looking back at Less Antman's position

Paul Merriman, Bill Bernstein and Less Antman showed that historically, 50/50 US/foreign gave lower volatility and a little better ROI. While non-correlation has narrowed in the past decade or two, I figure there are enough differences between the markets for me to keep 50/50.

I just ran across an old posting by Less Antman that I kept and decided it was time to take another look. This may be helpful for those wondering about adding non-US to their portfolios.

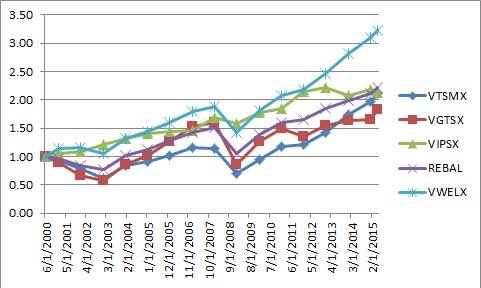

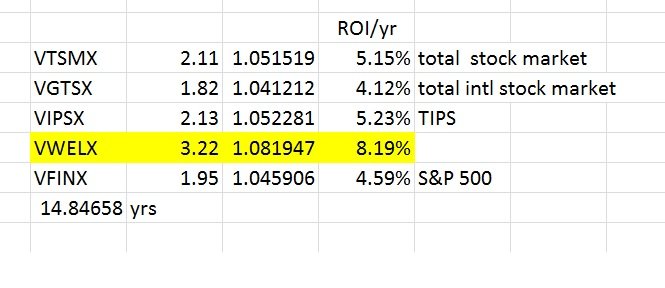

A long time ago (15? 20? years?) Less proposed a Vanguard equivalent to his recommendations to his clients consisting of 1/3 cash equivalents (TIPS, as VIPSX), 1/3 large US stocks (as VTSMX, V Total Stock Market Index) and 1/3 large international stocks (V Total International Index). I graphed them from 29 June 2000, when one of the funds started, up to today. I also rebalanced them once a year and also compared Vanguard's S&P 500 fund, VFINX (did not plot them, though, only calc'd the ROI), and Wellington, VWELX, for the same period. The data came from Yahoo Finance, Historical prices, normalizing the Adjusted Close (for total return) to the value on 29 June 2000. And I calculated the annualized ROI for each. Here are the results.

If I did this correctly, TIPs did better than either of his two stock mutual funds

and VWELX, 60/40 US stocks/bonds, did better than all of them. BTW, I am using an average 6% ROI for my own projections, which I thought was conservative.

As it happens, I do not use this particular set of funds (and I have not evaluated my personal portfolio yet; still hopeful about a carefully selected 50/50). I use some funds and some individual stocks (some may remember that I was dabbling in Oil & Gas and Pipelines) for my 50/50 US/foreign mix. Some time back I mentioned that my various strategies were not as good as I had hoped

and that I just might move everything into Wellington and forgeddaboutit. I am unwrapping my traditional IRA into Roths for the next three years, and when I am done, the plan is to have virtually everything in VWELX and a MMF to catch the earnings for distribution. I am in the drawdown phase now so simplifying the portfolio and abandoning unfruitful strategies is in order. The market can stay irrational longer than I can stay solvent.

I could go back and check Paul Merriman's strategy as well but it may show the same problem over the last 14+ years as the US component is the S&P 500 and I am not in a good mood right now.

Maybe, "This time it's [really] different!"

and that I just might move everything into Wellington and forgeddaboutit. I am unwrapping my traditional IRA into Roths for the next three years, and when I am done, the plan is to have virtually everything in VWELX and a MMF to catch the earnings for distribution. I am in the drawdown phase now so simplifying the portfolio and abandoning unfruitful strategies is in order. The market can stay irrational longer than I can stay solvent.

and that I just might move everything into Wellington and forgeddaboutit. I am unwrapping my traditional IRA into Roths for the next three years, and when I am done, the plan is to have virtually everything in VWELX and a MMF to catch the earnings for distribution. I am in the drawdown phase now so simplifying the portfolio and abandoning unfruitful strategies is in order. The market can stay irrational longer than I can stay solvent.