We have had a LTC policy with CALPERS since 1998 and have paid about $21K for a basic policy currently covering nursing home to $162/day, Residential Care facility to $81/day. It has a 5%/year inflation protection, a 90 day deductible and lifetime coverage. Premiums are currently $1,908/year for the two of us (Ages 64 and 62). There are about 150,000 members enrolled but enrollment has been closed for a few years now.

We just received a notice "You are receiving this notice because your policy provides lifetime benefits and built in inflation protection. Policies of this type are subject to the 2013 and 2014 five percent premium increase, as well as the 2015 premium increase of approximately 85 PERCENT".

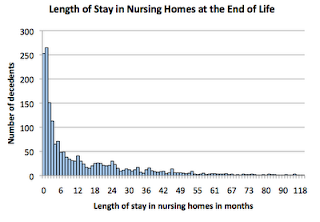

To my way of thinking, the value of the LTC policy is precisely in the lifetime benefits and inflation protection part. I'm sure the premium will be considerably lower if we change the policy to say a 3 year benefit period but then what's the point? A 3 year benefit is $177k and according to Firecalc my portfolio could handle that.

I'm conflicted and very tempted to just drop it but would certainly appreciate your input.

We just received a notice "You are receiving this notice because your policy provides lifetime benefits and built in inflation protection. Policies of this type are subject to the 2013 and 2014 five percent premium increase, as well as the 2015 premium increase of approximately 85 PERCENT".

To my way of thinking, the value of the LTC policy is precisely in the lifetime benefits and inflation protection part. I'm sure the premium will be considerably lower if we change the policy to say a 3 year benefit period but then what's the point? A 3 year benefit is $177k and according to Firecalc my portfolio could handle that.

I'm conflicted and very tempted to just drop it but would certainly appreciate your input.