and had the garage converted to a very nice den that was open to offers. Also saw the most immaculate 35 YO house I have ever seen on a really nice piece of property in a nice 'hood that had had the price slashed twice.

- We looked at a bank-owned property through the windows and stomped around the yard gawking. Really nice spot, but it needs a ton of work. No way they will get anything like their asking price. Even if they got their asking price, I would estimate that the bank will take a ~50% loss.

I think RE has a long way to go (down).

__________________

"All animals are equal, but some animals are more equal than others."

- George Orwell

Ezekiel 23:20

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

10-08-2007, 09:07 AM

10-08-2007, 09:07 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,022

|

Someone with a dissenting opinion will be along shortly to refute your observations...

BTW, nice avatar. I think it's "you".

__________________

Numbers is hard

|

|

|

10-08-2007, 09:12 AM

10-08-2007, 09:12 AM

|

#3

|

|

Full time employment: Posting here.

Join Date: Dec 2006

Location: Florida

Posts: 854

|

Our Sat paper has a RE section with a weekly front article by the local RE association. Each week the articles say it is a good great time to buy. They use statistics, local and national information in conflicting and misleading ways to prove their point. The main philosophy seems to be "if we tell 'em things are good often enough, they will believe it and start buying". By looking around my neighborhood and surrounding ones, the tactic is not working. The houses sit, prices drop some, and the houses continue to sit.

__________________

I would not have anyone adopt my mode of living...but I would have each one be very careful to find out and pursue his own way, and not his father's or his mother's or his neighbor's instead. Thoreau, Walden

|

|

|

10-08-2007, 09:21 AM

10-08-2007, 09:21 AM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2007

Posts: 1,891

|

Yup, each week I scan the new development section of the LA times and each week it's the "best time to buy ever" and prices are slashed by $100k at a time! I feel bad for those folks who got in right at the peak and are seeing their values drop so quickly (actually have a friend who is in that position). Hope they planned to stick around in the first place!

__________________

If i think of something clever to say, i'll put it here...

|

|

|

10-08-2007, 09:33 AM

10-08-2007, 09:33 AM

|

#5

|

|

Gone but not forgotten

Join Date: Jan 2007

Location: Sarasota,fl.

Posts: 11,447

|

Was scanning the real estate and saw a house next to my old house that sold in Nov.2006 for $370,000 .It is now on the market for $297,000. Ouch !! Houses just seem to be sitting around here (southwest Florida ) New houses are being slashed $100,000. I'd really like to sell my house but no way am I doing it now.My sister in Long Island ,NY has had her house on the market for almost two years .

|

|

|

10-08-2007, 09:42 AM

10-08-2007, 09:42 AM

|

#6

|

|

Moderator Emeritus

Join Date: Dec 2002

Location: Oahu

Posts: 26,860

|

Quote: Quote:

Originally Posted by brewer12345

They were interested in NJ, so DW, some other local friends and I took them on a tour yesterday. I did most of the pseudo-realtor duties, including walking into several open houses as we were cruising around looking at neightborhoods. This was all in central NJ, mostly in Monmouth County.

|

Nothing beats going through open houses, does it?

Hawaii first-time buyers are struggling even more than usual, and yesterday we were surprised to see all the open-house signs on the road leading to our cul-de-sac. A lot of high-end homes are for sale in our neighborhood, including a couple of clueless realtors & sellers premium properties that didn't have an open house yesterday, and I suspect that prices are going to get even better as we head into the slow part of the year.

Glad I'm not a renter. But if I had to be a renter, this would be the time to convert to homeowner.

__________________

*

Co-author (with my daughter) of “Raising Your Money-Savvy Family For Next Generation Financial Independence.”

Author of the book written on E-R.org: "The Military Guide to Financial Independence and Retirement."

I don't spend much time here— please send a PM.

|

|

|

10-08-2007, 09:50 AM

10-08-2007, 09:50 AM

|

#7

|

|

Recycles dryer sheets

Join Date: Jul 2007

Posts: 192

|

In addition to the now stale "Price Reduced" signs, we are beginning to see, "Just Reduced", "Further reduced", and "New Price" signs.

A tactic that has recently received some media attention here, an agent will take a house off the market one week and put it back on the market the next so that it appears at the top of the pile as a "New Listing!!!" in the MLS.

__________________

|

|

|

10-08-2007, 09:55 AM

10-08-2007, 09:55 AM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2003

Posts: 18,085

|

Quote: Quote:

Originally Posted by NotSoonEnough

In addition to the now stale "Price Reduced" signs, we are beginning to see, "Just Reduced", "Further reduced", and "New Price" signs.

|

The repo we looked at stated "bank owned" on the sign quite prominently. Bet that becomes a more popular sign.

__________________

"All animals are equal, but some animals are more equal than others."

