ziggy29

Moderator Emeritus

Sounds like a scam, right? In this case it's not -- it's a public service announcement!

When I worked at Megacorp I earned too much to ever look at this, but since then, with a much more moderate income, it can come into play.

I share this as an example so some of you on the 'cusp' of qualifying for this can look if putting a little more into a TIRA for the 2014 tax year may help out in a big way.

I've been entering all my tax documents into my tax software as I get them. The last piece -- a 1099-DIV from Schwab -- generated $600 in taxable dividends. Adding that reduced my reported refund by about $1300. Getting another $600 in income raised my taxes by $1300? Ouch!

Doing a little more research, I realized what happened. Before that extra $600 in income, I was getting a full $2000 tax credit for the Retirement Savings Contribution Credit (RSCC) -- getting a 50% credit on the first $4000 in TIRA contributions. That extra $600 in dividend income not only increased my taxable income but also reduced the credit to 20%, or $800!

So playing the "what if" game, I went back to the tax software and added in another $500 in TIRA contributions for 2014. (We contributed over $4000 previously, but hadn't maxed out.) That increased my refund back by more than $1200, as the $800 credit became $2000 again. So in a nutshell, Uncle Sam *gave* me $1200 for putting another $500 into my IRA!

Suffice it to say I logged on to my Schwab account and quickly transferred another $500 into a TIRA for the 2014 tax year.

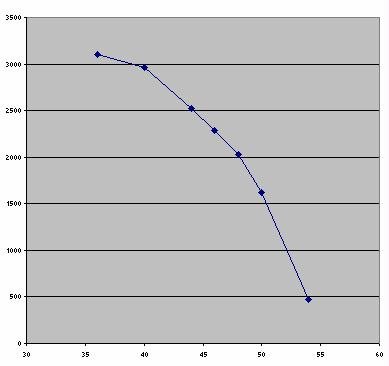

Those of you in the appropriate income range (for MFJ the 50% credit -- up to $2000 -- becomes only 20% at the level of $36,000 in AGI for 2014) may want to play with this a little and see if you can get an instant 240% return on investment. In my case, the extra $500 in TIRA contributions gets my AGI below $36K again, and that made all the difference.

When I worked at Megacorp I earned too much to ever look at this, but since then, with a much more moderate income, it can come into play.

I share this as an example so some of you on the 'cusp' of qualifying for this can look if putting a little more into a TIRA for the 2014 tax year may help out in a big way.

I've been entering all my tax documents into my tax software as I get them. The last piece -- a 1099-DIV from Schwab -- generated $600 in taxable dividends. Adding that reduced my reported refund by about $1300. Getting another $600 in income raised my taxes by $1300? Ouch!

Doing a little more research, I realized what happened. Before that extra $600 in income, I was getting a full $2000 tax credit for the Retirement Savings Contribution Credit (RSCC) -- getting a 50% credit on the first $4000 in TIRA contributions. That extra $600 in dividend income not only increased my taxable income but also reduced the credit to 20%, or $800!

So playing the "what if" game, I went back to the tax software and added in another $500 in TIRA contributions for 2014. (We contributed over $4000 previously, but hadn't maxed out.) That increased my refund back by more than $1200, as the $800 credit became $2000 again. So in a nutshell, Uncle Sam *gave* me $1200 for putting another $500 into my IRA!

Suffice it to say I logged on to my Schwab account and quickly transferred another $500 into a TIRA for the 2014 tax year.

Those of you in the appropriate income range (for MFJ the 50% credit -- up to $2000 -- becomes only 20% at the level of $36,000 in AGI for 2014) may want to play with this a little and see if you can get an instant 240% return on investment. In my case, the extra $500 in TIRA contributions gets my AGI below $36K again, and that made all the difference.

Last edited: