Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

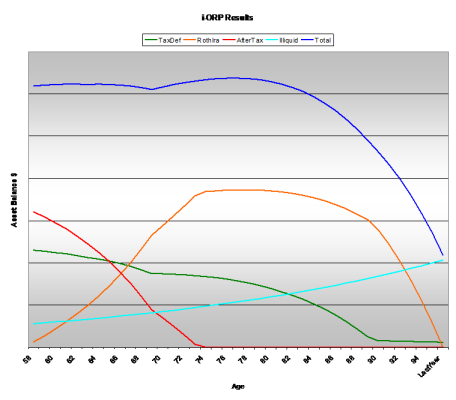

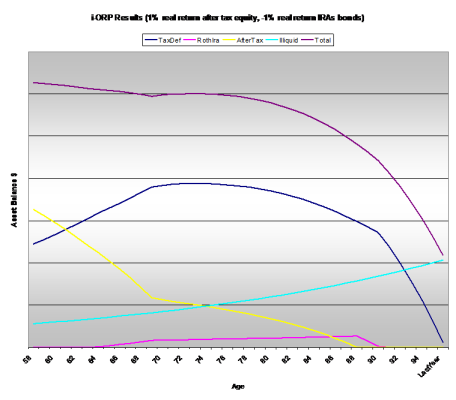

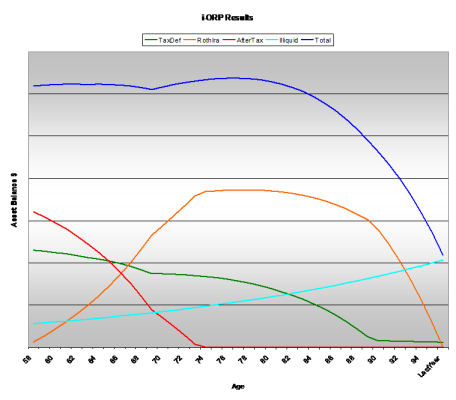

I'm trying to get my head around how to plan for minimizing taxes during withdrawal. I've run i-orp and while it's a little difficult to interpret the results (to me), I think I understand. In the spirit of second opinions, anyone know of another tax/withdrawal optimizer that can deal with taxable, tax deferred and Roth's (currently $0 for us), Soc Sec, etc.? I realize no one can predict future tax rates or investment (sequence of) returns.

Free/donation based is good, but paid apps would be fine if it's value added...

Free/donation based is good, but paid apps would be fine if it's value added...