TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

I had a happy rebalancing experience. I did it on Monday the 4th, so I had a nice 1.6% increase in my stock funds on that day. That is, the sale occurred at the end of the trading day, so I got the benefit of that day's increase. There haven't been any big up days after that.

I was able to lock in the gains on the money that I rebalanced into stocks last year.

I was able to lock in the gains on the money that I rebalanced into stocks last year.

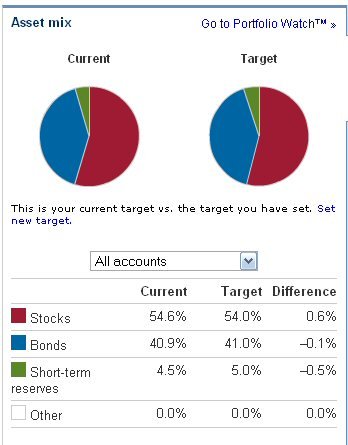

Apparently I used a figure for the withdrawal that was off when computing how much of each fund to sell. Other than cash everything else is proportioned correctly.

Apparently I used a figure for the withdrawal that was off when computing how much of each fund to sell. Other than cash everything else is proportioned correctly.