The subject of inflation can be confusing when planning for the future. During the earning years, not as obvious as it can be during the retirement years.

Generally speaking, as prices go up, wages also rise.

Food for thought:

Inflation for $100 in these arbitrary 20 year brackets.

1930-1950 $144

1950-1970 $161

1970-1990 $337

1990-2010 $167

1994-2014 $159

Consider how that might affect retirement.

If... investment returns go up or lag the inflation rate.

If... pension or Social Security is inflation indexed or not.

In retrospect, our retirement in 1990 has seen relatively low inflation compared to someone who retired on fixed assets in 1970.

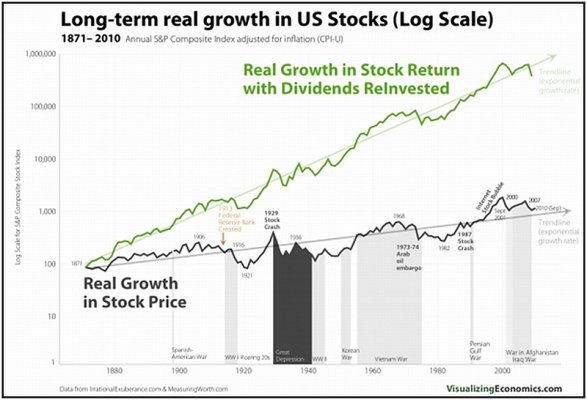

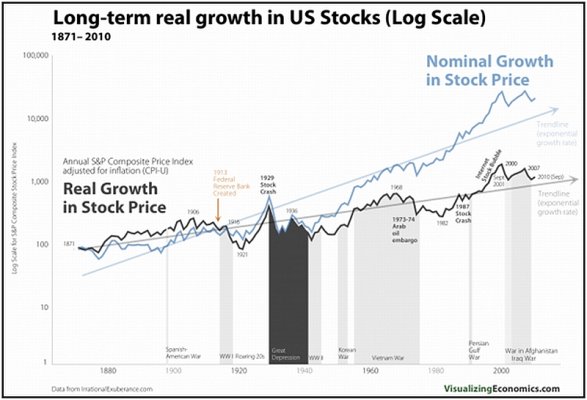

It would be interesting to see the average portfolio growth during the same periods.

The numbers are apropos of no theory or conclusion, but a picture of how different rates of inflation could affect a 20 year retirement... especially one that relies on fixed assets and conservative investing.

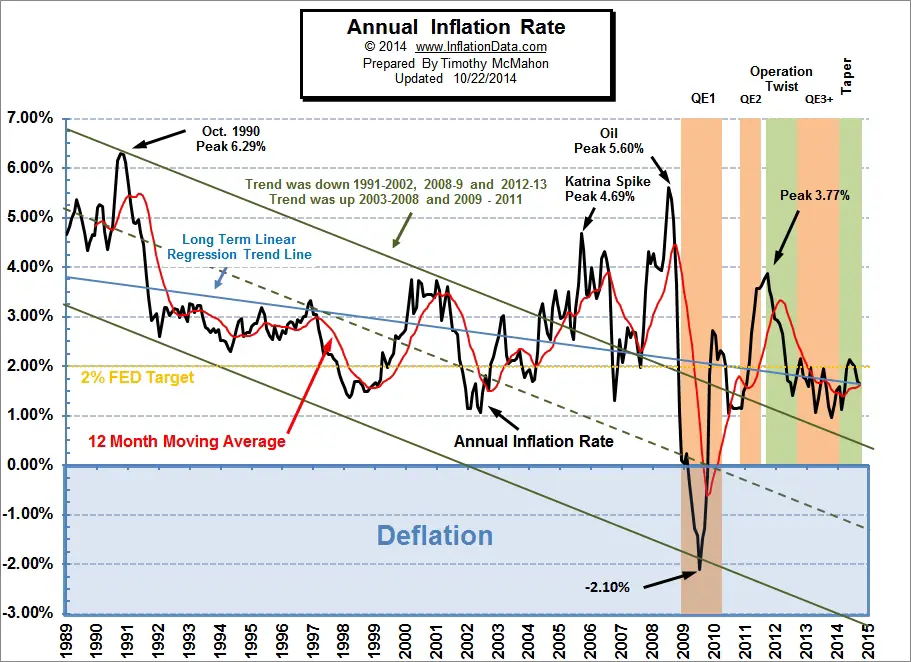

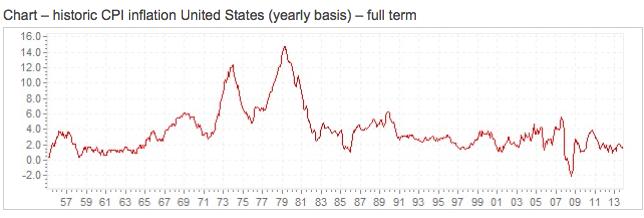

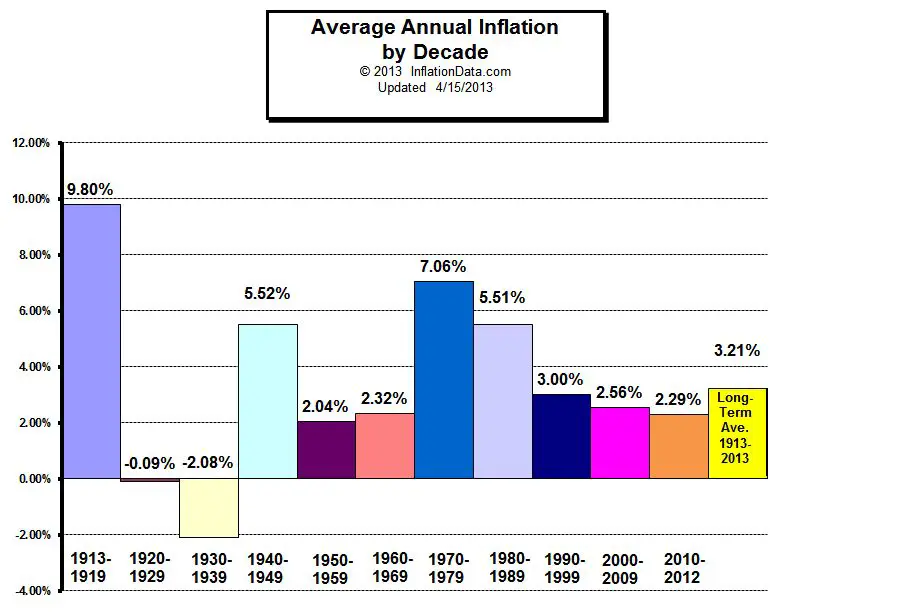

Here's a chart of the inflation rate by year. Note the high rates between 1974 and 1984.

http://www.multpl.com/inflation/table

Generally speaking, as prices go up, wages also rise.

Food for thought:

Inflation for $100 in these arbitrary 20 year brackets.

1930-1950 $144

1950-1970 $161

1970-1990 $337

1990-2010 $167

1994-2014 $159

Consider how that might affect retirement.

If... investment returns go up or lag the inflation rate.

If... pension or Social Security is inflation indexed or not.

In retrospect, our retirement in 1990 has seen relatively low inflation compared to someone who retired on fixed assets in 1970.

It would be interesting to see the average portfolio growth during the same periods.

The numbers are apropos of no theory or conclusion, but a picture of how different rates of inflation could affect a 20 year retirement... especially one that relies on fixed assets and conservative investing.

Here's a chart of the inflation rate by year. Note the high rates between 1974 and 1984.

http://www.multpl.com/inflation/table

Last edited: