pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hmm, so if I don't get the answer you think, my TurboTax (current 2018 Premier, not a What-if on last year's version like you used) must be wrong.

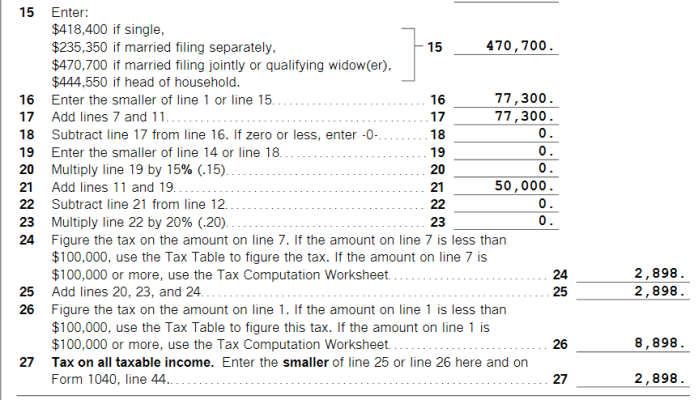

OK, you're right about the $77,200 vs. $77,400 -- mea culpa. Though interestingly, TT showed no tax due at $77,400. And I didn't add $1,000 of capital gains, but rather a $1,000 tIRA withdrawal, as I said.

So ... I reran the sample return with your exact parameters (though I characterized as tIRA withdrawals, not Roth conversions, though that shouldn't make a difference). And the answer I got was ... $12. My guess (without sleuthing the calculations in the Qualified Dividend and Capital Gains worksheet) is that that the incremental amount ends up being taxed at either the LTCG or ordinary income rate, whichever is lower.

Congrats, you appear to have uncovered an error in last year's TurboTax what-if worksheet. Be sure to let them know.

All snarkiness aside, can't you see my point? Each dollar of taxable income is taxed at one rate or the other, never both (except when you get into NIIT, etc.).

Actually, I think it is more likely that I uncovered either an error in the 2018 TT software or an error that you made... probably the latter... and in this case it is taxed at both until all LTCG is pushed out of the 0% LTCG tax bracket.

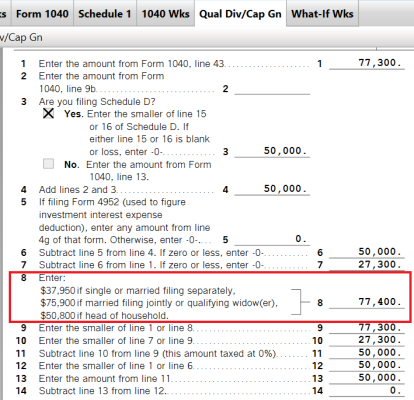

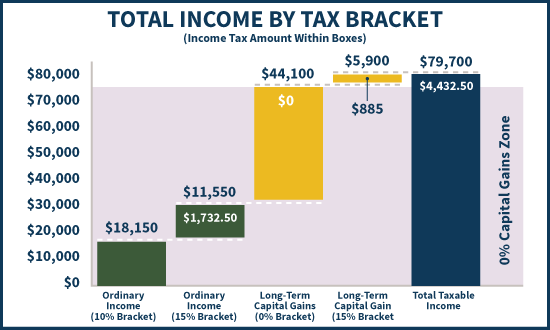

Your point is wrong.... what happens is that the extra $100 of ordinary income is taxed at 12% and it also pushes $100 of LTCG from the 0% LTCG tax bracket to the 15% LTCG tax bracket... the total impact being 27%.

| Base case | Base case + $100 | ||||

| LTCG | 50,000 | 50,000 | |||

| Roth conversions | 51,200 | 51,300 | |||

| Deductions | -24,000 | -24,000 | |||

| Taxable income | 77,200 | 77,300 | |||

| Ordinary income | |||||

| 10% bracket | 19,050 | 1,905 | 19,050 | 1,905 | |

| 12% bracket | 8,150 | 978 | 8,250 | 990 | |

| Preferenced income | |||||

| 0% bracket | 50,000 | 0 | 49,900 | 0 | |

| 15% bracket | 0 | 100 | 15 | ||

| Taxable income | 77,200 | 2,883 | 77,300 | 2,910 | |

| 27 | |||||

Last edited: