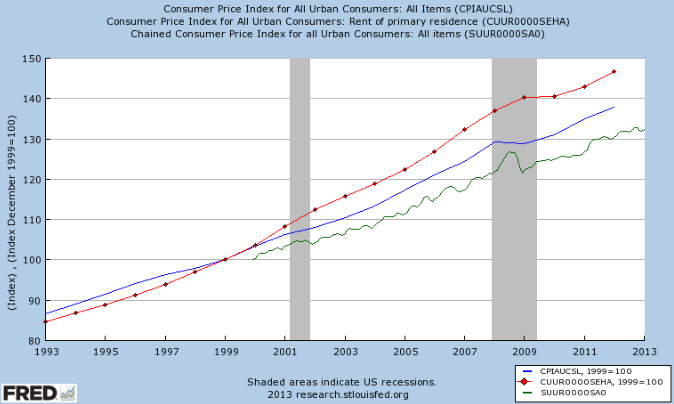

I looked over the data which is available since 2000 of Chain-CPI vs regular CPI. I found that since 2000 it is lower than regular CPI by 0.25%. Since 2006 the difference has been about 0.2%. Using a 0.25% difference that would make a difference of about 5% over 20 years and 10.5% over 40 years. I would make a macroeconomic assumption that as the world economy gets more integrated and prices movements shift faster in response to supply and demand Chain-CPI should really converge to CPI.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much of a difference would Chain-CPI make

- Thread starter kmt1972

- Start date

Semiretired2008

Recycles dryer sheets

If medical costs slow down with their inflation over the costs of other areas that could very well become true...

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The grand objection of some to chained-CPI doesn't make a lot of sense to me. While it is true that SS beneficiaries will get less (if they didn't then why would it help make SS more solvent?) the effect seems slight and the practical reality is that beneficiaries will respond to the changes.

It SS is their sole source of income it will hurt more than if it isn't but that is something that they could have controlled during their working lives and the piper must eventually be paid.

It SS is their sole source of income it will hurt more than if it isn't but that is something that they could have controlled during their working lives and the piper must eventually be paid.

This was discussed recently, here http://www.early-retirement.org/forums/f28/chained-cpi-ss-loss-calculator-65598.html

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

BellBarbara

Recycles dryer sheets

- Joined

- Oct 17, 2010

- Messages

- 392

Here is 2min video by Robert Reich on chained CPI and why it's not good. Basically he says that seniors spend 20-40% on healthcare, which they cannot "shop" for, and that healthcare costs are not included....

Robert Reich on Chained CPI (the proposal to cut Social Security benefits) - YouTube

Robert Reich on Chained CPI (the proposal to cut Social Security benefits) - YouTube

The difference really depends upon your income level during retirement. Those that are well off will not really feel any effects, while those at the lower end of the income scale like $12K or a couple at $24K will really feel the effects.

The most recent eye-opener for me regarding Chained CPI is how, once deployed across all places where CPI is currently used, its most significant impact allegedly won't be benefit reductions, but rather revenue enhancement, because if/when applied to the boundaries of tax brackets and such, it'll result in applying higher income tax rates on lower income longer. It seems destined, since it helps provide a means of "cutting a political deal" while both sides save face (cuts spending and raises revenue).

See Bloomberg's Peter Orszag column on Chain CPI

Chained CPI

Something I pointed out in my post which is that this really will have small and diminishing impact looking at the data last few years.

"What neither side seems to have noticed, however, is that the difference between the chained CPI and the standard CPI has been diminishing."

"Over the course of those 13 years, however, the differences between the annual growth rates of the indexes have become substantially smaller. From January 2000 to January 2003, the annual increase in the chained index was 47 basis points lower than that in the CPI-U. From 2003 to 2006, the difference was 31 basis points. From 2006 to 2009, it dropped to 15 basis points. And over the past two years, the average difference has been just 11 basis points."

"Why is this happening? Examining the subcomponents of each index, it appears that housing and other goods and services have played a role. Sorting through the causes is complex, however. In any case, the more relevant question is, what is the best time period to use as a historical basis for projecting future differences in the indexes?"

Chained CPI

Something I pointed out in my post which is that this really will have small and diminishing impact looking at the data last few years.

"What neither side seems to have noticed, however, is that the difference between the chained CPI and the standard CPI has been diminishing."

"Over the course of those 13 years, however, the differences between the annual growth rates of the indexes have become substantially smaller. From January 2000 to January 2003, the annual increase in the chained index was 47 basis points lower than that in the CPI-U. From 2003 to 2006, the difference was 31 basis points. From 2006 to 2009, it dropped to 15 basis points. And over the past two years, the average difference has been just 11 basis points."

"Why is this happening? Examining the subcomponents of each index, it appears that housing and other goods and services have played a role. Sorting through the causes is complex, however. In any case, the more relevant question is, what is the best time period to use as a historical basis for projecting future differences in the indexes?"

wmc1000

Thinks s/he gets paid by the post

Wow - $6mil? - I would have been out several times over - Congrats to you.

The difference really depends upon your income level during retirement. Those that are well off will not really feel any effects, while those at the lower end of the income scale like $12K or a couple at $24K will really feel the effects.

Chained CPI is a sneaky way to simultaneously cut all sorts of indexed benefits and raise taxes, and do it so slowly people will hardly notice. It is similar to the frog in the water where you gradually raise the temperature and the frog doesn't even know what is going on. I wouldn't worry too much about people at the bottom. They will be protected from the adverse affects of any change. They always are.

Similar threads

- Replies

- 9

- Views

- 3K

- Replies

- 11

- Views

- 3K

Latest posts

-

-

-

-

-

-

-

MYGA Company Ratings. AMBest "A vs A+ vs A++" Does it really Matter?

- Latest: ShokWaveRider

-

-