You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is it better to have stocks or bonds in 401k?

- Thread starter novaman

- Start date

GTFan

Thinks s/he gets paid by the post

Bonds and other fully taxable income investments (e.g. REITs) in 401ks, IRAs, Roths etc., stocks in taxable accounts. You're doing it right.

Remember that it's the overall mix for all of your accounts that determines your AA, the above just helps you avoid unnecessary tax while saving.

http://www.bogleheads.org/wiki/Principles_of_tax-efficient_fund_placement

Remember that it's the overall mix for all of your accounts that determines your AA, the above just helps you avoid unnecessary tax while saving.

http://www.bogleheads.org/wiki/Principles_of_tax-efficient_fund_placement

Last edited:

An additional benefit to having bonds in 401k and IRA's is that since growth will generally be slower than stocks there will be less to be taxed when RMD time comes. Also, generally stock dividends from taxable accounts will be taxed at a lower rate

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

One can have anything and everything in tax-advantaged accounts: bonds, stocks, REITs, whatever.

In a taxable account one wants to have tax-efficient assets and things that are easy to tax-loss harvest. That might be stocks, index mutual funds, ETFs, and municipal bond funds. Also don't forget that assets that always go down in value are good in a taxable account because they are the most tax-efficient in that they give you a tax break.

So don't forget that you can have equities in your 401(k), too. Your 401(k) does not need to consist solely of bond funds.

In a taxable account one wants to have tax-efficient assets and things that are easy to tax-loss harvest. That might be stocks, index mutual funds, ETFs, and municipal bond funds. Also don't forget that assets that always go down in value are good in a taxable account because they are the most tax-efficient in that they give you a tax break.

So don't forget that you can have equities in your 401(k), too. Your 401(k) does not need to consist solely of bond funds.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

You can, but you sure shouldn't have tax free bonds in it, for one thing.One can have anything and everything in tax-advantaged accounts: bonds, stocks, REITs, whatever.

Why would anyone hold an asset that always goes down in value? I suppose if it threw enough income it would be ok, but then the income would be taxable.In a taxable account one wants to have tax-efficient assets and things that are easy to tax-loss harvest. That might be stocks, index mutual funds, ETFs, and municipal bond funds. Also don't forget that assets that always go down in value are good in a taxable account because they are the most tax-efficient in that they give you a tax break.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Why would anyone hold an asset that always goes down in value? I suppose if it threw enough income it would be ok, but then the income would be taxable.

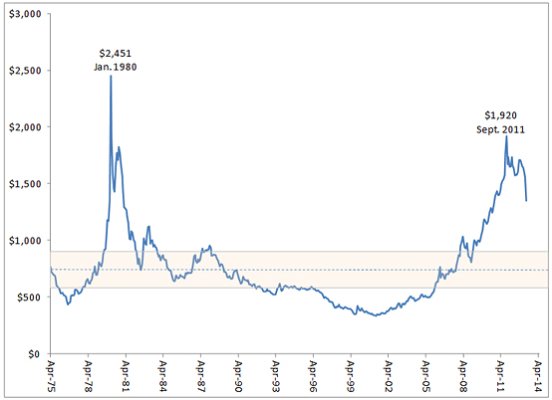

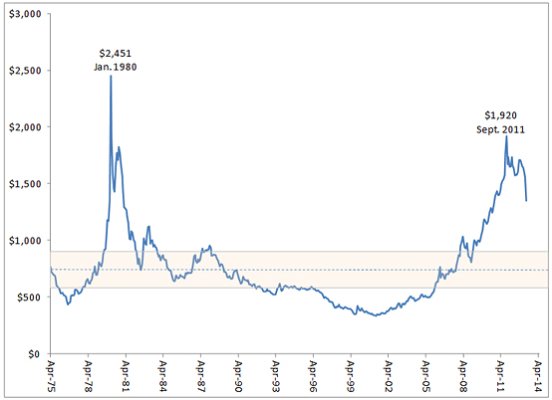

Good question. Why not ask the people who buy gold?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

http://goldprice.org/charts/history/gold_20_year_o_usd.pngGood question. Why not ask the people who buy gold?

http://b-i.forbesimg.com/rickferri/files/2013/04/GoldFig22.jpg

Sent from my iPhone using Early Retirement Forum

Sent from my iPhone using Early Retirement Forum

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,205

I have money both in our 401k's and outside of them. I have been parking most of my 401k money in bond funds while investing in stock funds outside, but now I'm thinking that was not a wise move. So what's the smart move here?

when michael kitces looked at this he found for the most part conventional wisdom is wrong .

putting equity's in a taxable account may not be the best idea.

fund turnover and distributions over the long term can wipe away any tax advantage.

as well as the fact compounding on bonds and cash in a deferred account is minimal at best .

https://www.kitces.com/blog/asset-l...e-account-versus-ira-depends-on-time-horizon/

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Sure they can, but so can stupidity.fund turnover and distributions over the long term can wipe away any tax advantage.

