|

|

I am totally confused on the 2018 taxation of LTCG!

04-18-2018, 08:13 AM

04-18-2018, 08:13 AM

|

#1

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

I am totally confused on the 2018 taxation of LTCG!

Search for that in Google and each link takes you to a different answer.

There was a recent post on another thread by audreyh1 who at the point I am writing this has 17,698 posts where she said:

Quote: Quote:

Three brackets.

On Taxable Income (AGI minus deduction(s)):

For the income up to the top of the 12% bracket limit - LTCG are taxed at 0%

For income above 12% and up to the 39.5% tax bracket, LTCG are taxed at 15%

For income above the 39.5% tax bracket, - LTCG are taxed at 20%.

Note that ordinary income counts first, so long term cap gain income which includes qualified dividends, gets pushed up to the higher portion of whichever brackets you cross.

|

Sorry for using your quote Audrey; First of all there is no 39.5% bracket any longer!

The motley fool article, https://www.fool.com/taxes/2017/12/2...s-in-2018.aspx, published 12/22/2017 says that you start paying 15% at $38,600 and 20% at $425,800.

Everything else I see says that the 22% bracket starts at $38,700, not $38,600.

Iíve searched irs.gov and I canít even find the taxation points for LTCGs.

Iím making all of my retirement plans based on not paying the 15% rate on LTCG and QD, and I do wish I was worried about the 20% rate but if I was Iíd be asking my personal CPA, not posting here!

The thing I am trying to avoid is:

Earning a dollar which causes 85 cents of my SSB to become taxable, $1.85 at 12% is 22.2 cents, a marginal rate of 22.2%, but this also forces $1.85 of my LTCGs into the 22% bracket which are then taxed at 15% and 15% of $1.85 is 27.75 cents for a total tax increase of 49.95 cents because I earned or withdrew $1, the marginal tax rate of 49.95%. Hey, at least the feds are taking less than half our money now!

When the 49.95% marginal bracket ends, you are in the 22% federal bracket, but a dollar of income makes 85 cents of your SSB taxable and 22% of $1.85 is 40.7 cents, a 40.7% marginal tax rate, which ends when 85% of my total SSB has been taxed at which point I drop back to the standard 22% tax bracket.

My planning:

Determine how much of my IRA has to be converted to ROTH today at 22% and maybe even 24% to avoid the 49.95% and 40.7% marginal brackets during retirement.

So my question to the group, so I can share accurate information with others, is where do I find the accurate information on the tax brackets and the tax rates for LTCGs and Dividends.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

04-18-2018, 10:59 AM

04-18-2018, 10:59 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

From Kiplinger's:

Quote: Quote:

Tax rates on long-term capital gains and qualified dividends do not change.

Currently, your capital gains and dividends rate depends on your tax bracket.

But with the bracket changes, Congress decided to set income thresholds instead.

The 0% rate will continue to apply for taxpayers with taxable income under $38,600

on single-filed returns and $77,200 on joint returns. The 20% rate starts at $425,800

for singles and $479,000 for joint filers. The 15% rate applies for filers with incomes

between those break points. The 3.8% surtax on net investment income remains,

kicking in for single people with modified AGI over $200,000…$250,000 for marrieds.

|

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-18-2018, 11:02 AM

04-18-2018, 11:02 AM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

There is still an income level above which you pay 20% capital gains tax rate, and it's actually 23.9% because the bracket exceeds the level at which you pay the Net Investment Income tax on LTCGs.

The LTCG tax brackets have now been separated from ordinary income tax brackets, although they are somewhat close to the prior relationship. But they essentially work the same way, just have slightly different thresholds.

Here are the LTCG brackets for 2018

| | Single | Joint | Head of household | | 0% tax bracket | $0-38,600 | $0-$77,200 | $0-$51,700 | | beginning of 15% tax bracket | $38,601 | $77,201 | $51,701 | | beginning of 20% tax bracket | $425,801 | $479,001 | $452,401 |

Table from: https://www.marketwatch.com/story/yo...tes-2018-04-16

__________________

Retired since summer 1999.

