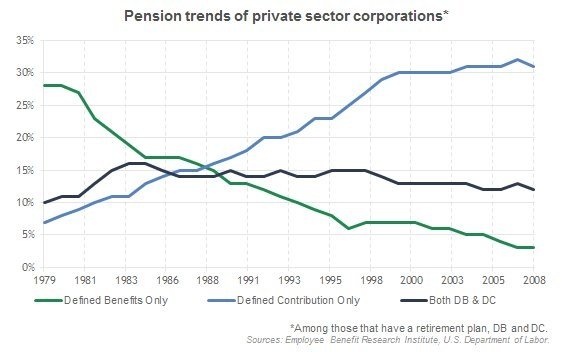

From your graph about 17% of private sector companies have DB plans.

4-5% of companies have ONLY DB plans...

but another 12-13% have BOTH DB and DC plans.

Unless I'm misinterpreting the black line as being companies that have both types of plans.

The company I retired from 3 years ago had a traditional DB pension plan and a 401k with a 50% match for the first 5% of employee contributions. It also still has a retiree HI plan. (so far so good)