- George Orwell

Ezekiel 23:20

|

|

|

10-08-2007, 09:58 AM

10-08-2007, 09:58 AM

|

#9

|

|

Recycles dryer sheets

Join Date: Jun 2007

Posts: 316

|

Quote: Quote:

|

yesterday we were surprised to see all the open-house signs on the road leading to our cul-de-sac.

|

Maybe the neighbors are worried that a trend is starting and that the place might get overrun with long haired surfer dudes that don't have jobs.

|

|

|

10-08-2007, 10:00 AM

10-08-2007, 10:00 AM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2006

Posts: 1,703

|

Quote: Quote:

Originally Posted by brewer12345

I think RE has a long way to go (down).

|

Ya really thing so?

Yeah, me too.

FWIW, I'm in a burb of Seattle (the last hot market in the US), and the market seems to have stalled, sellers who were merely fishing have delisted, and I've seen asking prices come down a lot. Even some sellers that will take a loss vs last year's purchase price.

__________________

Emancipated from wage-slavery since 2002

|

|

|

10-08-2007, 10:07 AM

10-08-2007, 10:07 AM

|

#11

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2005

Posts: 2,032

|

You think the realtors look sad now? Wait until January comes and the snow is piling up. Those open houses are going to get really lonely.

|

|

|

10-08-2007, 10:09 AM

10-08-2007, 10:09 AM

|

#12

|

|

Moderator Emeritus

Join Date: Dec 2002

Location: Oahu

Posts: 26,860

|

They wish. We have the best house in the neighborhood because we have the time to take care of it. The second- and third-best houses in the neighborhood are getting our help too...

I really get the gimmes when I see the blue-light-specials start flashing all over the place. Then I remember that it's actual real work to pull this off. I lie down for a nap and the feeling eventually fades away.

Small surf this morning, but I'm taking an Army officer out to White Plains on one of his very few days off. He works insane hours at PACOM and he's considered to be a rising star on a hot career, but I bet I can corrupt his work ethic in less than an hour! I met him while taking care of his house for his landlord...

__________________

*

Co-author (with my daughter) of “Raising Your Money-Savvy Family For Next Generation Financial Independence.”

Author of the book written on E-R.org: "The Military Guide to Financial Independence and Retirement."

I don't spend much time here— please send a PM.

|

|

|

10-08-2007, 10:29 AM

10-08-2007, 10:29 AM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2007

Location: New Orleans

Posts: 47,500

|

Quote: Quote:

Originally Posted by twaddle

FWIW, I'm in a burb of Seattle (the last hot market in the US), and the market seems to have stalled, sellers who were merely fishing have delisted, and I've seen asking prices come down a lot. Even some sellers that will take a loss vs last year's purchase price.

|

New Orleans is not a hot market (as I'm sure most of you know). Inventory of existing homes for sale is very high. But amazingly, some sellers are STILL fishing. The house next door to me is for sale for at least $25/sq ft more than the other three houses for sale on this (short) block, and their house is no better than the others! Nobody seems to know what a house might be worth around here. Major cranial flatulence abounds.

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

10-08-2007, 10:50 AM

10-08-2007, 10:50 AM

|

#14

|

|

Full time employment: Posting here.

Join Date: Dec 2004

Posts: 699

|

Quote: Quote:

Originally Posted by twaddle

Ya really thing so?

.

|

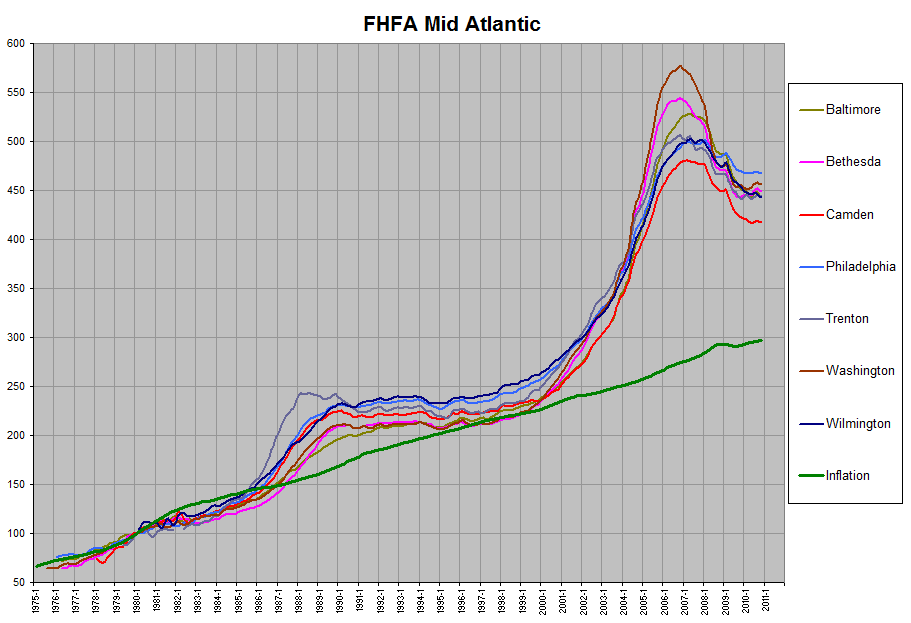

That chart is very interesting. Back in late 80's/early 90's- RE "got ahead of itself" and leveled off for a bunch of years until "back on the trendline".

I'd normally expect same this time. HOWEVER, this time prices are so far out of whack - that things have to dip AND go sideways for a bunch of years.