Kitces has written a good article which hints at how not to be stupid with one's taxable account.

I recently reviewed my tax returns to find out when was the last time I paid any capital gains taxes. I went back to 1999 and could not find any cap gains taxes that I paid. And this despite lots of changes over the years.

Of course, the reason is tax-loss harvesting which for me occurred in big numbers in 1987, 2000, and 2008-2009.

But as with all these tax things and asset location things, one should understand how the pundits come up with their advice and answers, so that one does not shoot themselves in the foot.

Very interesting, I guess we'll have to add this topic to the other perennial ones- SS at 62 or 70?, pay off the mortgage or not? With the answer to all of these seemingly being "it depends" I guess I better get some Depends.... at least they are not too expensive...

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This this mean that you have never had net realized capital gains?Sure they can, but so can stupidity.

Kitces has written a good article which hints at how not to be stupid with one's taxable account.

I recently reviewed my tax returns to find out when was the last time I paid any capital gains taxes. I went back to 1999 and could not find any cap gains taxes that I paid. And this despite lots of changes over the years.

Of course, the reason is tax-loss harvesting which for me occurred in big numbers in 1987, 2000, and 2008-2009.

But as with all these tax things and asset location things, one should understand how the pundits come up with their advice and answers, so that one does not shoot themselves in the foot.

Ha

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,205

yep , i have enough gains now in our taxable account in equity's that selling would generate a huge tax bill even at 15% capital gains rates . the good news tax wise is the funds were managed funds with quite a bit of taxes paid over the decades.

if they were tax efficient index funds with decades of pent up gains any changes i wanted to make would be even more painful .the trade off might have been worth it with the efficient index funds but it doesn't make the tax pain any better .

if they were tax efficient index funds with decades of pent up gains any changes i wanted to make would be even more painful .the trade off might have been worth it with the efficient index funds but it doesn't make the tax pain any better .

Last edited:

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

That's eye opening. Of course if you're IRA grows that much, you may not be in the 15% bracket anymore when MRDs come. That would almost certainly swing it back.when michael kitces looked at this he found for the most part conventional wisdom is wrong .

putting equity's in a taxable account may not be the best idea.

fund turnover and distributions over the long term can wipe away any tax advantage.

as well as the fact compounding on bonds and cash in a deferred account is minimal at best .

https://www.kitces.com/blog/asset-l...e-account-versus-ira-depends-on-time-horizon/

Like many, I've been keeping my least tax efficient funds in my tIRA, but as I convert that I am keeping some of the bonds in my Roth. It's been nagging at me that I should be keeping my highest growers in the Roth, since I'll never face a tax on those earnings. Not sure if I want to bite off the large cap gains I would take by switching it over though. As this article also shows, the worst case it to have a large turnover.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Not in recent times, so "never" is not quite right. I am sure I paid some cap gains taxes when I was much younger before too many index funds were conceived and made available to retail investors.This this mean that you have never had net realized capital gains?

Ha

I still have 6-figure carryover losses to which should last quite a number of years going forward. Presently, my unrealized gains in taxable accounts exceed the carryover losses amount.

Another thing that can help is donating appreciated shares to charity such as a donor-advised fund. This avoids not only the cap gains taxes, but the income as well.

Last edited:

growing_older

Thinks s/he gets paid by the post

- Joined

- Jun 30, 2007

- Messages

- 2,657

Doesn't this somewhat depend on what kind of an IRA or 401k? My 401k is too big a percentage of my total portfolio to make it all bonds, plus some of it is Roth. I'm going to want the biggest gains I can to be in tax-free Roth accounts, so I put equities in there too.

Rothman

Recycles dryer sheets

- Joined

- Apr 30, 2013

- Messages

- 252

Sure they can, but so can stupidity.

Kitces has written a good article which hints at how not to be stupid with one's taxable account.

I recently reviewed my tax returns to find out when was the last time I paid any capital gains taxes. I went back to 1999 and could not find any cap gains taxes that I paid. And this despite lots of changes over the years.

Of course, the reason is tax-loss harvesting which for me occurred in big numbers in 1987, 2000, and 2008-2009.

But as with all these tax things and asset location things, one should understand how the pundits come up with their advice and answers, so that one does not shoot themselves in the foot.