|

|

|

04-18-2018, 11:42 AM

04-18-2018, 11:42 AM

|

#4

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

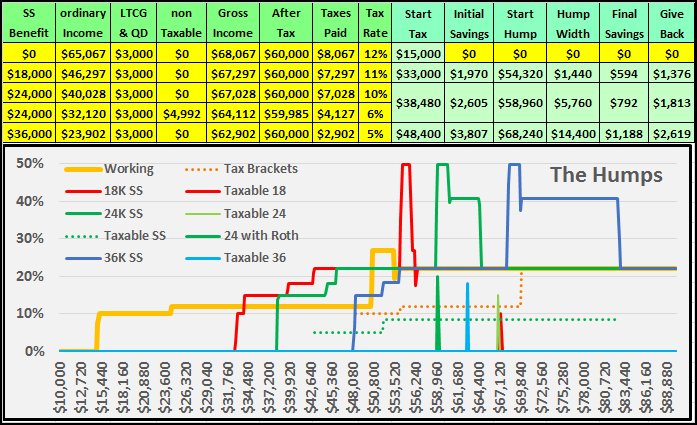

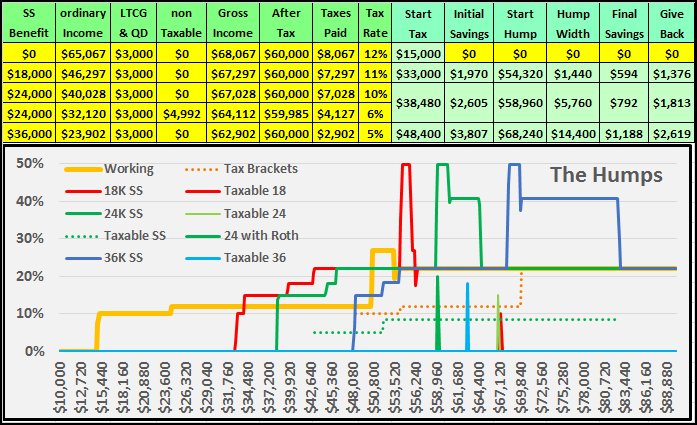

Thanks for the proper information and the additional work I now have to do to my spreadsheet that graphs the marginal tax rates! I will change the calculations for LTCGs and post a copy of the results as soon as I have the new data incorporated.

|

|

|

04-18-2018, 12:13 PM

04-18-2018, 12:13 PM

|

#5

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

The change was far easier than I thought, my spreadsheet already had a dedicated location for the starting point for LTCG taxation which was linked to the start of the 22% bracket. All I had to do was to make that value a fixed value.

This chart represents retired single individuals, over 65.

The chart lines above graph 500 Excel spreadsheet lines which in this case uses $160 as a required scale. That is why the new data only shows a small drop when changing from the 49.95% marginal tax rate to the 40.7% marginal rate.

This chart was designed to show how smaller social security benefit levels are taxed earlier than larger benefits. The larger the benefit, the longer it takes to start taxation, the more taxes you save, so “The Hump” is wider so you can give more of those savings back to the IRS.

It also shows at the $24,000 benefits level with a desired after Federal tax income/lifestyle level of $60,000, doing things before retirement to give yourself access to non-taxable income sources can drop your overall tax rate during retirement significantly from 10% to 6%.

|

|

|

04-18-2018, 12:30 PM

04-18-2018, 12:30 PM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2017

Location: Tellico Village

Posts: 2,622

|

Quote: Quote:

Originally Posted by Sandy & Shirley

The change was far easier than I thought, my spreadsheet already had a dedicated location for the starting point for LTCG taxation which was linked to the start of the 22% bracket. All I had to do was to make that value a fixed value.

This chart represents retired single individuals, over 65.

The chart lines above graph 500 Excel spreadsheet lines which in this case uses $160 as a required scale. That is why the new data only shows a small drop when changing from the 49.95% marginal tax rate to the 40.7% marginal rate.

This chart was designed to show how smaller social security benefit levels are taxed earlier than larger benefits. The larger the benefit, the longer it takes to start taxation, the more taxes you save, so ďThe HumpĒ is wider so you can give more of those savings back to the IRS.

It also shows at the $24,000 benefits level with a desired after Federal tax income/lifestyle level of $60,000, doing things before retirement to give yourself access to non-taxable income sources can drop your overall tax rate during retirement significantly from 10% to 6%. |

Thanks for the post, it does make the point that being able to control your sources of income is very important in retirement.

VW

__________________

Retired May 13th(Friday) 2016 at age 61.

|

|

|

04-18-2018, 02:10 PM

04-18-2018, 02:10 PM

|

#7

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

The first step should be to try to estimate what your income levels will be for Social Security, Pensions, Annuities, etc. during retirement. Then estimate how much more you will need to meet your personal lifestyle goals and what sources will be available for the extra income, IRA, personal investments, savings, Roth, etc.

Next, calculate your taxes as if you are retired now. I used to say beware of the 22% tax bracket, but that is now your taxable LTCG level. As you see “The Humps” in my chart, you want to avoid that taxable income level if at all possible.

I am already retired and made a lot of mistakes. I have worked hard to make sure that Shirley doesn’t make any mistakes. We did a number of Roth Conversion when BREXIT happened and the available Recharacterization was very helpful back then, but it is no longer available.

