CountryGal

Recycles dryer sheets

- Joined

- Jan 11, 2016

- Messages

- 235

kgtest - yes, having a column that shows the source is essential. Thanks for pointing that out.

RonBoyd - yes that answers the receipt question. I have tried the scanning practice and failed. I probably could have gotten it to work eventually, but felt like too much work. Dumping all receipts into a basket seems the easiest. For disorganized me, they may get lost before they get there. The app I mentioned above has the ability to save "pictures" of your receipts as you enter entries.

Pretty sure I'm the odd one here. I use a budget book and write everything in by hand every week or so:

Robot Check

Only started doing it about ten years ago, so I don't have decades of spending records, but it works for us.

I certainly don't want to enter every transaction manually. We keep our checking and expense accounts at wells fargo, and they have a money map function that tracks everything that goes in and out of expense accounts. I use bill pay there, too so everything goes through there. It even categorizes the expenses pretty well. It tracks our average expenses over 6 and 12 months. That's all we really need to know.

You spend life-energy making money, or investing, etc. Spending money, and knowing immediately what you spend it on, provides loads of feedback. Regardless of what method is used I highly recommend using a method that incorporates immediate or near immediate feedback. Looking at expenses once a month doesn't provide the same sense of where your money goes.

As noted on this thread there are lots of tools to keep track of expenses. The most important think to do is the actual act of doing it. I've seen lots of people utilize smart phone apps, spreadsheets and other software but you have to find a method that allows you to record every expense - whether it's a check, a credit or debit card, cash, etc.

For me and DW that means we each use a small spiral bound book - small enough that it fits in a shirt pocket - and we write down everything. And I do mean everything.

(c) collect all receipts and transfer them at the end of each day to a Ziploc bag labeled "current month spending"

(d) document any unreceipted cash transactions (1-3 per month) on a Post it note in the Ziploc bag.

(f) download data from current and credit card accounts to Excel expense spreadsheet at the end of each month. Reconcile with the contents of the Ziploc bag. Shred all receipts unless needed for warranties or tax returns.

I could never be disciplined enough to keep a notebook and pencil with me constantly and write every expense into it immediately, as you do. It could be socially awkward. However, like you, I do record everything. My strategy is to reduce effort by automation, as follows:

(a) put all my utilities and regular payments on automatic debit

(b) charge everything possible to one credit card (I now use fewer than 10 cheques per year)

(c) collect all receipts and transfer them at the end of each day to a Ziploc bag labeled "current month spending"

(d) document any unreceipted cash transactions (1-3 per month) on a Post it note in the Ziploc bag.

(e) check my current and credit card accounts online every 1-2 days

(f) download data from current and credit card accounts to Excel expense spreadsheet at the end of each month. Spreadsheet is preloaded with regular recurring payments, e.g. Strata fees. Reconcile with the contents of the Ziploc bag. Shred all receipts unless needed for warranties or tax returns.

(g) repeat.

I automate things even a bit more. I use Moneydance on my computer for all financial stuff. It also has an app for my iPhone that syncs via Dropbox. When I'm out and about, I can take just a few seconds to enter a purchase in the phone app (and even take a picture of the receipt if I like). When I get home, it has already been entered into my Moneydance file.

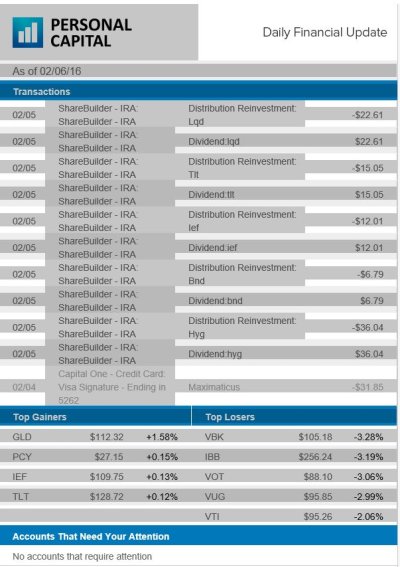

This is very similar to my routine except I do it weekly. Another difference is "e" in which I rely on Personal Capital (and some others) to monitor my transactions. such as:

View attachment 23186

BTW, braumeister is doing what I should be doing... and as soon as I "get around to it," that is exactly what I intend to do going forward.