RE pricing fundamentally has to be tied to affordability - right ? Some multiple of income and/or wealth. Historically I thought 4x average income - now we're 8x.

And I don't see any drivers for real wage growth - in fact, the opposite - offshoring, productivity gains reducing, etc.

Maybe the weak dollar could create some "manufacturing / export boom" - but I wouldn't hold my breath on that. If the currency drops 50%, these developing country laborers are now making $2/hour instead of $1....

|

|

|

10-08-2007, 10:54 AM

10-08-2007, 10:54 AM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2007

Posts: 1,891

|

Has there been any other point in history (recorded) where the prices got soo out of line?

if so, what happened? that 80's bump looks nothing like this one...was it the easy (dumb) credit?

__________________

If i think of something clever to say, i'll put it here...

|

|

|

10-08-2007, 10:59 AM

10-08-2007, 10:59 AM

|

#16

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2006

Posts: 1,703

|

Quote: Quote:

Originally Posted by bright eyed

Has there been any other point in history (recorded) where the prices got soo out of line?

|

No, I think this will go down as the largest bubble in US history. But NASDAQ was pretty close. My original estimate was that if we get back to the historical housing appreciation trend line, $7 trillion in wealth will be wiped out.

Quote: Quote:

|

if so, what happened? that 80's bump looks nothing like this one...was it the easy (dumb) credit?

|

Who knows what will happen. Not much happened after the NAZ popped -- just a mild recession followed immediately by a different asset bubble.

And, yeah, it was a combination of easy credit and speculation. People actually thought of their home as an investment! Can you imagine? Does anybody think of their furniture or cars as an investment?

__________________

Emancipated from wage-slavery since 2002

|

|

|

10-08-2007, 10:59 AM

10-08-2007, 10:59 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2007

Location: New Orleans

Posts: 47,500

|

Quote: Quote:

Originally Posted by Delawaredave5

RE pricing fundamentally has to be tied to affordability - right ? Some multiple of income and/or wealth. Historically I thought 4x average income - now we're 8x.

|

Wow!! That's awful. No wonder I am on a great track to ER. My house cost 2.6x my income when I bought it in 2002, and assuming I could sell it, it now would be worth only 2.3x my present (larger) income.

I could no more handle 8x than fly!

__________________

Already we are boldly launched upon the deep; but soon we shall be lost in its unshored, harbourless immensities. - - H. Melville, 1851.

Happily retired since 2009, at age 61. Best years of my life by far!

|

|

|

10-08-2007, 11:21 AM

10-08-2007, 11:21 AM

|

#18

|

|

Full time employment: Posting here.

Join Date: Dec 2006

Location: Florida

Posts: 854

|

Twaddle:

if $7 trillion vanishes, I would think that a lot of people are going to be hurting. Those with high mortgages and equity loans won't be able to sell or refinance. I don't see how they can all walk away - where would they go? It's not like letting your car or furniture get reposed. You have to live somewhere. I guess the rental market could be tight as a result. Then again, if many of those who get caught are boomers, they will need to keep working.

__________________

I would not have anyone adopt my mode of living...but I would have each one be very careful to find out and pursue his own way, and not his father's or his mother's or his neighbor's instead. Thoreau, Walden

|

|

|

10-08-2007, 11:27 AM

10-08-2007, 11:27 AM

|

#19

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2006

Posts: 1,703

|

Quote: Quote:

Originally Posted by Sandy

if $7 trillion vanishes, I would think that a lot of people are going to be hurting. Those with high mortgages and equity loans won't be able to sell or refinance. I don't see how they can all walk away - where would they go? It's not like letting your car or furniture get reposed. You have to live somewhere. I guess the rental market could be tight as a result. Then again, if many of those who get caught are boomers, they will need to keep working.

|

If it really falls by that much, it'll be similar to the magnitude of the NASDAQ drop. I think the NAZ lost around $6 trillion. It "hurt" a lot of people, but there were also a lot of people who sold and captured a bunch of the upside.

I think we'll see something similar here. A lot of job losses (much of the job growth in the last few years was related to real estate). A big decrease in consumption. But then we'll probably have a new round of fiscal and monetary policy to get a new party started.

I just don't know how many of these serial parties we can have, though.

__________________

Emancipated from wage-slavery since 2002

|

|

|

10-08-2007, 12:20 PM

10-08-2007, 12:20 PM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2006

Posts: 1,703

|

BTW, I should point out that my methodology is pretty simplistic.

The federal reserve publishes a balance sheet each quarter, and one of the line items is total real estate value owned by households. In the latest report, that value is about $21 trillion.

Historically, the total value of housing has been pretty close to the total size of GDP. It really started to grow much faster than GDP starting in about 1997. Current GDP size is about $13.5 trillion, so the delta is now $7.5 trillion ($7 trillion was from 2006). I don't really expect value to get down to 100% of GDP again, but even at 120% of GDP, we'd be looking at a $5-6 trillion drop in value.

For comparison, google tells me that the NASDAQ drop from peak to valley was $4.2 trillion.

__________________

Emancipated from wage-slavery since 2002

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|