To make this easy to see without a calculator, let’s assume that your combined Federal, State, and Local tax rate is 30%. You convert $10,000 of your IRA to Roth and you end up with $7,000 in the Roth after taxes. Wait until you need the money after retirement and assume that all of your investments have doubled. You now have $14,000 in your Roth. If you didn’t do the conversion you would have $20,000 in your IRA and withdrawing it at the same 30% combined tax rate would leave you with the same $14,000 of spendable cash. Of course you could also use a Conversion as a way to pay those taxes from another source, basically making additional Roth contributions.

The Conversion situation is different today. The marginal tax rate prior to The Hump is 22.2%, 12% of $1.85 due to the dollar earned plus the 85% taxability of your Social Security benefits and once the full 85% is taxed you go back to the 22% level. Doing a conversion today at 22% or 24% is probably not worth it if you are far under or over The Hump level.

But, if your personal tax calculations show that you will be very close to or slightly into or over “The Hump” marginal tax levels, then doing that Roth Conversion at 22% or 24% is definitely worth it to avoid the 49.95% or 40.7% marginal tax levels.

|

|

|

04-18-2018, 03:59 PM

04-18-2018, 03:59 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2004

Location: Portland, Oregon

Posts: 7,113

|

I just developed a spreadsheet for a neighbor who insisted she needed to substantially exceed her IRA MRD because she "needed the money" all the while she had significant investments in her investment account. I showed her by just taking her MRD and SS (85% taxable income) keeping her taxable income below $38,700, she could sell long term investments capturing $25,000 in gain tax free.

Did I get that right?

[Tabs don't work, sorry]

Single person Taxable Income

SS $15,640.00 ( $18,400.00 85% taxable)

IRA $30,767.00 MRD

Interest $0.00

Total $46,407.00

Standard Deduct $12,000.00

Extra for 65+ $1,600.00

Taxable income $32,807.00 Net

LTCG $20,000.00

Qualified dividends $1,737.00

Total $21,737.00

LTCG/Dividends tax $0.00 to $38,600

LTCG/Dividends tax $0.00 Over $38,700

Applicable tax bracket Total taxable income

12% $3,746.34 to $38,700

22% NA Over $38,700

^Tax on income

Total Fed Income Tax Income + LTCG/Div: $3,746.34

__________________

Duck bjorn.

|

|

|

04-18-2018, 08:10 PM

04-18-2018, 08:10 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

No, I don't think that is right. Her taxable income would be 85% of SS + RMD + LTCG + Qual div - Std dedn = $54,544.

Her ordinary income would be $32,807... the first $9,525 would be taxed at 10% ($953 in tax) and the remaining $23,282 would be taxed at 12% ($2,792 in tax).

Her preferenced income would be $21,737. The first $5,793 (up to $38,600 of taxable income) would be taxed at 0% and the remaining $15,944 would be taxed at 15% ($2,392 in tax).

Her total tax bill would be $6,138.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-18-2018, 09:08 PM

04-18-2018, 09:08 PM

|

#10

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

According to the table provided by Audrey, you are wrong!

Quote: Quote:

Originally Posted by audreyh1

| Single Joint Head of household | | 0% tax bracket $0-38,600 $0-$77,200 $0-$51,700 | | beginning of 15% tax bracket $38,601 $77,201 $51,701 | | beginning of 20% tax bracket $425,801 $479,001 $452,401 |

|

Since her capital gains are all over the $38,600 level, they will all be taxed at 15%.

|

|

|

04-18-2018, 09:29 PM

04-18-2018, 09:29 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by Sandy & Shirley

According to the table provided by Audrey, you are wrong!

Since her capital gains are all over the $38,600 level, they will all be taxed at 15%.

|

You need to take into account the new $12,000 standard deduction plus extra deduction for 65+. The table I linked is the LTCG tax brackets table, but it does not take into account other things that might reduce taxable income such as deductions.

This can raise the effective limits quite a bit.

__________________

Retired since summer 1999.

|

|

|

04-18-2018, 09:34 PM

04-18-2018, 09:34 PM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2004

Location: Portland, Oregon

Posts: 7,113

|

The new standard deduction covers her deductible expenses. The only other available deduction is for seniors.

Her capital gains & qualified dividends are not over $38,000, they do not exceed $22,000 in my example.

This seems very circular IMHO. Are capital gains & qualified dividends counted twice? How can that be?

__________________

Duck bjorn.

|

|

|

04-18-2018, 09:50 PM

04-18-2018, 09:50 PM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

Maybe I can clarify... the $38,600 the total taxable income (ordinary and preferenced... so including LTCG and qualified dividends) that a single can have and still have preferenced income taxed at 0%. You seem to be thinking that there are two limitations... one for ordinary income and one for preferenced income when they are in fact, combined.

