Just for grins, I dug a little deeper. For some reason Yahoo's record of VFINX (Vanguard's S&P 500 index fund) only goes back to March, 1987. Interesting. Does everyone remember what happened in Oct, 1987?

VGENX (Vanguard's energy index fund) goes back to September, 1987. Good.

VEIEX (Emerging Markets index fund) only goes back to 1995, so I didn't bother with it.

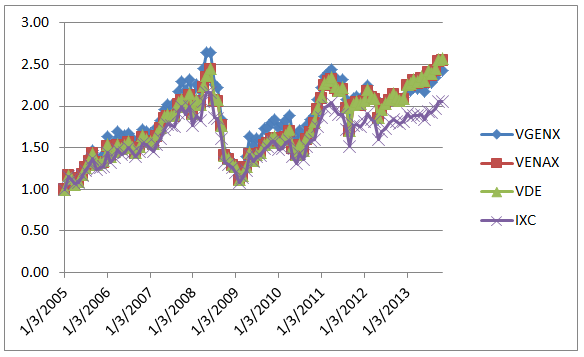

From Oct, 1987, it took both VGENX and VFINX about 18 months to get back to where they started (dividends included). They were pretty much neck-and-neck until about 2000, then they both took off but one did better than the other.

In the 26 years since 1987, VFINX grew 847% (including dividends). VGENX grew 1844%. (Someone please check my numbers.) This is why I have a bias against large caps as a class.

Unless fusion becomes economical or unless the population of the world declines radically (either one I would applaud--unless the decline includes me, of course), I figure oil and gas will perform better than the S&P over time. It is not my only asset class by any means, but it is the biggest. Will my stock picks do as well as VGENX? Maybe. XOM has not done as well as VGENX, so since I don ont own XOM, I am betting against it AND VGENX. Probably not a high probability of success, but I am not betting the farm on O&G and I figure to reduce exposure when I am not in the accumulation phase anymore.

Besides, I can always go back to work. O&G pays REALLY well these days.

Although I feel I have a special power over the market and can cause a drop in any stock just by me purchasing it.