|

|

How I handle a market downturn

01-07-2016, 04:31 AM

01-07-2016, 04:31 AM

|

#1

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Posts: 1,390

|

How I handle a market downturn

I simply accept what it is and I do not look at my statements as much. I realize that market downturns are a part of the process. I am far from a market expert . I am no expert at all. But everyone has an opinion. Mine is I would not be the least bit surprised we enter a bear market this year. Too many moving parts and none of them are good. I think the two most important that stand out to me are rising rates and a historically high price to earnings ratio. I think we go down 20% - 30% and slowly claw are way back up. No matter what I will hold tight and ride out the storm like I always have. The storm always passes eventually. This is where nerves of steel and asset allocation are so valuable. Is this how everyone else feels about it ?

__________________

Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things. Charlie Munger

The first rule of compounding: Never interupt it unnecessarily. Charlie Munger

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-07-2016, 04:33 AM

01-07-2016, 04:33 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,021

|

Sums it up nicely for me.

__________________

Numbers is hard

|

|

|

01-07-2016, 04:51 AM

01-07-2016, 04:51 AM

|

#3

|

|

Recycles dryer sheets

Join Date: Feb 2015

Posts: 296

|

I handle market downturns the same as I would handle huge market gains.

Double stoli on the rocks.....and keep 'em coming!

|

|

|

01-07-2016, 04:55 AM

01-07-2016, 04:55 AM

|

#4

|

|

gone traveling

Join Date: Sep 2013

Posts: 1,248

|

From high up long term charts look pretty good even with many 20-30 percent drops.

|

|

|

01-07-2016, 05:20 AM

01-07-2016, 05:20 AM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2011

Location: NC Triangle

Posts: 5,807

|

I don't have nerves of steel (as someone once guessed my username implied), but I agree with your viewpoint.

__________________

|

|

|

01-07-2016, 05:24 AM

01-07-2016, 05:24 AM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2015

Location: philly

Posts: 1,219

|

Quote: Quote:

Originally Posted by UnrealizedPotential

I simply accept what it is and I do not look at my statements as much. I realize that market downturns are a part of the process. I am far from a market expert . I am no expert at all. But everyone has an opinion. Mine is I would not be the least bit surprised we enter a bear market this year. Too many moving parts and none of them are good. I think the two most important that stand out to me are rising rates and a historically high price to earnings ratio. I think we go down 20% - 30% and slowly claw are way back up. No matter what I will hold tight and ride out the storm like I always have. The storm always passes eventually. This is where nerves of steel and asset allocation are so valuable. Is this how everyone else feels about it ?

|

+1

I do get a bit nervous because I'm planning on retiring in a few months (thanks fire) but then I just have a cup of tea and remind myself that i've done pretty much every thing I can to ensure my families financial well being.

now if I could only lose weight.

|

|

|

01-07-2016, 05:39 AM

01-07-2016, 05:39 AM

|

#7

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,410

|

I think that 2008 showed us all the folly of panic and the wisdom of just holding on for dear life.

(Almost) the worst happened, and those who held on made out just fine. Make a drink, let the dividends roll in and wait it out.

* A while ago someone here posted a chart showing the short duration of bear markets....would be nice to see it at this time.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

01-07-2016, 05:39 AM

01-07-2016, 05:39 AM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2014

Location: Austin

Posts: 1,384

|

+1 and I had to put that into action today.

Yesterday I closed an account at Schwab I've had for years, originally set up 20+ years ago back when I owned individual stocks. Money was sitting in a balanced fund I wasn't happy with and there wasn't that much in there to begin with. So, in the interest of consolidating accounts, the fund was sold and the proceeds moved to my bank account.