While this article hasn't been updated for the 2018 changes, it shows how the calculations work.

https://www.kitces.com/blog/understa...p-up-in-basis/

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-18-2018, 10:02 PM

04-18-2018, 10:02 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

| | 2018e | | | | | Dividends | 1,737 | | | | | SS income | 15,640 | | | | | RMD | 30,767 | | | | | LTCG | 20,000 | | | | | Total income | 68,144 | | | | | | | | | | | Standard deduction | (13,600) | | | | | Federal Taxable Income | 54,544 | | | | | | | | | | | Federal income tax calculation | | | | | | Qualified dividends | 1,737 | | | | | LTCG | 20,000 | | | | | Ordinary income | 32,807 | | | | | Taxable income | 54,544 | | | | | | | | | | | Qualified tax @ 0% | 5,793 | | 0% | - | | Qualified tax @ 15% | 15,944 | | 15% | 2,392 | | Ordinary tax @10% | 9,525 | 9,525 | 10% | 953 | | Ordinary tax @ 12% | 23,282 | 38,600 | 12% | 2,794 | | Total tax | 54,544 | | | 6,138 |

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-18-2018, 10:18 PM

04-18-2018, 10:18 PM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2006

Posts: 4,172

|

An alternative : see tfb's stacked bar chart 12/11/11 (reddish brown/green)

https://www.bogleheads.org/forum/viewtopic.php?t=86849

You stack the QDIV/LTCG income on TOP of the ordinary income. Subtract the deduction from the bottom of the stack. The remaining total is taxable income. Draw the line separating 12% bracket from the 22% bracket (the actual breakpt differs slightly from this). Any QDIV/LTCG below this line is taxed at 0%; any QDIV/LTCG above this breakpt is taxed at 15%. Then you have to add the tax on the ordinary income to this.

Tax calculators like the HR Block and Taxcaster can do this for you. Input into the 2017 calculator and the end result will be both 2017 and 2018 taxes.

HRB gets 6137 for 2018.............very similar to pb4uski. For some reason Taxcaster gets a slightly different answer 6239 tax 2018.

AGI 68144, deduction 13600, taxable inc 54544

|

|

|

04-19-2018, 08:06 PM

04-19-2018, 08:06 PM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2004

Location: Portland, Oregon

Posts: 7,113

|

It still isn't clear to me how the tax on LTCG and qualified dividends are calculated. I presume the $ that sets the step is Total taxable income (in the example $54,544). What next? How do you get $5,793 at 0%?

__________________

Duck bjorn.

|

|

|

04-19-2018, 09:02 PM

04-19-2018, 09:02 PM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

Quote: Quote:

Originally Posted by Brat

It still isn't clear to me how the tax on LTCG and qualified dividends are calculated. I presume the $ that sets the step is Total taxable income (in the example $54,544). What next? How do you get $5,793 at 0%?

|

The $5,793 is $38,600 taxable income limit for 0% on preferenced income less $32,807 of ordinary income.

Ordinary income gets taxed first at ordinary rates... preferenced income then gets taxed a preferenced rates (0% and 15% in this case).

It might be easier to see if I change the order of the tax calculation as follows:

| Ordinary tax @10% | 9,525 | | 10% | 953 | | Ordinary tax @ 12% | 23,282 | | 12% | 2,794 | | Total ordinary | 32,807 | | | 3,747 | | Qualified tax @ 0% | 5,793 | | 0% | - | | Qualified tax @ 15% | 15,944 | | 15% | 2,392 | | Total tax | 54,544 | | | 6,138 |

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-20-2018, 07:15 AM

04-20-2018, 07:15 AM

|

#18

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2006

Posts: 4,172

|

Quote: Quote:

Originally Posted by Brat

It still isn't clear to me how the tax on LTCG and qualified dividends are calculated. I presume the $ that sets the step is Total taxable income (in the example $54,544). What next? How do you get $5,793 at 0%?

|

Perhaps try matching the brown& green stacked bar chart by tfb on 12/11/11 here https://www.bogleheads.org/forum/viewtopic.php?t=86849

with pb4uski's table.

In the stacked bar chart you stack the QDIV/LTCG on TOP of the ordinary income. You take the deductions from the bottom. The gray horizontal line is the zero point for taxable income. The red horizontal line above it is the dividing line between 0% QDIV/LTCG and 15% QDIV/LTCG rates. The new tax law has 10% & 12% ordinary rates (vs 10% and 15% as shown in the chart).

pb4uski's chart corresponds to the bar chart picture listing the tax on the bar chart chunks from the bottom up:

1) 10% on ordinary income

2) 12% on ordinary income

3) 0% on QDIV/LTCG income (below the red line)

4) 15% on QDIV/LTCG income (above the red line).

|

|

|

04-20-2018, 07:30 AM

04-20-2018, 07:30 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,370

|

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

04-20-2018, 07:47 AM

04-20-2018, 07:47 AM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2006

Posts: 4,172

|

p.........thanks! That helps a lot..........need to get that in my skill set.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|