Sorry, I had to take my kid to school.

What a bunch of empty platitudes! I thought you guys were supposed to be pro's!

So let me summarize...

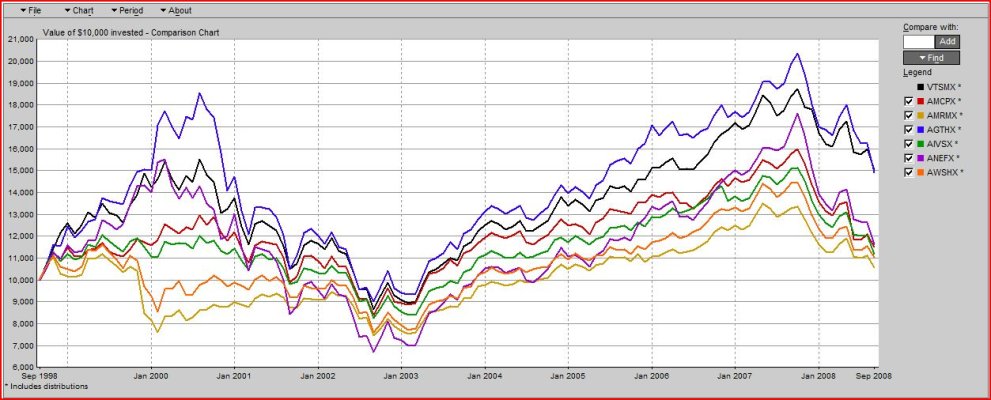

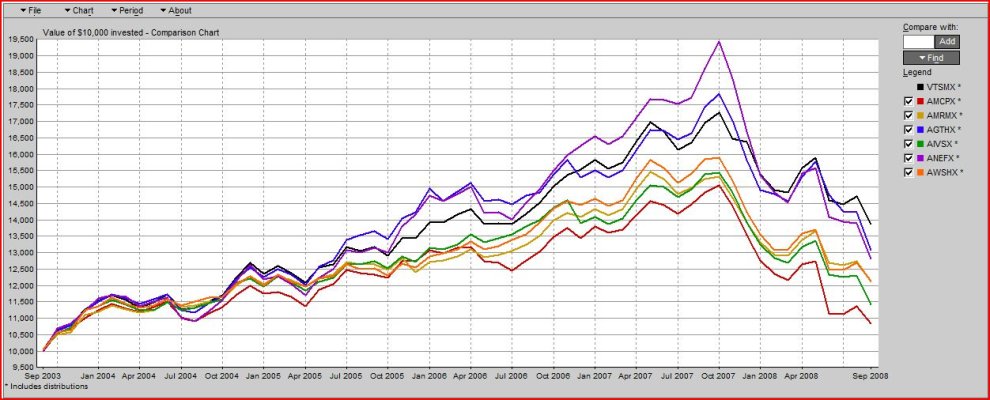

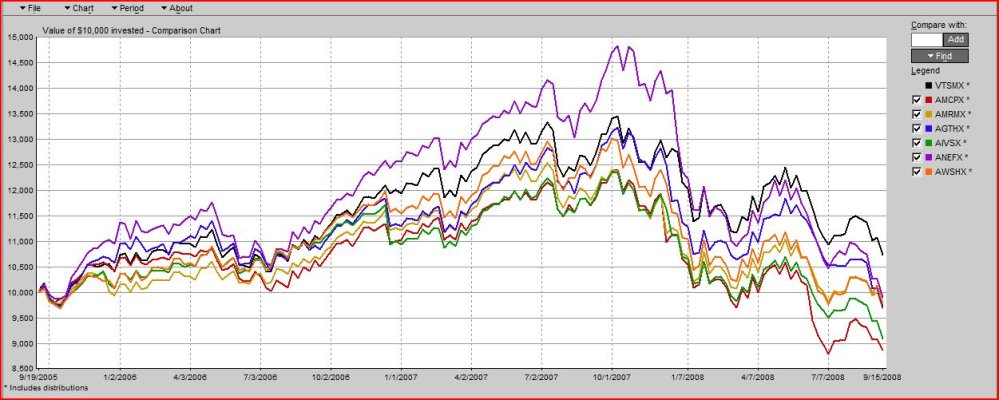

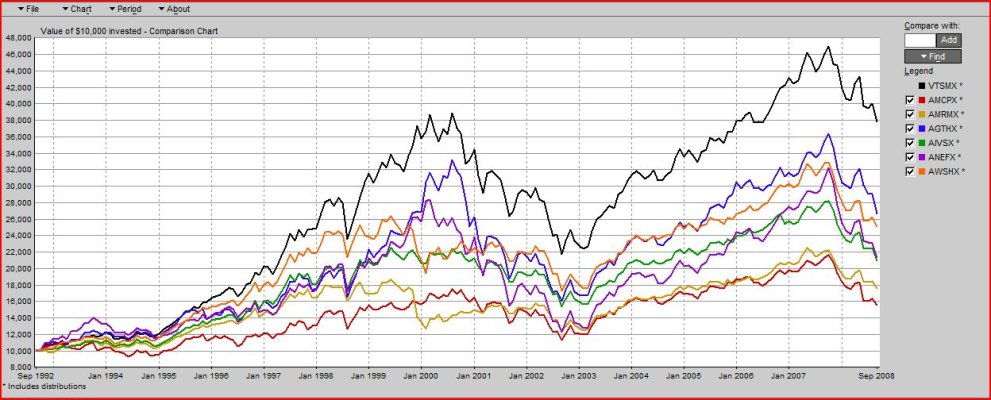

- The performance of these funds as reported by a major public financial web source is demonstrably worse than cheaper, lower turnover alternatives, but since you guys have so frequently produced facts to the contrary in the past (which nobody can find or point out) you feel its unnecessary to do so at this time.

- Turnover is good for you, even though it generates trading costs and taxable events and appears to have not been beneficial towards returns. An expense of .65% (with a 5.75% front end load) isnt that high, so a .15% expense rate with no front end load isnt worth considering.

- Art has "books" that tell him information that appears to be different from publicly available performance information.

- AMCAP should be compared with the S&P 500, a large cap blend fund, even though American says it is a diversified multi cap fund.

- AMCAP is "their worst performer", although in looking at Americans web site, it seems that AMCAP's returns are substantially similar to most of the other American stock funds. I see several dozen "equity income", "growth" and "growth and income" funds but they dont specifically say where I'd use one vs another. Perhaps one of the experts can tell me which one they recommend as a core equity portfolio holding? By the way, my "cherry picking" consisted of taking the very first fund on their list, their registered trademarked flagship fund. Generally when I see a fund family with lots of funds that appear to have the same information, its because they want to make sure a handful of them that perform well can be used in advertising while the losers can be whisked away and ignored as "cherry picking".

- When you hand over your money to a fund for them to invest it for you, its preferable that they keep a large percentage of this money in cash. Because thats definitely what I want my investment professionals to do...take my investing money and put it in a money market account. Is that really their best idea?

Dont worry Art, I'll be here all day. But having read all the worthy responses chock full of...absolutely no actual data and some ridiculous statements, I think the points been made.

But do go on. I hope for a pearl of investing wisdom that rivals your prior statement that bank cd's and debt in companies about to go out of business are roughly equal on the risk scale.