Was on Vanguard this morning to do some buy orders with the proceeds. Put it in cash? Load up on my bond fund because things are turbulent right now? Nah. Just distributed it among my various holdings which put my AA back to the target.

|

|

|

01-07-2016, 05:45 AM

01-07-2016, 05:45 AM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2005

Location: Central MS/Orange Beach, AL

Posts: 9,071

|

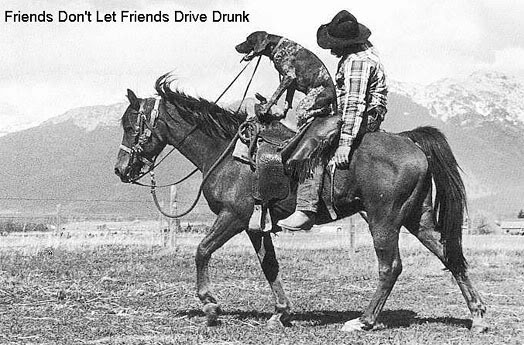

After a bad day in the market...........

__________________

Retired 3/31/2007@52

Investing style: Full time wuss.

|

|

|

01-07-2016, 05:52 AM

01-07-2016, 05:52 AM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,298

|

Good OP summary.

Though IMHO 'nerves of steel' come from studying long term market history. I never sold anything, actually bought a little, in the 1987, 2000 & 2008 downturns - and was rewarded for it. There WILL be corrections, some painful, along the way - that has always been the case. And even the biggest corrections don't look so bad when you look at the long term trend. That's what let's me sleep at night in good times and bad, not 'nerves of steel'...

And as retirees, most of us don't have to be as aggressive with our AA, so the downturns % are dampened.

Anyone want to have the 'this time it's different' discussion?

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

01-07-2016, 05:58 AM

01-07-2016, 05:58 AM

|

#11

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2009

Location: SF East Bay

Posts: 4,342

|

Quote: Quote:

Originally Posted by UnrealizedPotential

This is where nerves of steel and asset allocation are so valuable.

|

Or simply an ability to change focus, and concentrate on all the other areas of your life - hobbies, loved ones, walking the dog, coffee meet-ups, long hikes in the country etc etc.

In other words, if you're happy with your strategy, then disengage and let it do it's thing while you get on with your life.

__________________

Contentedly ER, with 3 furry friends (now, sadly, 1).

Planning my escape to the wide open spaces in my campervan (with my remaining kitty, of course!)

On a mission to become the world's second most boring man.

|

|

|

01-07-2016, 06:01 AM

01-07-2016, 06:01 AM

|

#12

|

|

Recycles dryer sheets

Join Date: May 2015

Posts: 66

|

Recently retired (Oct 2015) and have planned for downturns but now that it's here, oh boy! I am a bit concerned as I believe most are, but it's good to hear other perspectives, especially from experienced RE's who have weathered previous turbulence.

I'm pretty much going along with the plan in that I have cash set aside to live off of and don't plan to get out of the market, especially now.

While I was working, this type of event was always viewed as a buying opportunity! Now I'm on the other side. So I'm gona sit tight, be aware of whats happening but not hit the panic button :-)

|

|

|

01-07-2016, 06:10 AM

01-07-2016, 06:10 AM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

I'm feeling very fortunate right now. In December I moved my 401k into a stable value fund to prepare to roll over to my tIRA and Roth IRA, with the checks arriving today to send off to USAA. We also liquidated in December a large portion of DW's stock options currently sitting in cash. We still have significant stock holdings, but avoided a lot of the current downtrend by having so much cash. The hard part is when to buy back in and what to buy. Nice problem to have I guess.

Sent from my iPhone using Early Retirement Forum

|

|

|

01-07-2016, 06:34 AM

01-07-2016, 06:34 AM

|

#14

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 1,743

|

A few months shy of two years in retirement I have no plan to do anything. This may or may not be the start of the market correction that some people have been predicting for a while. If it is our 50/40/10 AA allows enough cash for a few years of living expenses to ride out the downturn.

Besides 20%-30% drop will only be 10%-15% for us and we can live with that.

|

|

|

01-07-2016, 06:44 AM

01-07-2016, 06:44 AM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Location: Williston, FL

Posts: 3,925

|

I think we are going to find out how people really handle a market downturn, not just say how they handle it...

