I don't know if we can really use FIRECalc in the deterministic sense that we would like to. It can only tell us the rough WR that we can expect. Too much tweaking, and we are actually expecting the future to duplicate the past, which I am sure it will not (however, it may rhyme).

Just for kicks, instead of using the default portfolio of Total Market/Treasury in FIRECalc, I played with the more detailed "Mixed Portfolio", and was able to get a higher WR without going negative. Try the following portfolio: "30% US Small Value, 30% US Large Value, 40% 1-month Treasury". That last one is almost like cash. FIRECalc will say you can get up near 4.4%WR without going broke in 30 years.

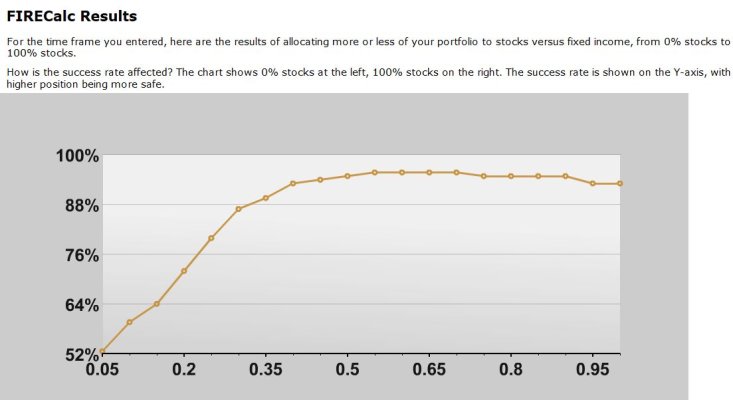

Along the same vein, I posted some other results in this past thread:

http://www.early-retirement.org/forums/f28/optimal-firecalc-portfolio-69523.html. Take all these with a grain of salt, per the earlier caveat.