I think LOL! This means you do lots of movements between funds in the year? Otherwise it seems cap gains would have occurred. Or do you not withdraw from taxable ahead of other accounts as is traditional recommendation.

Sent from my iPad using Early Retirement Forum

I do periodic rebalancing as well as trading in and out of mutual funds. I follow the Fidelity Monitor & Insight model portfolios. I've done well listening to them but have had to pay some hefty taxes as a result of capital gains from moving money around from fund to fund. On reflection I was thinking maybe I should've put the stocks in the 401(k)

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

I don't quite understand what you are thinking.I think LOL! This means you do lots of movements between funds in the year? Otherwise it seems cap gains would have occurred. Or do you not withdraw from taxable ahead of other accounts as is traditional recommendation.

Sure, I have unrealized capital gains (no taxes on them). Yes, I sell things at a loss in tax-loss harvesting moves, so I have both return of capital (no taxes on that) and realized capital losses (they offset realized cap gains). Yes, I sell things that have realized cap gains, but those realized cap gains have always been offset by either current year realized losses or previous year realized losses.

I do not do lots of movements between funds in taxable accounts. Indeed, I might make 0 to 4 transactions in taxable accounts on average every year.

Rothman

Recycles dryer sheets

- Joined

- Apr 30, 2013

- Messages

- 252

what I was thinking looking at my own portfolio in my taxable account I have lots of capital gains to realize once I retire and start drawing down the taxable account first. If I look at Vanguard Total Stock Market VTI it was at 34 with the 2009 low and is now 107. Maybe your picks are "lucky" enough to have tax-loss offsets but my last 5 years just haven't provided the opportunity to offset these gains. I also saw the other problem mentioned as I owned some FBIOX biotech that last year decided to do a capital distribution and hence I saw the taxable income I could not avoid. I have followed the philosophy of bonds in my tax deferred and tax free accounts but when I look at the last five years in hindsight I certainly would have been better off from a tax minimization perspective to have done the opposite.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks LOL.Not in recent times, so "never" is not quite right. I am sure I paid some cap gains taxes when I was much younger before too many index funds were conceived and made available to retail investors.

I still have 6-figure carryover losses to which should last quite a number of years going forward. Presently, my unrealized gains in taxable accounts exceed the carryover losses amount.

Another thing that can help is donating appreciated shares to charity such as a donor-advised fund. This avoids not only the cap gains taxes, but the income as well.

Ha

About 40% of our holdings are in taxable accounts with 60% in tax deferred accounts. We're not retired yet, but the AA in our taxable accounts is about where we want it to be when we do retire. In it, the bond holdings are primarily muni-bond funds (with some TIPs and a smidgen of EM bond funds thrown in) and our stock funds have fairly low turnover. The deferred accounts are more aggressively weighted towards stock funds with the idea (hope) that we can live off of the taxable accounts until 70. All bond funds in those account are taxable bond funds. Over time, we'll bring the deferred accounts AA down to where our taxable accounts are today.

Big-papa

Big-papa

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

We have lots of unrealized capital gains from positions purchased in March and April 2009 in our taxable accounts. They were purchased with money realized from selling other positions at a loss in tax-loss harvesting moves. Yes, there have been only smallish opportunities to tax-loss harvest since April 2009, but I can assure you that we take every such opportunity that presents itself.what I was thinking looking at my own portfolio in my taxable account I have lots of capital gains to realize once I retire and start drawing down the taxable account first. If I look at Vanguard Total Stock Market VTI it was at 34 with the 2009 low and is now 107. Maybe your picks are "lucky" enough to have tax-loss offsets but my last 5 years just haven't provided the opportunity to offset these gains.

That written, our carryover losses date from 2009 and earlier. As we draw down our taxable accounts, we do offset realized gains, so no taxes. We are not withdrawing a large percentage of taxable assets every year, so by the time our losses are used up offsetting gains, we should be in the 15% marginal income tax bracket where LTCG are taxed at 0%.

So to summarize: carryover losses offset cap gains while we are in a higher tax bracket, then when in lower brackets, gains are tax-free. Ain't that nice?

And in the meantime, Roth conversions are happening. I have traditional 401(k) and a Roth 401(k), so I can convert within those plans pretty easily as my tax situation allows.

So to get back to the thread topic: Tax efficiency is complicated by the future. Most of the "studies" that I have read do not cover the situations that I find myself in, so there are no "rules of thumb". It is helpful to understand the tax rules and how different kinds of accounts and income are taxed and come up with one's own plan.

Last edited:

Similar threads

- Replies

- 40

- Views

- 2K

- Replies

- 18

- Views

- 721