Hopefully I am not raining on your parade, but here is my .02.

You are in your 30s. You need stable income for a long time, before you start drawing your assets. Your assets should be invested in something that provides that kind of income while you let your investment grow. The 4% rule is for people nearing retirement at 55+, not sub-40. You should be thinking 2-3% WR, or less. Even a $30K lifestyle would need at least $1M. A $30K lifestyle is not much after a mortgage or rent payment.

You will not have much in terms of Social Security, ever, as you will not have 35 years in. You likely do not have a pension. Your sole source of income, according to your posts, will be your investments. Therefore, you will need solid income producing investments. Stocks, rental income, CDs, bonds, etc.

Retiring in your 30s, with any kind of decent lifestyle, is extremely difficult without an inheritance, or large influx of cash. Some business owners can do it, and some employees of private firms that go public can do it. For the average Joe, in decent health, it is near impossible. The system is not geared for it, nor does it allow enough time for compounding growth of your assets. If you have another wage earner with you, it is more likely.

Having said that, your risks are inflation and out living your assets. Inflation is not an issue for now. Running out of your assets is your major concern. You may think that you can go back to your career if things do not work out. After a few years, you will be 50+, and have out of date skills. If you are over 50, it is difficult to get work; especially of you are already out of work.

Healthcare expenses will continue to increase as you get older, unless it becomes ‘free’.

Think hard about your decision, and do not adjust the calculators so that you have a ‘perfect path’. Go with general default parameters. Make sure you are 100%, and then some.

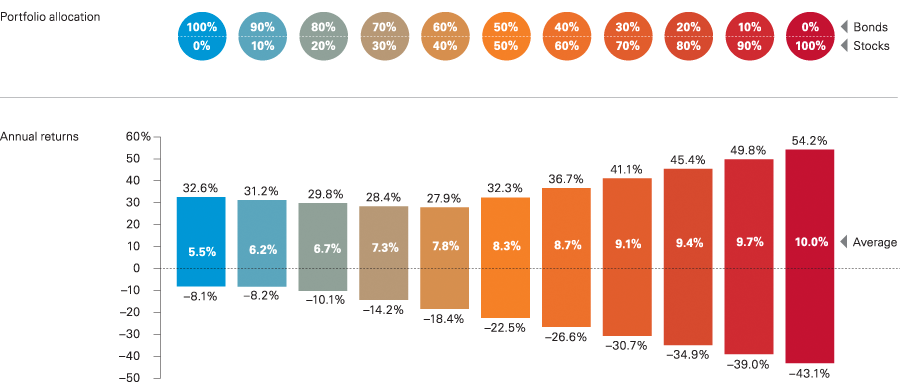

The market has been very good the past few years, and likely will be good for a few more. But just as it comes, it can go. Be sure to account for future market risk.