Urchina

Full time employment: Posting here.

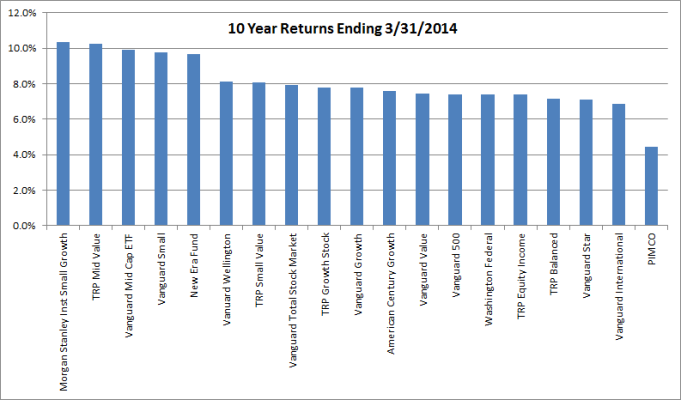

Question for those of you who have (or have not) used Vanguard's Wellesley/Wellington funds. DH and I are planning to RE (late 50's, about 20 years away). Right now we are 95% in index funds, and 95% in stocks. (Aggressive portfolio, high risk tolerance). However, we are ready to move to more bonds (probably a 80/20 stocks/bonds mix) and are considering Wellington/Wellesley as part of this, because we also like the idea of building holdings in these funds as an income stream. We would keep the bulk of our funds in Vanguard stock and bond index funds.

I can see the clear utility of these two funds for people who are already retired (some growth and consistent income), but what does the board think of them for people who are a couple of decades away from retirement? Pros and cons of this approach?

If you think they might be a good choice for people who have just hit 40, where would you put them? Our options are Roth IRA, Traditional IRA, and taxable accounts. I realize that because they generate income, they are not usually recommended for taxable accounts. We fund our Roths through conversions from our traditional IRAs (since we're not eligible to contribute to them directly).

Thanks for the input!

I can see the clear utility of these two funds for people who are already retired (some growth and consistent income), but what does the board think of them for people who are a couple of decades away from retirement? Pros and cons of this approach?

If you think they might be a good choice for people who have just hit 40, where would you put them? Our options are Roth IRA, Traditional IRA, and taxable accounts. I realize that because they generate income, they are not usually recommended for taxable accounts. We fund our Roths through conversions from our traditional IRAs (since we're not eligible to contribute to them directly).

Thanks for the input!