Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

Thank you. High praise, especially someone not inclined to see my point of view.

It’s certainly true that markets can go from euphoria to panic in the blink of an eye – we’ve seen it in practice. It's also true that countries who issue debt in their own currencies have some special advantages that make them less susceptible to these kinds of panics. Having said that, credible entitlement and tax reforms can go a long way to solidifying confidence in our long-term fiscal solvency. This stuff can be done without creating a near-term fiscal drag and should be put on the front burner.

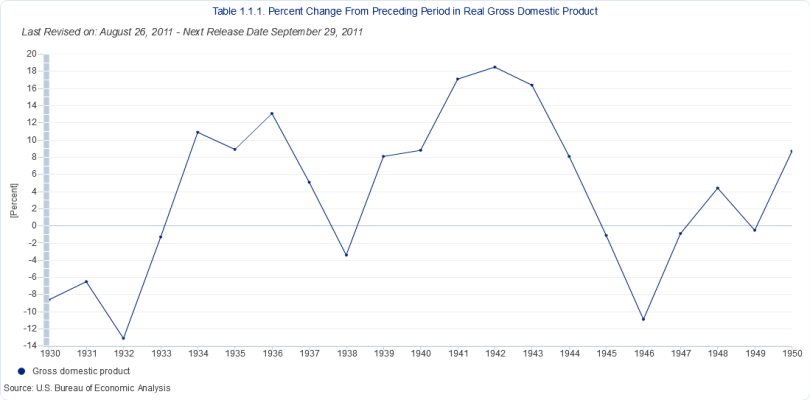

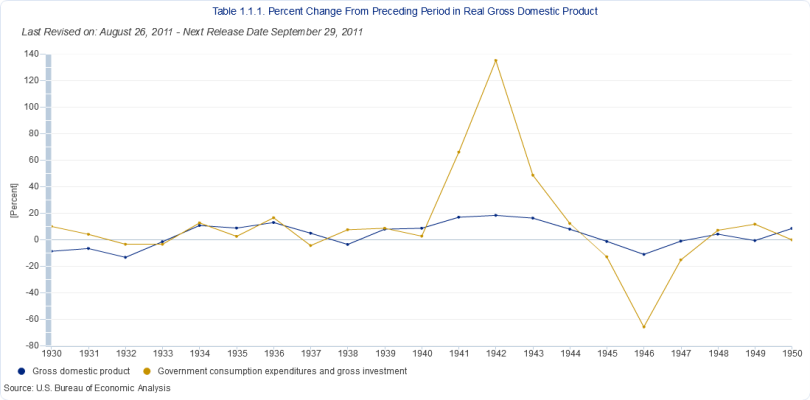

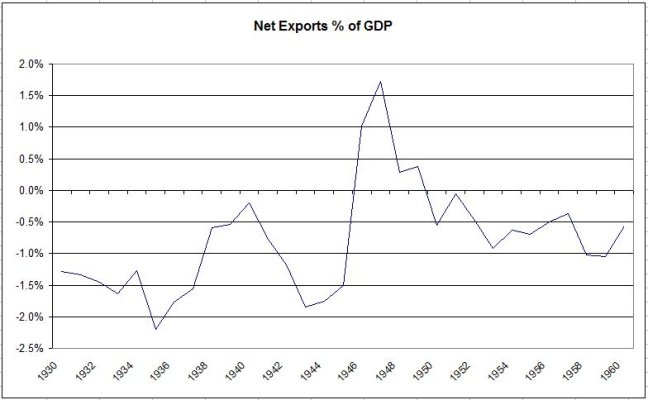

Another point worth considering is that the single biggest contributor to our current deficits isn’t anything people primarily talk about (stimulus, Bush tax cuts, wars, etc); it is recession and sub-par growth. A full-employment policy is a deficit reduction policy.

I agree that the biggest problem is that revenue has dropped a lot with all the people out of work... and getting them back to work would fix a lot of the sins that people talk about... but I do not think that it will fix our deficit problem since as a pct. of GDP it is still to high...