+1......I was able to do the same thing for the last three years at work from 2007-2010. The catch up clause in my 457 allowed me to almost double my contributions at that point. I remember people at work telling me I was going to lose everything.Yep. The years following the crash were my biggest accumulation years in my 401k- maxing out contributions with catchup contributions at highly reduced share prices. I never changed my AA. I've had a 133% gain in the 401k balance since the bottom.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How I did during the Great Recession

- Thread starter NW-Bound

- Start date

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

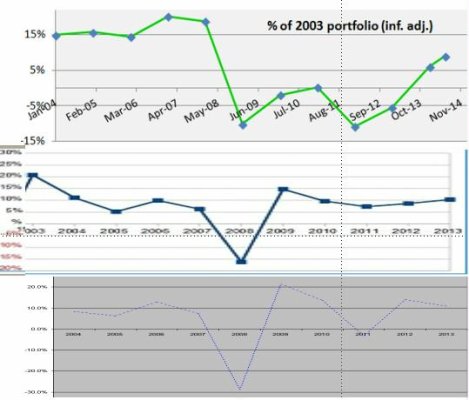

FWIW, here is our portfolio's ride over the last decade. Currently 9% above inflation adjusted starting value.

and the AA picture:

Please note the pretty colors .

.

and the AA picture:

Please note the pretty colors

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

... and I see some "bang-bang" control on international/US stock allocation. No visible effects on the bottom line though. Or am I missing something here?

Last edited:

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My international allocation is split between large international and midcap international. Each international component is tested against it's US cap equivalent and I go with whatever is doing best. This is a broadly based, completely mechanical algorithm, and employs monthly data. Have done this since 2009 after doing studies going back decades. So far it has done better then holding just straight international.... and I see some "bang-bang" control on international/US stock allocation. No visible effects on the bottom line though. Or am I missing something here?

The portfolio graph includes spending so one cannot easily infer performance from the AA.

- Joined

- Oct 13, 2010

- Messages

- 10,735

It probably looks like one of these anyway.Agreed, though that data is not readily available, and I'm too lazy to figure it out from spotty records...

Attachments

Similar threads

- Replies

- 6

- Views

- 1K

- Replies

- 29

- Views

- 2K

- Replies

- 36

- Views

- 3K

- Replies

- 12

- Views

- 883