__________________

FIRE no later than 7/5/2016 at 56 (done), securing '16 401K match (done), getting '15 401K match (done), LTI Bonus (done), Perf bonus (done), maxing out 401K (done), picking up 1,000 hours to get another year of pension (done), July 1st benefits (vacation day, healthcare) (done), July 4th holiday. 0 days left. (done) OFFICIALLY RETIRED 7/5/2016!!

|

|

|

01-07-2016, 06:45 AM

01-07-2016, 06:45 AM

|

#16

|

|

Full time employment: Posting here.

Join Date: Dec 2015

Posts: 617

|

Quote: Quote:

Originally Posted by ttvjef

Recently retired (Oct 2015) and have planned for downturns but now that it's here, oh boy! I am a bit concerned as I believe most are, but it's good to hear other perspectives, especially from experienced RE's who have weathered previous turbulence.

I'm pretty much going along with the plan in that I have cash set aside to live off of and don't plan to get out of the market, especially now.

While I was working, this type of event was always viewed as a buying opportunity! Now I'm on the other side. So I'm gona sit tight, be aware of whats happening but not hit the panic button :-)

|

Retired in Sept. Have been consumed with money fear recently. Yesterday I was rebalancing to a more tax-efficient AA on advice of Vanguard advisor. He reminded me that my current plan has a 99% statistical chance of lasting until age 91. That did help. And that is just the assets in Vanguard, not the 3 years of cash security blanket.

Regardless, seeing the cash slowly decrease b/c there is no more income is unsettling. But I already did the pull-out-at-the-bottom, then miss the upside, thing in 2009. Won't do that again.

|

|

|

01-07-2016, 06:49 AM

01-07-2016, 06:49 AM

|

#17

|

|

Full time employment: Posting here.

Join Date: May 2007

Posts: 984

|

Since I have a pension that covers expenses, I admit to being somewhat of a market timer. I tend to increase my allocation to equities as the market drops. In 2008, I was close to 100% equities a bit before the bottom. Today I am at 50% equities but plan to increase that % as the market drops.

|

|

|

01-07-2016, 07:04 AM

01-07-2016, 07:04 AM

|

#18

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Turn off CNBC...

Corrections are normal and healthy. This bull is old. We've had 1 official 10% correction since 2009 - corrections often renew and refresh the bull. Bulls usually end with a whimper. Was 2015 the whimper? Maybe.

We are only down about 11% from the highs of 2150 SP500. At least another 10% to go before we enter a bear. 1700 is SP500 bear territory.

It's perhaps more painful because 2015 was flat and then finished negative (-1% real return) thus doesn't feel good from a sequence of returns standpoint. And we've been up a lot since 2009

Remember you have to break to rally and rally to break.

Even if we have another 7 years ...but this time it goes down and down not up and up ... we are already a year into it so only 6 to go ! Where she stops, nobody knows...

|

|

|

01-07-2016, 07:24 AM

01-07-2016, 07:24 AM

|

#19

|

|

Full time employment: Posting here.

Join Date: Dec 2015

Posts: 617

|

Quote: Quote:

Originally Posted by papadad111

Turn off CNBC...

Corrections are normal and healthy.

|

This is why I read this forum. I love the brave experienced posters who say that when the market is down they buy equities like it's a fire sale.

My advisor sounded like he had done a lot of talking people down from the ledge yesterday. I told him about this forum. Maybe it can help those people as well.

|

|

|

01-07-2016, 07:32 AM

01-07-2016, 07:32 AM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 1,743

|

Quote: Quote:

Originally Posted by misshathaway

My advisor sounded like he had done a lot of talking people down from the ledge yesterday. I told him about this forum. Maybe it can help those people as well.

|

Why are these people investing in the stock market? if 3% drop in a couple of days is going to make them panic then they shouldn't be invested in equities.

Also shouldn't this advisor talk them out of the market if they can't handle volatility?

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|