I don't know if there's anything magical about $250K, although there's an old saying, "You're first Million is the hardest', and you can apply that to any amount.

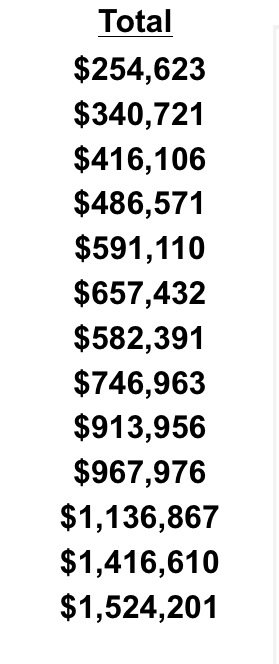

Awhile back, I did a chart showing my $100K thresholds, the date I hit them, and how long it took. I started keeping track in March of 1998, which was when I finally recovered from a bad divorce and was able to start investing again. Anyway, here goes...

3/1998: $0

1/2004: $100K

6/2005: $200K (some of this was proceeds from selling a condo, and I also started raiding some equity on my current home)

10/2006: $300K

10/2007: $400K

3/2010: $500K (the Great Recession took its toll, but I bounced back pretty quickly, also raided some more home equity and bought in, luckily, at the bottom of the market)

1/2011: $600k

3/2012: $700K

4/2013: $800K (would have happened sooner, but I was starting to cash in a bit, and pay down my HELOC, probably to the tune of about $30K)

12/2013: $900K (again, would have happened sooner, but I paid down about $20K on my HELOC)

As of yesterday's close, I hit $991K, so unless the market suddenly takes a turn for the worse, I'm sure I'll hit $1M any day now. If I hadn't paid down on that HELOC, I most likely would have hit $1M about 2-3 months ago.

And, I'm at the point now where the compounding, dividends, capital gains, etc, are more influential than additional investments. Even maxing out my 401k, with the company match, that only adds about $20,500 per year. Add a Roth IRA to that, for another $5500, and we're only talking $26,000, which isn't going to have much immediate impact on a ~$1M balance.

However, this year, to fund my Roth, I used money from an after tax account, so it was transferring money that was already invested, versus adding new money. So this year my added contributions are only about 2% of the total balance. The additional contributions do still add up, over time though. And in a down market, say a 50% loss like I had in the Great Recession, they help even more.